Will There Be a Recession in 2025? Markets, Data, and Trump’s Tariffs

The S&P and Nasdaq are both down hard, recession chances hit 66%, and Trump’s tariff rhetoric is shaking markets. What’s fueling the fears — and how close are we to a full-blown downturn?

On this page

Markets have entered full-blown panic mode, with traders rushing to price in the bleakest possible outcomes.

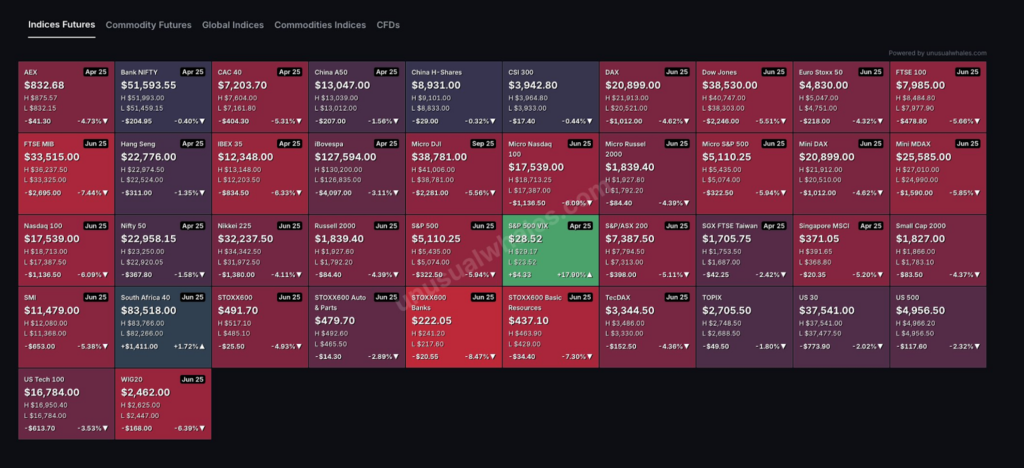

Key indices are collapsing:

- The Nasdaq-100 sank 5.4% in a day.

- The S&P 500 shed nearly 4%.

Not since Black Monday in 1987 has Wall Street seen a three-day collapse this steep — even the COVID-19 shocks pale in comparison.

On Kalshi and Polymarket, the numbers speak volumes: recession bets in the U.S. have soared to 66% and 65%. Only a week ago, they lingered at 40%. Confidence has shifted — what once seemed unlikely now feels inevitable. For many, a 2025 recession is no longer a question of if, but when.

But is this truly the start of a downturn — or merely the shadow of fear casting itself on the markets?

To cut through the noise, we need to get clear on one thing: what exactly is a recession?

Check this out: What Are Prediction Markets and How Do They Work

What Is a Recession in Economics?

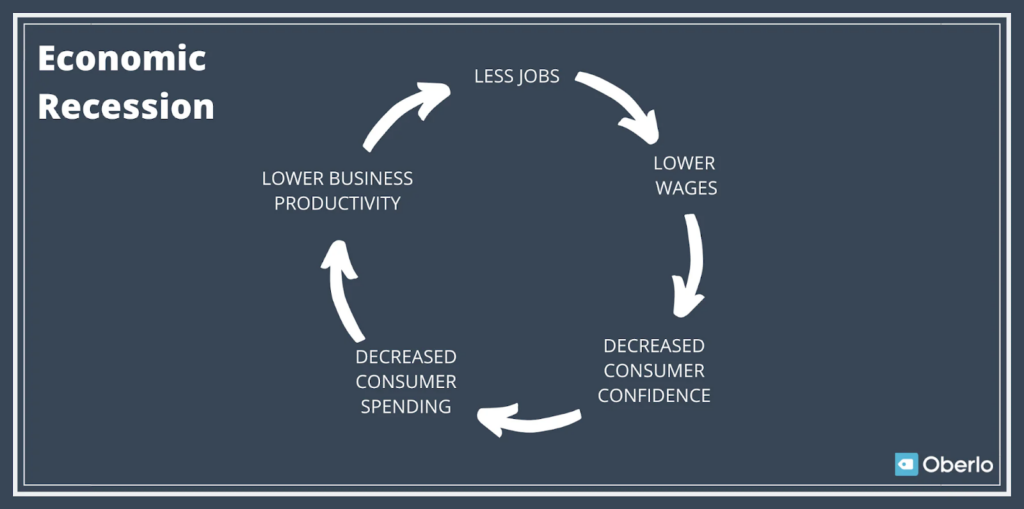

A recession is a deeper shift — a phase of the economic cycle when the economy begins to contract not in one area, but across the board.

During a recession, key indicators fall in tandem:

- production,

- employment,

- income,

- consumer spending,

- and retail sales.

One dip doesn’t make a recession. A chain reaction does.

In the U.S., it’s the National Bureau of Economic Research (NBER) that officially calls recessions. And despite public belief, it doesn’t use rigid rules like “two straight quarters of negative GDP.”

Instead, the NBER studies a broader range of data — including real incomes, employment figures, manufacturing trends, and retail sales — to pinpoint turning points in the economic cycle.

Recessions are typically recognized in hindsight, when the data is already behind us. At the same time, a negative GDP reading doesn’t guarantee a real recession if other indicators — jobs, spending, production — hold steady.

But on Wall Street, no one waits for official declarations. The market speaks early — and in capital.

Kalshi, the prediction market for real-world events, currently places the probability of a U.S. recession in 2025 at 66%. Polymarket follows closely at 65%. Both platforms recorded historic peaks within a 48-hour window. Just a week earlier, at the end of March, expectations sat at a far more tempered 35–40%.

The selloff hasn’t spared the major equity indices. Nasdaq-100 futures have collapsed 5.4%; the S&P 500, 3.84%. Analysts are already drawing comparisons to 1987 — a moment darker than even the market's pandemic descent.

And as the equity walls shake, capital seeks shelter. Investors are flooding into bonds. FedWatch now shows that over a third of participants expect the Fed to cut rates by 100 basis points before year’s end — a signal not of confidence, but of quiet alarm.

This isn’t proof of a recession. But it’s proof of something else: panic has set in. And often, it’s that panic — not the data — that sets the downturn in motion.

Is the U.S. Already in a Recession?

Not by the numbers — not yet.

- The U.S. economy is still expanding. GDP growth has decelerated, but it remains positive. Current quarterly data doesn’t support a technical recession call.

- The job market remains exceptionally strong. Unemployment is at multi-decade lows, hiring remains active, and the service sector is showing resilience. Manufacturing is soft but not in decline. Household incomes are stable. Retail performance is consistent. Business sentiment is volatile, but not deteriorating.

- What matters most is this: the NBER has yet to declare a recession. As the sole institution empowered to make that judgment, its silence speaks. Until the core signals align — across output, jobs, income, and demand — the downturn remains unofficial.

Web3 Work: Crypto Jobs Are Remote-First: Everything You Need to Know

Trump’s Tariffs: The Risk Behind the Market Panic

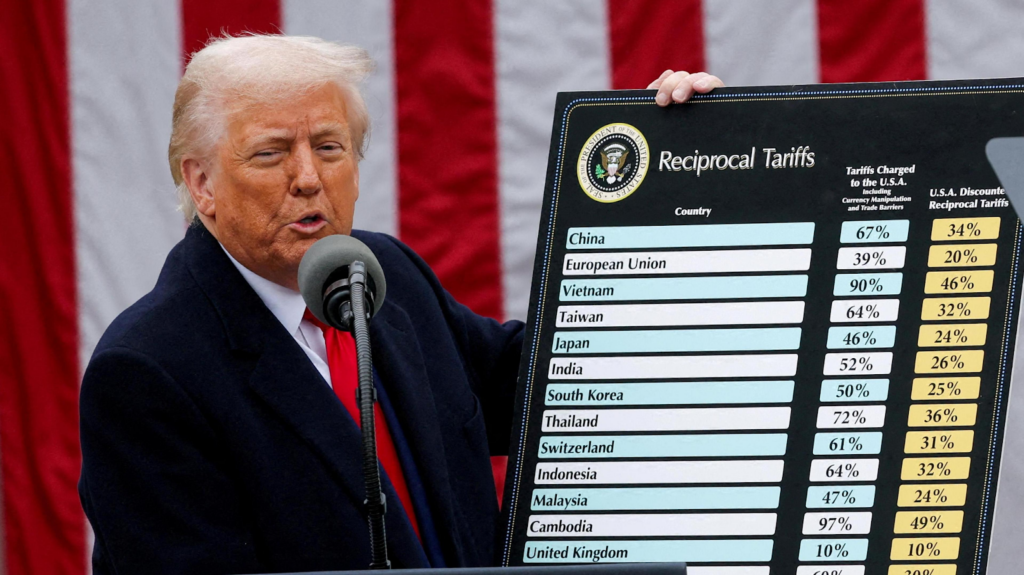

While current data doesn’t point to a recession, one looming policy shift could trigger a reversal: Donald Trump’s aggressive trade agenda. He’s calling for a 10% universal tariff on all imports — and up to 104% on Chinese goods.

This is the most significant trade disruption proposed in recent memory. For markets, it’s a signal they can’t afford to ignore.

After Trump’s latest declarations, bank shares cracked. HSBC and Standard Chartered dropped 10% overnight — not by accident, but because they sit where world trade converges.

Their fall reads like a symptom. The market senses something deeper: a coming lull in global momentum.

In tandem, oil and copper prices collapsed. These raw materials aren’t just assets — they’re economic thermometers. And when they cool, it means industry might be slowing, trade faltering, and demand softening across continents.

Tariffs are more than just duties at the border. They bring broader consequences:

- rising business expenses,

- shrinking margins,

- workforce cuts,

- and a slump in demand.

Should they come into force, these policies alone could pull the plug on the expansion — even without a single rate hike from the Fed.

Why Recessions Are Inevitable?

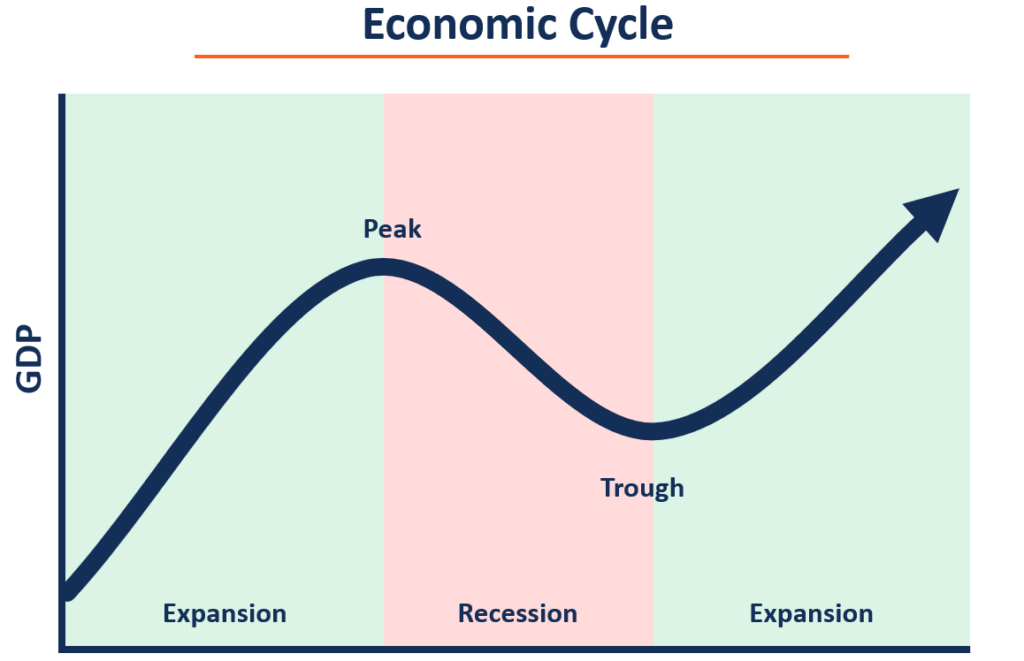

Economies don’t grow forever. They pulse — expanding, contracting, recovering. Recessions come when something interrupts that pulse.

A war. A virus. A tariff. A geopolitical rift. One spark is all it takes.

And when it hits, the damage spreads: disrupted supply lines, shattered assumptions, fear outpacing logic. The cycle folds inward.

An Overheating Economy. Rapid growth fuels inflation. To rein it in, central banks raise rates — making credit more expensive and cooling off investments. Growth, once soaring, begins to stall.

Bubble Trouble. When asset prices are inflated and investors wait too long to exit, the inevitable happens. In 2008, it was housing. In 2001, tech stocks collapsed. Different assets, same result.

Psychology. Fear causes consumers to hold back. Businesses notice the slowdown and begin slashing costs — often through layoffs. Purchasing power weakens. Demand slips further. A self-reinforcing cycle sets in.

Often, these forces converge.

At present, the warning signs are stacking up: tariff threats, anticipated rate cuts, and growing market unease. Technically, this isn’t a recession. But it could be the beginning of one.

Tariff Escalations: U.S.-China Trade War Sends Markets Reeling

A Market Crash ≠ A Recession

Markets react to what they think will happen — not what’s happening right now. That’s why they often move before the broader economy does.

A sharp drop on Wall Street? It’s a signal, not a certainty.

Remember 2022? The U.S. saw two consecutive quarters of negative GDP — but jobs kept growing. The NBER never declared a recession. The economy held up better than the markets feared.

It looks like a storm, but the ground hasn’t given way:

- The Nasdaq and S&P are tumbling as if a crisis is already here.

- Investors are rushing for cover in safe assets.

- The mood? Nervous, brittle, expectant.

Yet, the fundamentals remain intact — for now. Employment is stable. Consumer spending persists. Household incomes are still strong.

It’s a subtle truth: bear markets don’t guarantee a recession. But recessions rarely arrive without one.

Today, we’re already seeing the first indicator. The second — whether it follows — remains uncertain.

Crypto Basics: What Is a Bullish Market? How to Spot One Before It Happens

If the Recession Arrives

It won’t begin with headlines, but with silence. Fewer job openings. Raises that never come. Then, one by one, the layoffs start.

Businesses retreat. Small shops hit pause on growth. Big corporations shelve investments. Credit tightens. Demand thins. And the economy, like a tide pulling back, begins its slow retreat.

When crisis hits, policy kicks in:

- The Fed cuts rates to revive lending,

- The Treasury follows, deploying stimulus.

Stimulus doesn’t work overnight. The economy can continue to sputter even after the bottom is in. Just look at 2008: GDP was rising, but the job market stayed weak for years.

Meanwhile, crypto is still considered a risky bet. And in moments of panic, investors ditch risk first. That’s why Bitcoin often drops alongside the Nasdaq when a recession begins.

There’s a flip side, too.

A rate cut from the Fed would put pressure on the dollar — potentially boosting interest in alternative assets like crypto. That trend could accelerate if the central bank also reintroduces quantitative easing or rolls out new stimulus measures.

Long term, a recession might actually benefit crypto — reinforcing its role as a counterweight to traditional finance.

But in the short term, expect turbulence. Volatility and market pullbacks usually come first.

Economic Cryptoupdates: ETH/BTC Crashes to 2020 Levels as Markets React to Trump’s Tariffs

Are We in a Recession Yet?

By current data — no.

The U.S. economy continues to expand. Jobs remain plentiful. Incomes haven’t slipped. By the book, there’s no recession — yet.

But the storm may be forming just beyond the horizon. Markets sense it. And they’re moving ahead of the facts.

The signals are clear — and ominous:

- The yield curve has flipped,

- Indexes are falling fast,

- Betting markets like Kalshi and Polymarket are pricing in a downturn.

The wildcard? Trump. His tariffs could crush global trade. And if the Fed lags — the damage could run deeper.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.