$83K and Rising: Bitcoin Rallies After Tariff Freeze in U.S.-Trade War

A 90-day delay in new U.S. tariffs unleashed bullish momentum across markets, propelling Bitcoin beyond the $83K threshold.

On this page

In just 24 hours, Bitcoin rallied over 6%, riding the wave of news that the U.S. would delay its planned import duties for 90 days — a surprise that turned risk appetite back on.

At the time of writing, Bitcoin remains steady around the $82,000 level.

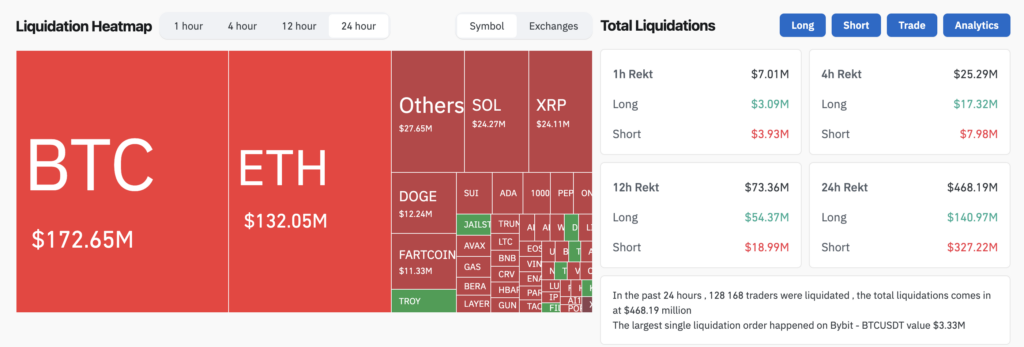

But not everyone celebrated the rally. Over $468 million in crypto positions were liquidated in just one day—most of it from short sellers, who saw $327 million wiped out as the price ripped higher.

A single policy decision out of D.C. turned markets around. The S&P 500 jumped by nearly 10%, reclaiming lost ground from earlier in the week—while crypto saw liquidation volumes spike in tandem.

The announcement of a tariff freeze made subtle but noticeable waves in crypto analytics:

- The Fear and Greed Index inched up to 25, exiting the “extreme fear” zone (source: CoinMarketCap).

- Bitcoin dominance remained virtually flat at 62.6%.

- Ethereum’s share of the market was unchanged at 7.4%.

- The Altseason Index is still suppressed, sitting at 16.

This reinforces a clear message: Bitcoin continues to outperform the altcoin segment.

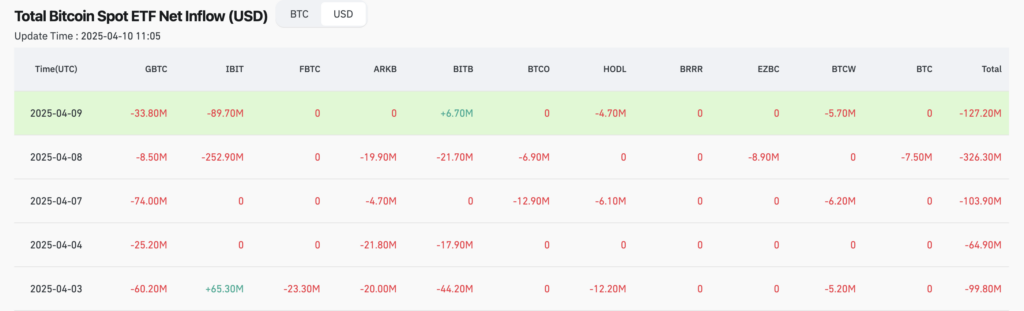

Bitcoin-ETF Bleeds for Fifth Straight Day as BlackRock Leads Losses

April 9 marked the fifth consecutive day of institutional outflows from U.S. spot Bitcoin-ETFs, totaling $127.2 million. Once again, BlackRock’s iShares Bitcoin Trust ETF (IBIT) topped the red list with $89.7 million in losses.

But the numbers might not capture the late-session optimism—Bitcoin’s late-day surge suggests a potential shift in momentum.

Bulls Are Back — Bitcoin Nails the Double Bottom

Though bullish sentiment was amplified by external catalysts, chart patterns had already begun hinting at a turnaround:

- The emergence of a double bottom hinted that bears were losing steam.

- A clear bullish divergence on key indicators underscored fading sell pressure.

- Most critically, Bitcoin broke through and held above $80,000, turning psychological resistance into support — a classic move by committed bulls.

The extended downtrend remains the major hurdle. There’s no official trend reversal, and the market knows it: the Bitcoin futures premium for two-month contracts has once again slipped below 5% annually, signaling subdued momentum and a tilt toward neutral to bearish expectations.

Caution still clouds the market, and it’s no wonder — Donald Trump’s erratic stance on tariffs offers little clarity. Just days earlier, he dismissed any suggestion of suspending duties. Meanwhile, the yield on 10-year U.S. Treasuries retreated to 4.29%, hinting at a growing investor preference for the security of long-term, stable assets.

You look at what happened to the curve last night, that was pretty extreme by anyone's metrics – 2s-10s steepening 30 basis points in a few hours; I've certainly never seen that,

Candriam Senior Fixed Income Portfolio Manager Jamie Niven remarked.

Bitcoin Sentiment Improves After U.S. Tariff Pause, But Analysts Urge Caution

Retail traders are feeling hopeful again, says Santiment, following news that the U.S. is pressing pause on tariff hikes. That kind of emotional turnaround often leads to impulsive buying — and could boost Bitcoin’s momentum.

But seasoned voices in the space advise restraint. Postponement isn’t the same as cancellation — and the tariff wildcard is still in play.

Bitwise CIO Matt Hougan doubled down on the company’s projection: Bitcoin could climb to $200,000 before the year’s end. He links this potential surge to what he describes as a strategic move by the Trump administration — a weakening of the U.S. dollar via tariff pressures and future rate cuts. In his view, it’s all part of a plan to revive domestic industry, even if it comes at the expense of the dollar’s global reserve status. Bitcoin, in that case, stands to benefit.

In the long term, the implications are even more positive. A shake-up in the global macro system creates an opportunity for new reserve assets to emerge. And that makes sense: Governments and companies turn to the dollar for international trade precisely because of its stability. When that stability comes into question, they have to look elsewhere,

Hougan notes.

Starting March 28, 2025, Binance has seen its Bitcoin holdings swell by 22,106 BTC — a staggering $1.8 billion in value. The influx typically hints at looming sell pressure, as traders position themselves ahead of volatile events. In this case, all eyes are on the next U.S. CPI report. A hotter-than-expected inflation reading could easily spark the next leg down.

Сheck this out: Will There Be a Recession in 2025? Markets, Data, and Trump’s Tariffs

Even with encouraging headlines around tariffs, Bitcoin is far from out of the woods. Persistent liquidity shortages, an entrenched downtrend, and volatile economic signals continue to shape the landscape. If the bulls can’t push past $83,000 or $85,000 soon, a return to $75,000 may be the market’s next chapter.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.