What Is MegaETH: How It Plans to Outperform Other Layer 2s?

MegaETH is a performance-focused blockchain designed to process transactions instantly. Seeing “MegaETH” metal heads might think of some Dave Mustaine’s blockchain project. But no, this one is exclusively tied to Ethereum.

On this page

It’s a Layer 2 solution created to push Ethereum’s limits, aiming for an impressive 100,000 transactions per second.

As of January 2025, MegaETH is in the pre-launch phase, preparing to release its public testnet.

How is MegaETH different from existing Layer 2s? Why did Ethereum co-founder Vitalik Buterin choose to invest in the project? When will MegaETH launch, and will it have a native token?

We’ll discuss all these aspects further in this article.

Why Ethereum Isn't There Just Yet

Despite its vision to be a global World Computer, supporting decentralized applications, it's still a work in progress. Web2-level performance, including high speed of transactions and simple user experience, remains on the agenda.

Currently, Ethereum is limited to 15 transactions per second. As Vitalik Buterin said, the blockchain is designed so that users with low hardware capacity can join and run a node.

On one hand, wide hardware participation increases decentralization, but the tradeoff is that users face slow confirmations and high fees because of congestion.

Related: Vitalik Buterin Targets 100,000 TPS in Ethereum’s Evolution

This doesn’t mean progress hasn’t been made though.

Over time, different projects appeared to help Ethereum become more scalable and address its limitations. Besides this, the network itself went through a number of technical updates.

One of the main technical breakthroughs in the space is Layer 2 solutions.

They are like extra layers built on top of Ethereum to handle transactions off the main chain, bundle them up, and then send a summary back to Layer 1 for faster and cheaper transactions.

According to L2Beat, there are more than 120 Layer 2s. Each of these chains offers benefits, but MegaETH mentions that they are limited by computing capacity.

For example, chains update their state every second or more while applications like complex games and high-frequency trading require millisecond-level responses.

So, MegaETH aims to address the issue with a new approach.

What MegaETH Is Doing Differently?

As we mentioned earlier, hardware capacity is a huge factor in how fast blockchain transactions can happen. Here’s the thing: for a block to be finalized, most of the nodes on the network need to process it first.

But sometimes, things slow down because a few nodes are struggling – maybe because of low-capacity hardware or running into some tech glitches. And that’s where MegaETH comes in with a fresh approach to tackle these bottlenecks.

Layer 2s can help with this because they don’t have the same one-size-fits-all hardware requirements.

MegaETH takes advantage of this by having specialized nodes that are designed to handle specific tasks more efficiently and avoid any hold-ups.

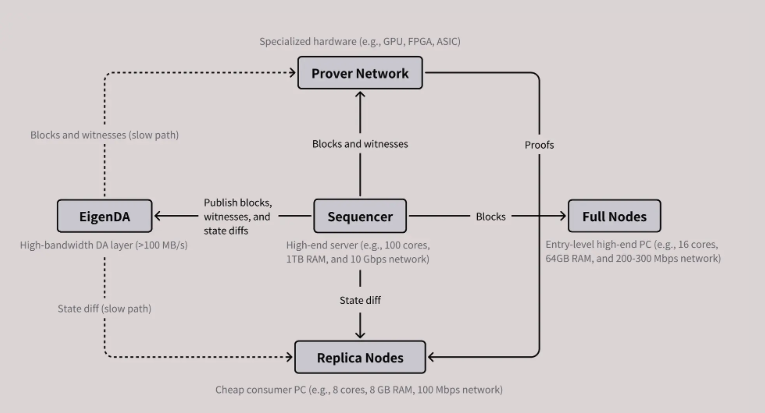

In MegaETH’s network, there are four main roles: sequencers, provers, full nodes, and replica nodes.

Sequencers are in charge of ordering and executing user transactions. However, only one sequencer is active at a time, which reduces the need for consensus while everything runs smoothly.

Replica nodes receive updates from the sequencer and apply changes directly to update their local states. They don’t re-execute transactions, but instead, they validate blocks using proofs provided by the provers.

Full nodes, on the other hand, re-execute every transaction to validate blocks. They are crucial for power users, like bridge operators and market makers, who need fast finality, though they require more hardware to keep up with the sequencer.

Finally, the provers validate blocks in a flexible order, without storing any state, using a stateless validation method.

To keep data running smoothly, MegaETH uses EigenDA as its data availability layer.

What About the MegaETH Team and Investors?

The idea for MegaETH started in the summer of 2022 when Yilong Li, CEO and co-founder, was finishing his PhD at Stanford. With a proof of concept in hand, he teamed up with Lei Yang, who was exploring blockchain consensus and networking at MIT. The two shared a passion for high-performance systems, so Lei joined as the CTO and co-founder, according to the project’s website.

To round out the team, they brought on Shuyao Kong, former Head of Global Business Development at ConsenSys, as CBO and final co-founder.

Together, they combined technical expertise with a strategic vision to form the core of MegaETH.

Since its creation, MegaETH has raised $30 million in two funding rounds. In the latest funding round in December 2024, they pulled in over $10 million through the angel investor platform Echo.

Before that, in June 2024 it raised $20 M in a seed round led by Dragonfly Capital. Investors included Vitalik Buterin, Joseph Lubin, Figment Capital, Folius Ventures, Robot Ventures, Big Brain Holding, Tangent and Credibly Neutral.

Commenting on his investment, Buterin said that developing hyper-scalable EVM implementations is essential for scaling Ethereum. “I am excited to see brilliant developers taking on this challenge”- he added.

When Will MegaETH Launch? Will There Be MegaETH Airdrop?

MegaETH’s public testnet is expected to go live in the next few months. In a post on X, founder and CBO Shuyao Kong shared that the team has been working on MegaETH for the past three years, and 2025 is shaping up to be the year it goes from an idea to something real.

Looking back, he mentioned that 2023 was mostly spent testing and fine-tuning the technical design.

Then, in 2024, things really started picking up. They launched the MegaMafia builders’ program to speed up the development of cool, fully on-chain, real-time apps for users. On top of that, they laid out their vision for creating a World Computer.

And they’re not slowing down: community-driven initiatives are also on the way.

Now, here’s the big question: will there be a native token? According to CryptoRank, an airdrop is on the cards. But, as of now, there haven’t been any official announcements or details about tokenomics.

MegaETH Seems Perfect – But There's One Catch

MegaETH, a performance-focused blockchain, promises impressive transaction speeds to make Ethereum great again.

But there’s a potential tradeoff: decentralization.

At any given time, only one active sequencer is responsible for ordering and executing user transactions. This means more control is concentrated in one place, which could lead to prioritizing or censoring transactions.

While MegaETH’s approach to block production leans toward centralization, it uses specialized nodes with adaptable hardware requirements to enable trustless block validation. This, in theory, ensures decentralization.

All things considered, MegaETH might not be exactly what decentralization purists are hoping for, but you can’t deny its bold approach to solving Ethereum’s scalability issues.

Looking ahead, MegaETH has big plans. It aims to set new standards for Layer 2 solutions with real-time transaction processing, potentially opening up use cases that weren't possible before.

Whether it becomes a go-to solution in the Layer 2 world will depend on how well it balances performance with decentralization, keeps its promises, and attracts developers and users.

In a space already full of new ideas and projects, MegaETH stands out by focusing on high performance and practical innovation. It’s definitely making people rethink what’s possible with blockchain, especially when it comes to blending speed and functionality with Ethereum’s future.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.