Cryptocurrencies as a Secure Haven: How They Protect Your Wealth

Cryptocurrencies are increasingly recognized as a popular choice for investing and preserving wealth. Offering enhanced security, autonomy, and protection from many risks tied to traditional finance, they’ve become a trusted alternative. But what makes these technologies so dependable?

On this page

- The Fundamentals of Cryptocurrency: What Makes Them Secure

- Decentralization

- Cryptography

- Blockchain

- The Advantages of Cryptocurrencies as a Store of Value

- Independence from the Banking System

- Enhanced Security and Ownership

- Reserve Assets in Times of Crisis

- Potential Risks and How to Mitigate Them

- Hacker Attacks

- Loss of Access to Private Keys

- Lack of Regulatory Clarity

- Practical Tips for Secure Cryptocurrency Storage

- Choose a Trusted Wallet

- Follow Basic Cybersecurity Best Practices

- Asset Allocation

- Why Cryptocurrency Security Rests with the User

- Understanding Cryptocurrency

- The Role of the User in Asset Protection

- Cryptocurrencies and Financial Literacy

Cryptocurrencies have become a defining feature of the modern financial world, rapidly gaining popularity as an innovative way to invest, transfer funds, and store value.

The traditional financial system often faces challenges like economic crises, inflation, and fraud. While cryptocurrencies are not immune to risks, they offer a compelling alternative rooted in decentralization and blockchain technology, reshaping the future of finance.

The Fundamentals of Cryptocurrency: What Makes Them Secure

To understand why cryptocurrencies are considered secure, it's important to delve into the core features of this technology. Let’s explore three key elements that provide their protection.

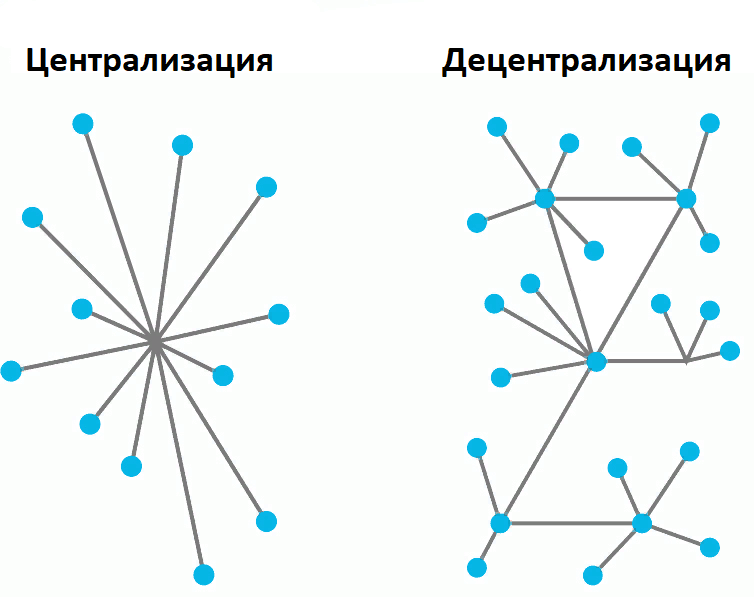

Decentralization

Decentralization is the process of distributing authority and responsibility from a central authority to independent, local nodes. Unlike traditional systems, most cryptocurrencies are not controlled by any single organization. Instead, they operate through thousands or even millions of independent nodes (computers) spread across the world.

For example, in the case of Bitcoin, transactions are verified through mining, a data-processing mechanism within a distributed network. This design makes it nearly impossible for any centralized attacks or manipulation by individuals or groups to succeed. Even if one node fails, the network remains operational.

Decentralization also mitigates the risk of systemic failures typical of centralized financial systems. For instance, a hack on a bank or payment platform can lock access to all funds. In contrast, because each cryptocurrency node functions independently, a complete system failure is virtually impossible. Moreover, decentralization enables users to store assets free from political or economic restrictions, a crucial advantage in regions with unstable economies.

Cryptography

At the core of cryptocurrencies are sophisticated encryption algorithms that ensure both data security and user anonymity. Cryptography guarantees that only the holders of private keys can authorize transactions, while records on the network remain tamper-proof.

Algorithms like SHA-256, used in Bitcoin, generate hashes that are virtually impossible to forge. Even the most powerful supercomputers would take thousands of years to crack the system. Thanks to cryptography, cryptocurrency users can rest assured that their assets are safe, even in the face of hacking attempts or network vulnerabilities.

Blockchain

Blockchain is a decentralized database where each record is linked to the previous one, forming an immutable chain. This structure ensures transparency, as all participants in the network can access the transaction history, making fraud almost impossible.

If a hacker tried to alter a record within the blockchain, they would have to rewrite every preceding block, an endeavor that is virtually impossible due to the system’s distributed nature. The transparency of blockchain is further demonstrated by its adoption across various sectors, from supply chain management to voting systems. This highlights blockchain’s potential not only as a secure data storage solution but also as a versatile tool for safe information exchange.

The Advantages of Cryptocurrencies as a Store of Value

Cryptocurrencies offer a variety of benefits that make them an effective tool for preserving wealth. Here are some of the key advantages.

Independence from the Banking System

Cryptocurrencies enable users to store and manage assets without relying on intermediaries like banks. This gives individuals full control over their funds, free from external interference. This independence from the traditional banking system is particularly valuable in countries with unstable economies, where banks may impose withdrawal restrictions or freeze accounts. Cryptocurrencies eliminate these barriers, ensuring users can access their assets at any time, regardless of political or economic turmoil.

Enhanced Security and Ownership

Private keys are the cornerstone of cryptocurrency security. They provide exclusive access to your assets, and only the holder of the private key can authorize transactions. If a private key is compromised, it could lead to the complete loss of funds, making it crucial to keep this information secure.

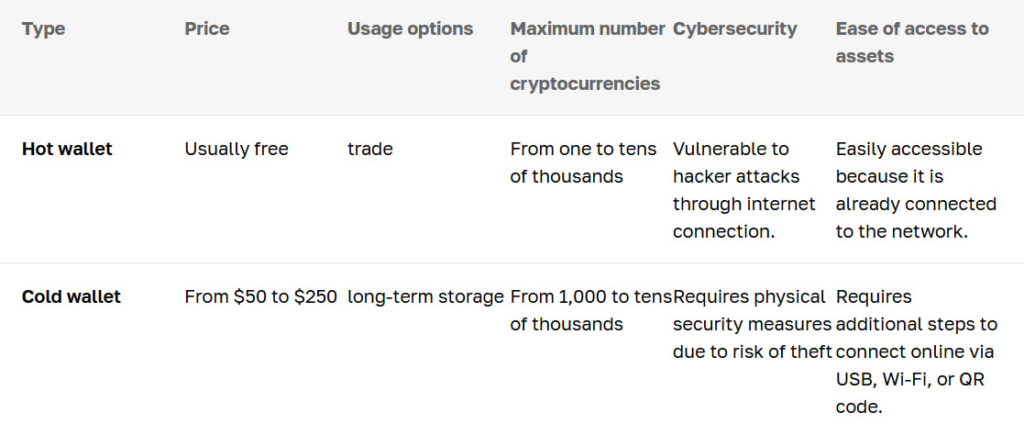

Cryptocurrency storage typically involves two main types of wallets: hot wallets and cold wallets. Hot wallets are connected to the internet and offer convenience for quick transactions but are more vulnerable to cyberattacks. Cold wallets, on the other hand, are offline storage solutions (either physical devices or software not connected to the internet), offering greater security against online threats. Cold wallets are ideal for long-term storage, while hot wallets are more suitable for frequent transactions.

Reserve Assets in Times of Crisis

Bitcoin is often referred to as “digital gold” due to its ability to retain value during periods of economic instability. Like gold, Bitcoin has a finite supply—capped at 21 million coins—which makes it less vulnerable to inflation compared to traditional currencies. During financial crises, when national currencies may experience devaluation, many individuals and businesses turn to cryptocurrency as a reserve asset to protect their savings from erosion. Additionally, cryptocurrencies, particularly Bitcoin, allow for asset storage outside of national banking systems, making them a secure option during financial upheaval or crises within a country.

Potential Risks and How to Mitigate Them

Cryptocurrencies are not without risks. It’s important to understand these challenges and take steps to protect your assets.

Hacker Attacks

Although cryptocurrencies are generally secure, wallets remain vulnerable to hacking. While the blockchain, the technology behind cryptocurrencies, is highly secure due to decentralization and encryption, wallets and exchanges where assets are stored can still be targeted. To mitigate these risks, additional security measures are crucial.

One effective measure is multi-signature (multisig) technology, which requires multiple private keys to authorize a transaction. This is particularly useful for securing large amounts or corporate wallets, where an added layer of verification is necessary to protect assets.

Hardware wallets are another essential tool for safeguarding cryptocurrencies. By storing private keys offline, these wallets protect assets from online hacking attempts. This is one of the safest methods of asset storage.

Loss of Access to Private Keys

Losing access to a private key poses a significant risk to cryptocurrency holders, as it effectively locks them out of their assets. To mitigate this, it's essential to create backup copies of the key and store them in secure locations, such as safes, hardware wallets, or safety deposit boxes. It's also wise to keep multiple copies in different places to guard against unforeseen circumstances. Using offline storage methods greatly reduces the risk of losing access to your assets.

Lack of Regulatory Clarity

The absence of clear regulation remains one of the biggest challenges for the widespread adoption of cryptocurrencies. In many countries, cryptocurrencies exist in a legal grey area or are inadequately regulated, creating additional risks for investors and users. Without clear legal guidelines, transactions may lack protection, and issues such as fraud or loss of funds can go unresolved.

It’s essential for users to be aware of the legal status of cryptocurrencies in their country. For example, in some jurisdictions, cryptocurrencies are considered financial assets and are taxed accordingly, while in others, their use is completely banned. Regulatory uncertainty can also create obstacles to the legal exchange of cryptocurrencies for fiat money or their use in commercial transactions.

Practical Tips for Secure Cryptocurrency Storage

To ensure the safest storage of cryptocurrencies, users should follow a few essential guidelines.

Choose a Trusted Wallet

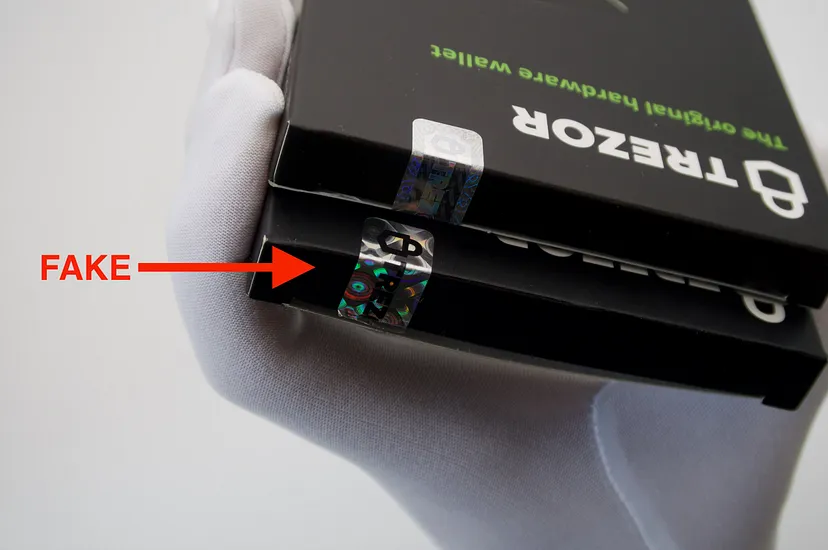

For long-term storage, hardware wallets such as Ledger or Trezor are the most secure options. These wallets store private keys offline, keeping them safe from hacking attempts. Always purchase these devices directly from the official website or authorized dealers to avoid counterfeit products. Additionally, set a strong password and regularly update the wallet's firmware to bolster security.

Follow Basic Cybersecurity Best Practices

Maintaining good cybersecurity habits is crucial to avoiding many threats. Always stay away from suspicious websites and never click on links from unknown sources. Enable two-factor authentication (2FA) on your accounts for exchanges and wallets—this extra layer of protection makes it far harder for hackers to access your funds. Before sending cryptocurrency, carefully double-check the recipient's wallet address, as even a small mistake could result in the permanent loss of assets.

Related: WhiteBIT’s Cybersecurity Tips

Asset Allocation

Diversification is a core principle of risk management. To protect your assets, consider storing some in a hardware wallet for long-term security and others in a hot wallet (online) for everyday transactions. This approach helps reduce the risk of losing everything if one wallet is compromised. Additionally, diversifying across different cryptocurrencies can mitigate the impact of any single asset's value decline.

By following these strategies, you can better safeguard your cryptocurrency holdings and minimize potential risks.

Why Cryptocurrency Security Rests with the User

The security of cryptocurrencies largely depends on the user. A lack of caution or understanding can easily put your assets in jeopardy.

Understanding Cryptocurrency

Cryptocurrency technology doesn’t allow for mistakes, as transactions are irreversible and access is solely controlled by private keys. Users who have a solid understanding of how blockchain works, as well as how wallets and exchanges operate, are less likely to make errors such as entering wrong addresses or storing keys in insecure places. It’s essential to keep your knowledge up-to-date and stay informed about the latest developments in the crypto world to be prepared for new risks and challenges.

The Role of the User in Asset Protection

The security of cryptocurrencies is closely linked to how responsibly the owner manages their assets. Using strong passwords, enabling two-factor authentication, and choosing reliable trading platforms are crucial steps in safeguarding your funds. Trusting your assets to unreliable or unverified platforms increases the risk of falling victim to scams. Additionally, conducting regular audits of your assets and reviewing how they are stored helps identify potential security threats early.

Cryptocurrencies and Financial Literacy

Investing in cryptocurrencies requires a solid understanding of the market, its volatility, the workings of blockchain, and the specifics of various cryptocurrencies. Taking excessive risks or making uninformed investments can often lead to significant financial losses. Users should carefully evaluate projects, assess their long-term potential, and avoid those promising “get-rich-quick” schemes. Improving financial literacy not only enhances asset management but also enables more informed decision-making.

Cryptocurrency holders should be not only users but also responsible managers of their assets, as the security of their investments is ultimately in their hands.

As technology and regulations continue to evolve, cryptocurrencies will become more accessible and secure. However, it is important to remember that the safety of your assets begins with personal responsibility.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.