The Top Cryptocurrency Scams to Watch Out for in 2025

AI, fake exchanges, celebrity deepfakes, and old tricks repackaged in new forms. Here’s a look at the cryptocurrency scams gaining traction in 2025 and how to avoid losing everything to fraudsters.

On this page

Cryptocurrencies continue to gain popularity as more people invest in digital assets, seeking high returns and financial freedom. However, as interest in crypto grows, scammers become increasingly active. In 2025, cryptocurrency scams aren't just widespread; they're evolving.

Fraudsters now use AI, deepfake technology, and advanced social engineering tactics to deceive even experienced investors.

Related: Social Engineering in Crypto: Top 5 Fraud Schemes

However, the root of the problem lies in a paradox. Cryptocurrency is all about technology and decentralization, but the lack of centralized oversight leaves users vulnerable. In most cases, lost funds cannot be recovered.

That's why it's more important than ever to understand the scams you might face.

In this article, we'll examine the most dangerous and common cryptocurrency scams likely to be used in 2025. You'll learn how to identify fraud, recognize key warning signs, and protect your assets.

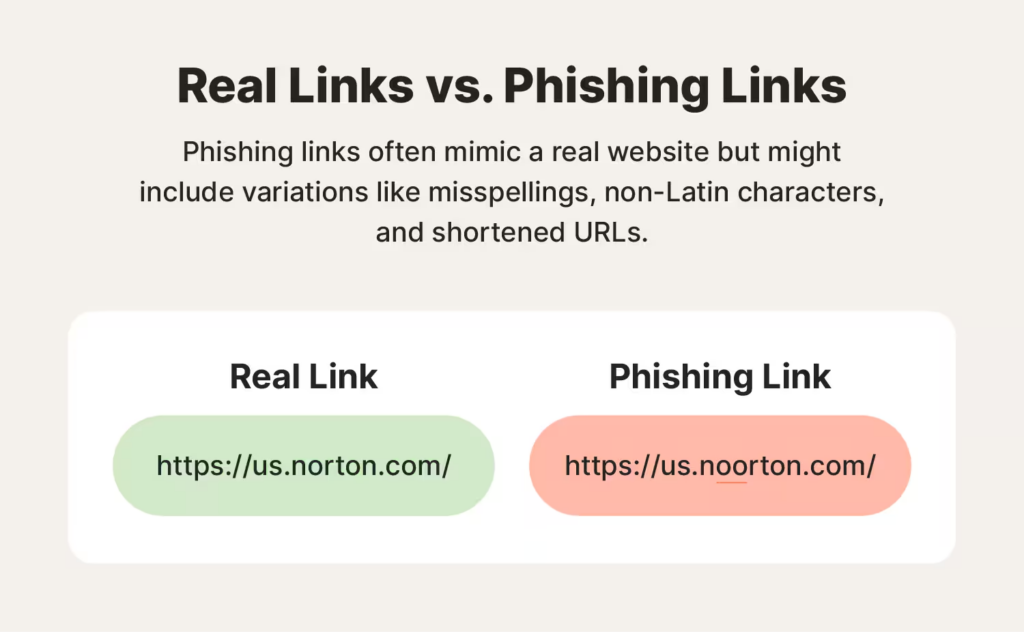

Phishing

Phishing remains one of the simplest yet most effective methods of deception. Attackers send fake emails, create fraudulent websites, and impersonate technical support teams from popular services to gain access to your private keys or cryptocurrency wallet logins.

How to protect yourself:

- Always carefully verify sender addresses and website URLs.

- Do not click on suspicious links, even if the message appears urgent.

- Never share your private keys or passwords with anyone.

- Enable two-factor authentication (2FA) on all your accounts.

Additionally, be especially cautious on messaging apps and social networks, as these platforms are frequently targeted for phishing attempts.

Related: How to Set Up a Crypto Wallet: Tips for Safe and Easy Setup

Fake Wallets and Exchanges

Fake wallets and exchanges look identical to legitimate platforms but are created specifically to steal your funds. They often replicate the design of well-known brands and attract users with promises such as bonuses, zero fees, or instant transactions.

How to protect yourself:

- Download applications only from official websites or authorized app stores.

- Always verify the website URL carefully; it should start with “https.”

- Store large amounts using hardware wallets.

If you're unsure about a platform, do not trust it with your money.

Related: Ledger Flex: A “Cold Storage” Star Among Wallets

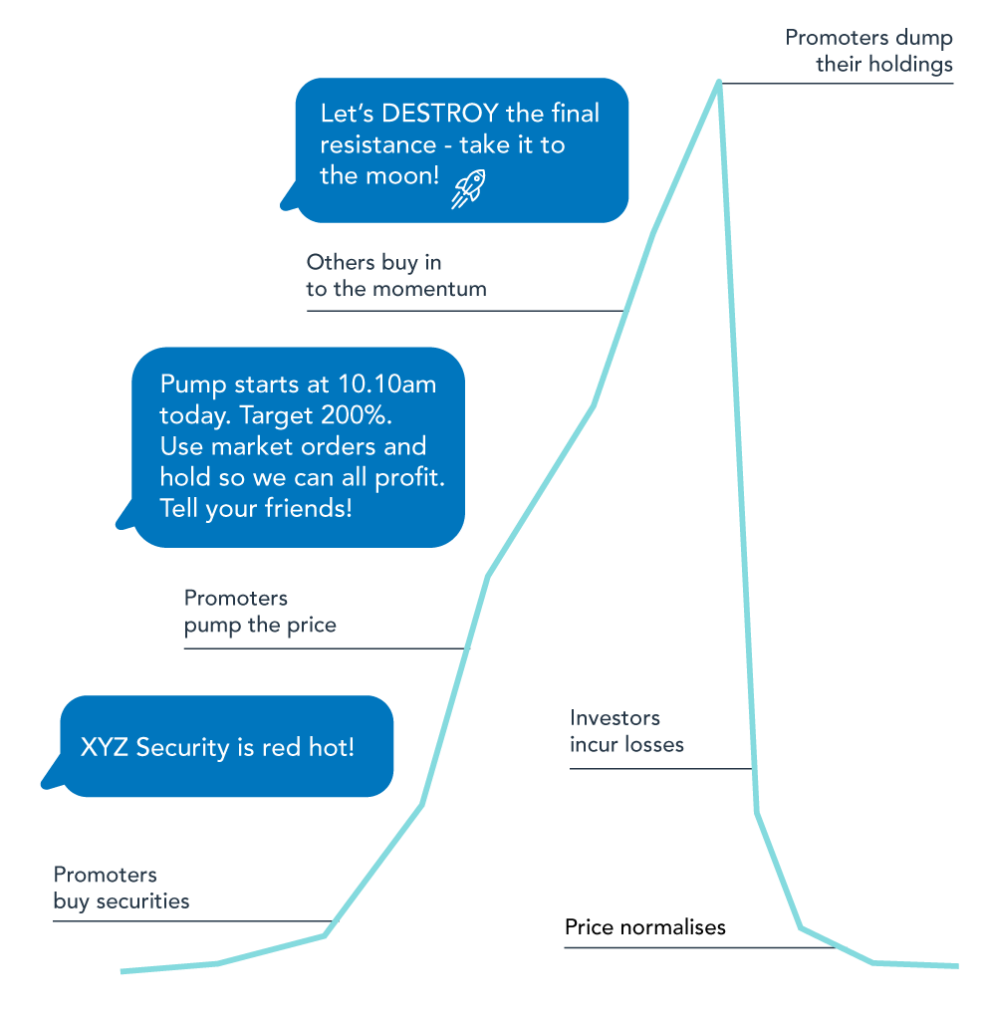

Pump and Dump Schemes

Pump and dump schemes are fraudulent tactics designed to generate quick profits at the expense of inexperienced investors. Initially, an affiliated group of developers aggressively promotes a token, leading to a rapid price increase. Once investor interest and trading volume peak, the organizers sell their holdings to new investors, causing the token's price to collapse.

How to protect yourself:

- Don't fall for unjustified hype on social media.

- Carefully check trading volumes and historical price data.

- Avoid projects with anonymous teams or without a real product.

Moreover, in 2025, such schemes are increasingly disguised as “AI-generated analytics,” making them even more dangerous.

Copycat Tokens

Scammers often create copycat tokens by replicating the names, designs, and even descriptions of legitimate projects, especially popular AI coins. These cryptocurrency scams rely on investors rushing to “get in early” without carefully verifying the project's authenticity.

How to protect yourself:

- Examine the project team and their previous projects.

- Review the technical documentation and tokenomics.

- Always read the whitepaper and check if it's original.

If a project cannot clearly explain its value, that’s a serious red flag.

Fake Celebrity Endorsements

Scammers use deepfakes and fake social media accounts to create the illusion that celebrities support certain projects. Typically, they promote “exclusive” investment opportunities or crypto giveaways to lure money from unsuspecting fans.

How to protect yourself:

- Always verify information through official pages and verified social media accounts.

- Never trust celebrity-backed offers promising guaranteed returns.

- Never send funds to addresses mentioned in videos or posts without careful verification.

Furthermore, deepfakes are becoming increasingly realistic, so never rely solely on first impressions.

Related: Top 5 Celebrity Crypto Projects That Failed

Rug Pulls and Honeypots

A rug pull is a cryptocurrency scam where developers create a token, attract investors' money, and then suddenly disappear with all the liquidity, effectively leaving investors empty-handed.

Related: What a Rug Pull and How Is It Related to a Scam?

On the other hand, a honeypot is a more deceptive scheme where investors can buy tokens but are unable to sell them due to hidden conditions embedded in the smart contract.

Related: 50 People Fall for a Honeypot Scam in South Korea

How to protect yourself:

- Carefully examine the project's whitepaper and team credentials.

- Check whether liquidity is locked.

- Look for a publicly available audit of the smart contract.

If the project team is anonymous and the token is rapidly gaining popularity, approach with extreme caution.

Ponzi Schemes

In the crypto world, Ponzi schemes often disguise themselves as DeFi projects, crowdfunding initiatives, or cloud mining. Typically, returns to earlier investors are paid using funds from new participants rather than from genuine profits.

How to spot a Ponzi scheme:

- Promises of “guaranteed returns” are a major red flag.

- If you're pressured to invest quickly, that's manipulation, not opportunity.

- Always seek transparency: Who is behind the project? How does it earn money? Has an audit been performed?

Remember, sustainable investments never promise quick profits without risk.

Related: What Is a Ponzi Scheme?

Cloud Mining Scams

Cloud mining schemes often turn out to be fraudulent. Scammers usually have no real mining equipment, and the profits shown exist only on your screen. Such websites appear professional, displaying fake statistics and high returns to convince you to invest.

How to protect yourself:

- Verify who is behind the project and confirm they have real infrastructure.

- Be skeptical of promises offering high returns with minimal investment.

- Look for independent reviews and community feedback.

If an offer seems risk-free or too good to be true, it's almost certainly a cryptocurrency scam.

Related: HashFlare: The Story Behind the Infamous Crypto Ponzi Scheme

AI and Deepfake Scams

Artificial intelligence offers new opportunities, both for businesses and scammers. Consequently, scams involving deepfake videos, fake AI platforms, and fraudulent social media accounts are increasingly common in 2025. This is particularly relevant for tokens marketed as “innovative” or “AI-powered.”

What to watch out for:

- Videos with unnatural facial expressions and movements might be deepfakes.

- Always verify sources carefully. Check who originally published the content and whether there’s official confirmation.

- Be cautious of projects promising revolutionary technology or quick profits without clear explanations.

Technology is becoming smarter, but caution remains your best protection.

How to Protect Yourself from Cryptocurrency Scams in 2025

Cryptocurrency scams are becoming increasingly sophisticated, but basic protective measures remain effective. Thus, here are practical steps to minimize risks and keep your assets safe.

Use reliable tools. Hardware wallets, reputable exchanges, VPNs, and two-factor authentication (2FA) represent the minimum security level every investor should maintain.

Do your own research (DYOR). Carefully evaluate the project's team, read the whitepaper, analyze social media presence, and check community forums. Look for independent reviews and verify whether the project has undergone an audit.

Stay informed. Follow trusted cryptocurrency news sources and participate in communities where users share experiences and warn about new scams.

Trust your intuition. If a project promises guaranteed returns or pressures you into making quick decisions, be cautious. Avoid rushing into investments driven by emotions.

Report scams. If you encounter fraud, document all details and report them to your local authorities, the Federal Trade Commission (FTC), or the Internet Crime Complaint Center (IC3). Your report can protect others and enhance overall community safety.

Practicing caution and maintaining healthy skepticism are your best defense in the crypto world.

Stay Alert

Cryptocurrency offers numerous opportunities, but the risks involved are equally significant. Fraud doesn't disappear; instead, it evolves, adapting to new technologies and user behaviors.

However, it's essential not to panic or avoid crypto out of fear. Instead, remain cautious, learn to recognize cryptocurrency scams, use protective tools, and act calmly and rationally.

Remember that knowledge, vigilance, and experience are the three key principles that will help protect your assets in 2025.

Related: Don’t Stress, Crypto Trader: Tips to Handle Trading Pressure

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.