OnyxCoin (XCN): Why This Layer-3 Blockchain Is Gaining Investor Attention

OnyxCoin isn’t just a crypto project—it’s an infrastructure built for the digital age, offering scalable, secure, and low-cost transactions for a globalized economy.

On this page

- OnyxCoin: Another L3 or a Hidden Crypto Gem?

- How Arbitrum Nitro & AnyTrust Power Onyx's Scalability

- Security & Fraud Prevention: How Onyx Stays Resilient

- OnyxCoin (XCN): Core Utility & Tokenomics

- Onyx DAO: Governance That Puts Power in the Right Hands

- XCN Scarcity: Why Onyx Burns Tokens

- XCN Staking: Incentives, Security & Ecosystem Growth

- AI-Driven Optimization in Onyx

- Onyx: Bringing Blockchain to Banks & Enterprises

- OnyxCoin: Transforming Finance for the Digital Age

A new era in crypto has arrived: Layer-3 (L3) blockchains are setting the stage for faster, more efficient transactions. Leading this revolution is OnyxCoin (XCN), a blockchain network designed for financial scalability and seamless execution.

Built on Arbitrum Orbit with an optimistic rollup mechanism, OnyxCoin handles high transaction volumes with ultra-low fees. Catering to institutional players and DeFi builders, it’s paving the way for mass adoption of blockchain-based finance.

Ethereum is the backbone of DeFi, with Arbitrum and Base thriving as L2 solutions. So why introduce an L3 like OnyxCoin?

- Efficiency Boost

Dynamic gas adjustments make transactions faster and cheaper.

- Enterprise Adoption

OnyxCoin simplifies asset tokenization and financial automation.

- DeFi Compatibility

Full EVM support enables a smooth transition for existing Ethereum projects.

Tired of waiting days for your money to transfer? Traditional banks still rely on outdated systems, but OnyxCoin changes the game with instant transactions—perfect for international payments and tokenized assets.

Want to do more with your crypto? OnyxCoin lets you take out loans backed by NFTs, earn with XCN staking, and automate finances using AI.

This isn’t just another digital token. OnyxCoin is laying the foundation for the future of finance—where DeFi and traditional banking work together in a smarter, faster ecosystem.

OnyxCoin: Another L3 or a Hidden Crypto Gem?

Blockchain technology has evolved beyond standard L1 chains like Ethereum and Bitcoin and L2 scaling solutions such as Arbitrum and Optimism. Enter OnyxCoin, a third-layer (L3) blockchain offering unparalleled speed, ultra-low fees, and maximum adaptability for businesses and developers.

Built on Arbitrum Orbit and integrated with AnyTrust for data management, OnyxCoin’s L3 framework is fine-tuned for high-performance applications, including corporate banking and DeFi ecosystems that demand efficient, scalable transactions.

While Ethereum and Bitcoin struggle with inefficiency and high costs, and L2s like Arbitrum and Base still face congestion issues, OnyxCoin’s L3 design provides a next-generation solution.

Onyx L3 brings unmatched scalability:

- Faster than L1 and L2 thanks to Arbitrum Nitro’s cutting-edge processing.

- Optimized transaction costs, minimizing fees through advanced batching.

- Enterprise adoption made easy, allowing businesses to run their own blockchains within Onyx.

At its core, Onyx integrates Arbitrum Nitro, AnyTrust DAC, and fraud-proof mechanisms, ensuring a powerful yet secure ecosystem. Let’s break it down.

Check this out: How Cryptocurrencies Are Boosting Financial Inclusion Worldwide

How Arbitrum Nitro & AnyTrust Power Onyx's Scalability

As blockchain adoption grows, network congestion and high gas fees have become major concerns. OnyxCoin leverages two key technologies to ensure seamless performance.

- Arbitrum Nitro

By leveraging a high-performance execution environment, Arbitrum Nitro enables parallel transaction processing. This architecture minimizes delays, optimizes network throughput, and significantly reduces overall congestion.

- AnyTrust DAC (Data Availability Committee)

Storing data on Ethereum is expensive and slows down processing. While L2 solutions struggle with this dependency, Onyx redefines efficiency with AnyTrust DAC (Data Availability Committee)—a system designed to slash storage costs and boost transaction speeds.

This synergy results in a streamlined blockchain network where transactions are not only more cost-effective but also significantly faster.

Security & Fraud Prevention: How Onyx Stays Resilient

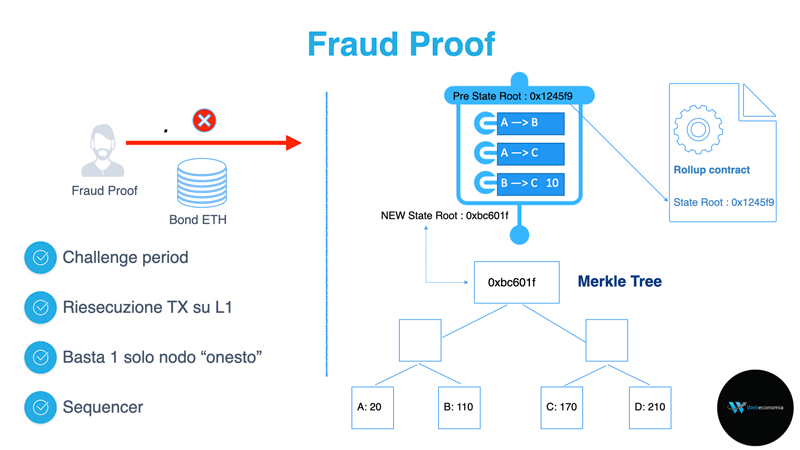

With its optimistic rollup framework, Onyx executes transactions before verifying them, ensuring superior speed and scalability. However, this method requires an advanced fraud-proof mechanism to detect and mitigate fraudulent activity.

Onyx’s fraud-proof mechanism acts as a safeguard against invalid transactions and data manipulation. If an unauthorized action is detected, network nodes can dispute it. To ensure accuracy, the system temporarily postpones blockchain finalization, giving validators the necessary time to verify transactions.

By integrating this model, OnyxCoin achieves both high performance and strong security, making it a reliable solution for corporations and everyday users alike.

Related: Crypto Heist 101: How Hackers Steal Millions in Crypto

OnyxCoin (XCN): Core Utility & Tokenomics

XCN plays a pivotal role in ensuring network efficiency and sustainability:

- Decentralized governance – Token holders contribute to protocol evolution.

- Staking mechanism – Incentivizes security and network participation.

- Lower gas fees – Optimizes transaction costs across applications.

- Supply control – Helps manage liquidity and long-term stability.я.

Many crypto tokens exist just for transactions. XCN breaks the mold. It’s a key player in the Onyx ecosystem, rewarding holders and fostering deeper network engagement.

Beyond simple transfers, XCN actively strengthens security, fuels growth, and attracts serious investors—proving that not all tokens are created equal.

More on topic: Token and cryptocurrency functions you need to know

Onyx DAO: Governance That Puts Power in the Right Hands

As a decentralized autonomous organization (DAO), Onyx enables XCN holders to take an active role in shaping the network. Governance decisions—spanning protocol adjustments, fee regulations, and ecosystem expansion—are determined through a structured voting process.

To prevent governance attacks or speculative interference, voting rights are reserved for holders of at least 100 million XCN, ensuring stability and long-term decision-making.

XCN Scarcity: Why Onyx Burns Tokens

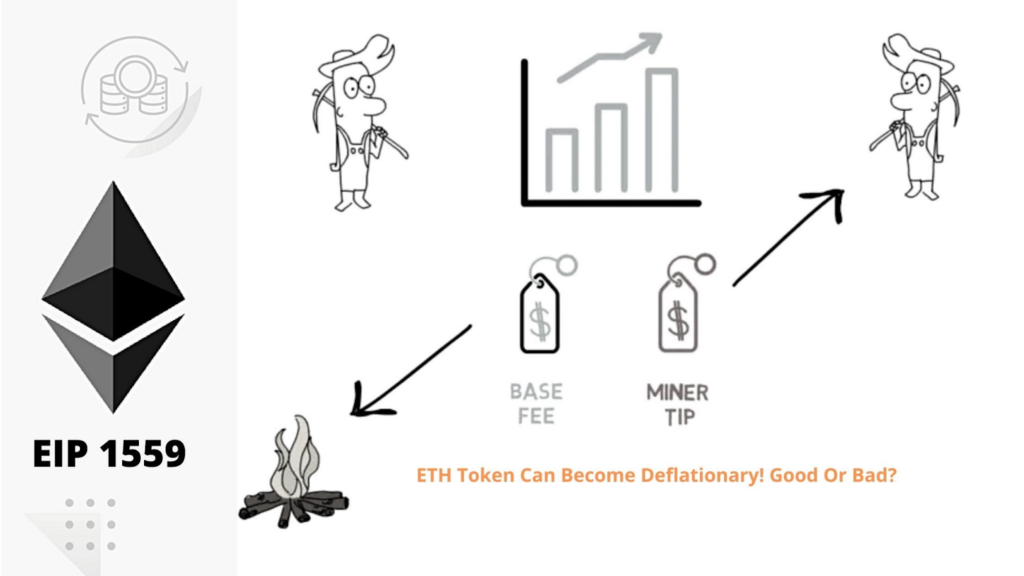

To maintain long-term value, Onyx integrates the EIP-1559 mechanism, a feature also used by Ethereum, where a fraction of transaction fees is permanently burned. This steadily reduces the total supply of XCN, making it scarcer over time.

The result? The more the network is used, the fewer XCN tokens remain in circulation—potentially driving up value as demand increases.

XCN Staking: Incentives, Security & Ecosystem Growth

The OnyxCoin staking system allows XCN holders to earn rewards while reinforcing network integrity. The staking APR dynamically adjusts based on network activity—higher engagement leads to greater rewards.

This mechanism not only promotes long-term holding but also enhances network stability, as staked tokens remain locked, reducing their availability for speculative trading.

As a versatile blockchain asset, OnyxCoin integrates governance, staking rewards, and decentralization, forming a robust ecosystem where users contribute to both security and economic sustainability.

Discover the intricacies: What is staking? Passive income in the crypto space

AI-Driven Optimization in Onyx

Why manage liquidity manually when AI can do it smarter? Onyx revolutionizes DeFi by integrating AI-driven automation, eliminating the inefficiencies of traditional platforms where users must track fee rates, investments, and liquidity on their own.

With deep market insights, Onyx AI dynamically adjusts liquidity pools, reducing risks for liquidity providers (LPs). No more assets stuck “out of range”—as seen in Uniswap V3—just a streamlined, intelligent financial ecosystem.

Topic of interest: Uniswap v4 Explained: What’s New in the Next Evolution of DeFi

Fixed DeFi fees don’t always work—especially when market conditions change rapidly. Onyx AI transforms the game with adaptive automation:

- Trading fees fluctuate based on market activity, reducing costs when transaction volume is low.

- Lending rates are adjusted dynamically, ensuring sustainable liquidity and balanced borrowing costs.

By embedding AI as a core component of the Onyx DeFi protocol, asset management becomes more intuitive, while risks for users are significantly reduced.

Onyx: Bringing Blockchain to Banks & Enterprises

Designed for both DeFi and institutional finance, OnyxCoin provides a framework for banks, investment funds, and enterprises to digitize operations, automate financial processes, and lower transaction costs. By bridging TradFi with blockchain technology, it enhances financial infrastructure.

With Onyx’s adaptable architecture, organizations can:

- Launch custom tokens for in-house transactions, customer incentives, and fundraising.

- Tokenize real-world assets, from stocks and bonds to real estate and funds, enabling seamless management and exchange.

Why wait days for a transfer when it can be instant? Why pay 5-10% in fees when costs can be cut to nearly zero? Onyx offers banks a revolutionary alternative to outdated financial infrastructure.

With Onyx, banks gain access to:

- Real-time, frictionless transactions without third-party intermediaries.

- Lowered costs by eliminating the need for SWIFT and other costly networks.

- Automated, secure financial operations through smart contracts.

By integrating Onyx, banks can develop faster, more cost-efficient financial services that outperform traditional banking models.

OnyxCoin: Transforming Finance for the Digital Age

OnyxCoin (XCN) is paving the way for a new paradigm in decentralized finance (DeFi), seamlessly blending speed, security, and adaptability. Its cutting-edge three-layer architecture (L3), powered by Arbitrum Orbit, reduces fees and boosts capacity, providing an efficient and scalable solution for both individuals and corporations.

The applications of Onyx extend far beyond DeFi, reaching Web3, corporate finance, and global payments. With the integration of AI, the platform ensures smart liquidity management and safeguards against market manipulation. The ability to tokenize assets and develop customized business solutions brings new opportunities to the traditional financial sector.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.