What Is Market Cap in Crypto? How It Affects Crypto Pricing

In the crypto world, terms like “market cap,” “market capitalization” and “cryptocurrency market cap” are frequently used by traders, investors, and enthusiasts. Understanding what market cap means in the context of crypto assets valuation is essential for making informed investment decisions. But what is it? Let’s find out.

On this page

- What Is Market Cap in Crypto?

- General Formula for Market Cap in Crypto:

- How Does Market Cap Affect Crypto Pricing?

- Market Cap and Types of Cryptocurrencies

- Market Cap and Crypto Pricing Fluctuations

- Market Cap vs. Price: What’s the Difference?

- What Does Market Cap Tell You About Crypto?

- FAQs About Crypto Market Cap

- 1. What is a good market cap in crypto?

- 2. Is a higher market cap better?

- 3. Should I buy crypto with a low or high market cap?

- 4. What does market cap tell you?

What Is Market Cap in Crypto?

Market capitalization, or simply market cap, refers to the total value of a cryptocurrency in circulation. It is a fundamental metric used to assess the size and overall value of a cryptocurrency.

The market cap is calculated by multiplying the current price of a single unit of the cryptocurrency (token or coin) by the total circulating supply. This gives investors a snapshot of the overall value of the cryptocurrency in the market.

General Formula for Market Cap in Crypto:

Market Cap=Price per Coin×Circulating Supply

For example, if a cryptocurrency has 1 million coins in circulation and each coin is worth $100, the market cap would be:

1,000,000×100=100,000,000

This means the cryptocurrency’s market cap is $100 million.

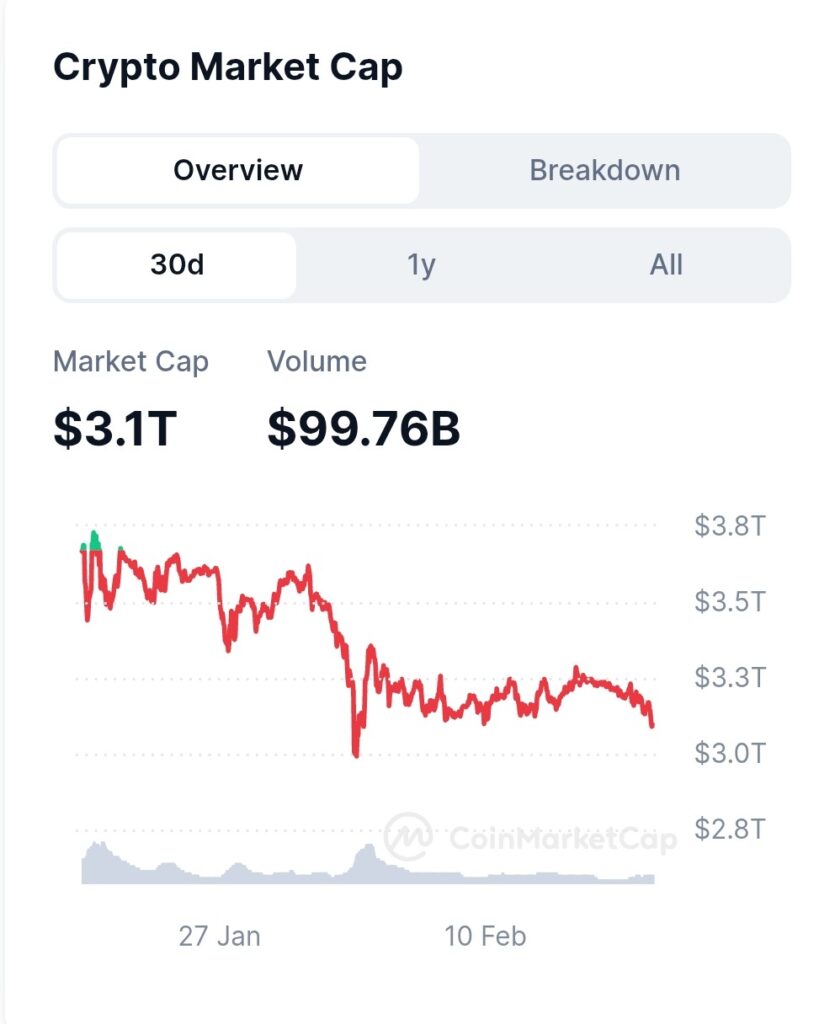

When it comes to the capitalization of the entire cryptocurrency market (i.e. the current value of all the coins and tokens in free circulation), we simply need to sum the capitalization of all these cryptocurrencies.

How Does Market Cap Affect Crypto Pricing?

Actually, it's the opposite: the price of cryptocurrencies determines market capitalization.

However, market capitalization plays an important role in determining the objective state of the market, providing insight into trends, dynamics, dominance of certain sectors, and many other useful metrics.

- Price Influence

Market cap is directly linked to the price of a cryptocurrency. When the price of a coin increases while the circulating supply remains constant, the market cap also increases. Conversely, if the price drops, the market cap decreases.

- Circulating Supply

The circulating supply refers to the number of coins that are currently available for trading in the market. A coin with a large circulating supply, even if priced low, can still have a large market cap. For example, a cryptocurrency with 10 billion coins priced at $1 will have a market cap of $10 billion, even though each coin is relatively inexpensive.

- Market Perception

Investors and traders often use market cap as a benchmark to assess the potential of a cryptocurrency. A higher market cap may suggest that a cryptocurrency is more established or has a larger market following. On the other hand, a lower market cap may indicate that the coin is relatively new, smaller in terms of market influence, or has greater growth potential.

- Volatility and Liquidity

The market cap can also indicate the volatility and liquidity of a cryptocurrency. Lower market cap coins are typically more volatile because they are less liquid and subject to larger price swings with smaller amounts of capital entering or exiting the market. Higher market cap coins, on the other hand, tend to be more stable due to their larger market presence.

Related: Stablecoins Achieve Historic $200 Billion Market Cap

Market Cap and Types of Cryptocurrencies

Cryptocurrencies are often classified into categories based on their market cap. These classifications help investors understand the size and maturity of a particular crypto asset, providing a clearer picture of the associated risks and opportunities.

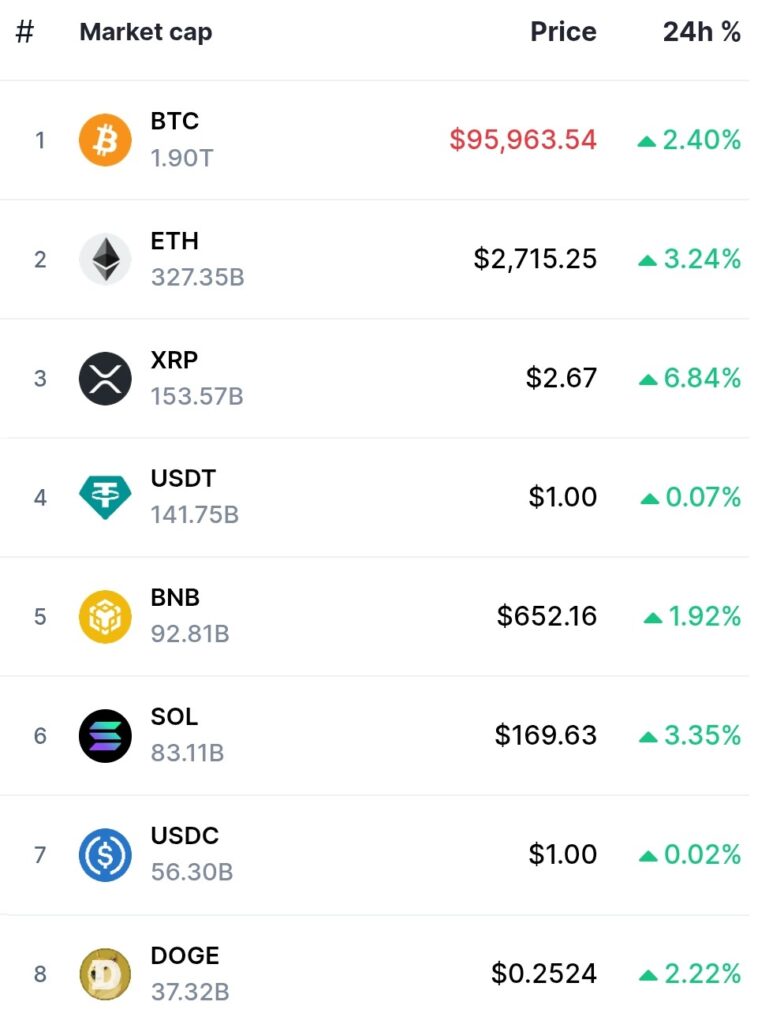

- Large-Cap Cryptocurrencies

Large-cap cryptocurrencies are those with a market cap over $10 billion. These coins are generally considered more stable and less volatile. Some of the most well-known cryptocurrencies, like Bitcoin and Ethereum, fall into this category. Due to their size and liquidity, large-cap cryptocurrencies are often seen as safer investments, but they might also offer lower growth potential compared to smaller coins.

Example: Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB)

- Mid-Cap Cryptocurrencies

Mid-cap cryptocurrencies typically have a market cap ranging from $1 billion to $10 billion. These coins are generally more volatile than large-cap coins but may still present relatively lower risk than smaller cryptocurrencies. Mid-cap cryptos may have the potential for higher growth compared to large-cap coins, as they are still in the process of establishing themselves in the market.

Example: Chainlink (LINK), Polygon (POL), Near Protocol (NEAR)

- Small-Cap Cryptocurrencies

Small-cap cryptocurrencies have a market cap below $1 billion. These coins are typically seen as higher-risk investments due to their low liquidity, high volatility, and potential for manipulation. However, they may also offer higher potential returns for those willing to take on more risk. Many altcoins fall into this category and often attract investors looking for speculative plays.

Example: The Sandbox (SAND), Chiliz (CHZ), Decentraland (MANA)

- Micro-Cap Cryptocurrencies

Micro-cap cryptocurrencies are those with a market cap under $100 million. These coins are the most speculative and risky. Investors in micro-cap coins should be prepared for extreme price swings and the potential for large losses. However, these coins can also present enormous upside if they succeed in gaining mainstream adoption or recognition.

Example: Coin98 (C98), Omni Network (OMNI), Velodrom Finance (VELO)

To know the market cap of cryptocurrencies, you don't always need to calculate it on a calculator. All this data can be found on specialized aggregator websites (like CoinMarketCap or CoinGecko)

Market Cap and Crypto Pricing Fluctuations

The price of any cryptocurrency fluctuates frequently due to various factors, and these price fluctuations directly affect the market cap. Cryptocurrency prices are driven by market demand, news, regulatory changes, investor sentiment, and overall market conditions. When the demand for a particular cryptocurrency increases, the price rises, which leads to an increase in market cap. Conversely, if the demand decreases, the price falls, and so does the market cap.

This is the kind of data needed as a basis for fundamental analysis.

Factors Influencing Crypto Market Cap:

- Demand and Supply

Just like traditional financial markets, the balance of demand and supply significantly impacts cryptocurrency prices and, by extension, market cap. When more people buy into a cryptocurrency, its price rises, which leads to an increase in market cap.

- Adoption and Technological Advancements

The success of a cryptocurrency often depends on its adoption within various sectors, whether it's through decentralized finance (DeFi), gaming, or NFTs. Technological upgrades, such as Ethereum’s transition to Proof-of-Stake (PoS), can also affect the market cap by making the cryptocurrency more appealing to investors.

- Regulatory News

News related to government regulations can have a major impact on the pricing of cryptocurrencies. Positive regulatory news can cause a surge in prices, while negative news, like potential bans or restrictions, can lead to significant price drops.

Market Cap vs. Price: What’s the Difference?

While market cap and price may seem like interchangeable terms, they are very different.

- Price refers to the current value of one individual unit of a cryptocurrency.

- Market Cap provides the total value of all the coins or tokens currently in circulation.

A cryptocurrency with a high price per unit may not necessarily have a high market cap if the circulating supply is low. Conversely, a cryptocurrency with a low price may have a high market cap if the circulating supply is large.

For example: Litecoin (LTC), with 84 million coins circulating at $135, has a larger capitalization than Bittensor (TAO), with the coin worth over 3 times more ($410). The reason is a much smaller supply on the market (8.39 TAO).

What Does Market Cap Tell You About Crypto?

Market cap serves as a metric to help assess the relative size, risk, and growth potential of a cryptocurrency. While it provides a quick snapshot of how much value a coin holds in the market, it is not the sole indicator to guide investment decisions.

- Risk and Volatility: A low market cap typically signals higher volatility and risk, while a high market cap may indicate more stability.

- Growth Potential: Lower market cap cryptocurrencies may have more room to grow, but they also come with increased risk.

- Market Sentiment: Large-cap cryptocurrencies tend to be widely adopted and are more likely to remain in the market for the long term. On the other hand, small-cap cryptos may experience rapid rises and falls in value.

FAQs About Crypto Market Cap

1. What is a good market cap in crypto?

A “good” market cap in crypto depends on your investment goals and risk tolerance. Large-cap cryptocurrencies (market cap over $10 billion) are typically considered safer but may offer lower returns. Mid-cap cryptos (market cap $1 billion – $10 billion) balance risk and reward. Small-cap coins (market cap under $1 billion) have higher growth potential but come with greater risk.

2. Is a higher market cap better?

Not necessarily. A higher market cap generally indicates greater stability and less volatility, but it might also suggest slower growth potential. Smaller market cap coins may provide higher returns but come with increased risk. It's important to consider your investment strategy before deciding if a higher market cap is better for you.

3. Should I buy crypto with a low or high market cap?

The decision to buy crypto with a low or high market cap depends on your risk appetite and investment goals. High market cap coins are less volatile and more stable, making them suitable for conservative investors. Low market cap coins offer higher growth potential but are more speculative and risky.

4. What does market cap tell you?

Market cap provides insight into the overall size and value of a cryptocurrency. It helps assess its relative stability, risk level, and growth potential. A higher market cap suggests a more established and stable cryptocurrency, while a lower market cap could indicate a more volatile or speculative asset.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.