Bitcoin Tests $75K Support Amid Renewed U.S. Tariff Hike Pressure

As U.S. tariffs on China rise, Bitcoin’s $75,000 level is under pressure once more.

On this page

The world’s largest crypto fell 3.67% in the past 24 hours, briefly dipping to $75,000 — a level that’s taken on symbolic importance for market participants. BTC has since rebounded to $76,500 at the time of writing.

Speculation surged following news that the U.S. plans to raise tariffs on Chinese imports to 104% — a level many experts equate with an effective trade blockade. With such costs, American companies are unlikely to maintain supply chains dependent on China.

Bitcoin, despite the shockwaves, held the $75,000 line. But the market paid a price: total liquidations hit $423 million, and long positions accounted for nearly $291 million of that total — a clear sign of shaken confidence.

- The Fear & Greed Index sank to 15 points, indicating extreme fear — as investors react nervously to Trump’s unpredictable tariff policies.

- Bitcoin’s market dominance rose to 62.6%, while Ethereum’s share fell below 7.3%, reflecting a reshuffling of investor priorities.

Is Bitcoin Building a Double Bottom?

Though BTC has seen wild swings lately, trading volume tells a different story — just $13B exchanged hands in the past 24 hours, compared to $53B during the last test of $75K, Binance data shows. That drop in activity may suggest the formation of a local bottom.

A bullish extended divergence on the 4-hour RSI also supports the idea of an upward move — potentially to $80K, or even $85K if momentum holds.

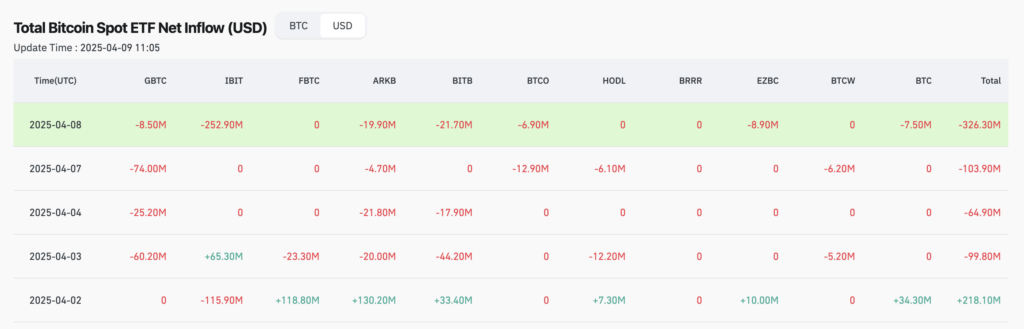

Bitcoin ETFs Bleed $326M in a Day

Capital is flooding out of U.S. spot Bitcoin ETFs, with $326.3 million withdrawn on April 8 alone. BlackRock’s flagship fund, IBIT, took the hardest hit, shedding $252.9 million. Across the board, inflows have dried up.

This marks the third straight day of redemptions, unfolding in lockstep with China’s tariff retaliation against the U.S. — a sign that geopolitics are beginning to weigh heavily on institutional crypto appetite.

Lennix Lai, Global Сhief Commercial Officer at OKX, says Bitcoin and spot ETFs are still heavily influenced by the broader liquidity environment — and right now, that liquidity is scarce. In such conditions, risk appetite dries up fast.

But he argues that Bitcoin’s value shouldn’t just be measured in dollar terms:

More investors are starting to see it as a strategic reserve asset — a diversification tool in an era of traditional market instability.

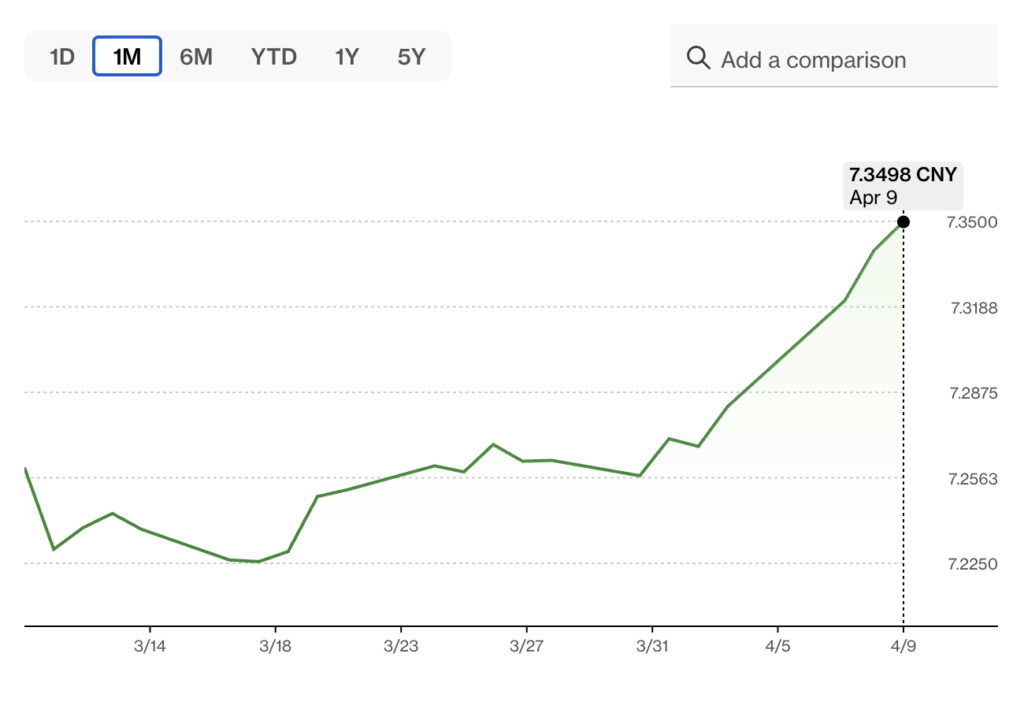

Yuan Drop Seen as Bullish Signal for Bitcoin

Facing aggressive U.S. tariffs of up to 104%, China is recalibrating — exploring internal growth drivers and allowing its currency more flexibility. A weaker yuan could push capital toward crypto as a hedge. With the yuan hitting 7.36 to the dollar — a two-year low — the conditions for a Bitcoin rally are quietly falling into place.

Ben Zhou, the CEO of Bybit, argues that China may deliberately weaken its currency in retaliation to U.S. trade moves — a playbook seen before. In his words, Chinese investors often turn to Bitcoin as a form of capital protection during such shifts, despite local restrictions on crypto access.

Yet not everyone sees a runaway devaluation ahead. Analysts warn that China is unlikely to unleash unlimited yuan liquidity, pointing instead to a controlled, strategic approach.

Beijing's more strident stance on U.S. tariffs could align with some softening in the yuan to better absorb incoming shocks. But the People's Bank of China will not desire or pursue sharp depreciation as financial stability features,

notes Vishnu Varathan, Head of Macro Research for Asia excluding Japan at Mizuho Bank.

With economic strategies being rewritten across leading nations, market volatility is poised to escalate. Brent Donnelly, President of Spectra FX Solutions, warns that investors are preparing for broader turbulence — not just in USD and CNY, but across all major liquid currencies — as trade tensions ripple through virtually every corner of the global economy.

Forecasting where the market goes next is no easy task in this environment. For now, Bitcoin is hovering between support at $75K and resistance at $80K. A breakout beyond either end of this range — and sustained movement — could indicate which side has the upper hand: buyers or sellers.

Read on: Trump’s Tariffs and Crypto: PitchBook Weighs the Real Risk Ahead

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.