Investing in Crypto-Friendly Assets in Dubai

How can you turn digital assets into long-term income through investing crypto Dubai strategies? Here’s how to take advantage of everything this unique city offers.

On this page

- Investing Crypto in Dubai Real Estate

- Buying Property with Bitcoin and Other Cryptocurrencies

- Profitability and Long-Term Potential

- Staking as a Source of Passive Income

- How Staking Works in Dubai

- Regulated Options as Part of Crypto Investment in Dubai

- Real Estate Tokenization in Dubai

- How Much Can You Earn from Real Estate Tokens in Dubai

- Investing Through Licensed Platforms

- Participating in Crypto Funds

Dubai has earned a reputation as a city of opportunity, where blockchain innovation and financial growth go hand in hand. With the global rise of cryptocurrencies, the emirate has become one of the leading destinations for crypto-friendly business and investment.

In Dubai, investors can put their crypto assets to work across a wide variety of innovative investment options, from buying a villa on Palm Jumeirah to earning steady passive income through regulated staking. The city offers opportunities for investors of all kinds.

With strong government support for blockchain projects and no capital gains tax, Dubai has become a prime destination for those who understand the importance of diversification.

Investing Crypto in Dubai Real Estate

Residential and commercial properties in Dubai have long been seen as some of the most reliable investment options. Now that cryptocurrency payments are accepted, this market has become accessible to digital asset holders as well.

The city offers a combination of high returns and a level of stability that is rare in today’s world. This makes it especially appealing to international investors.

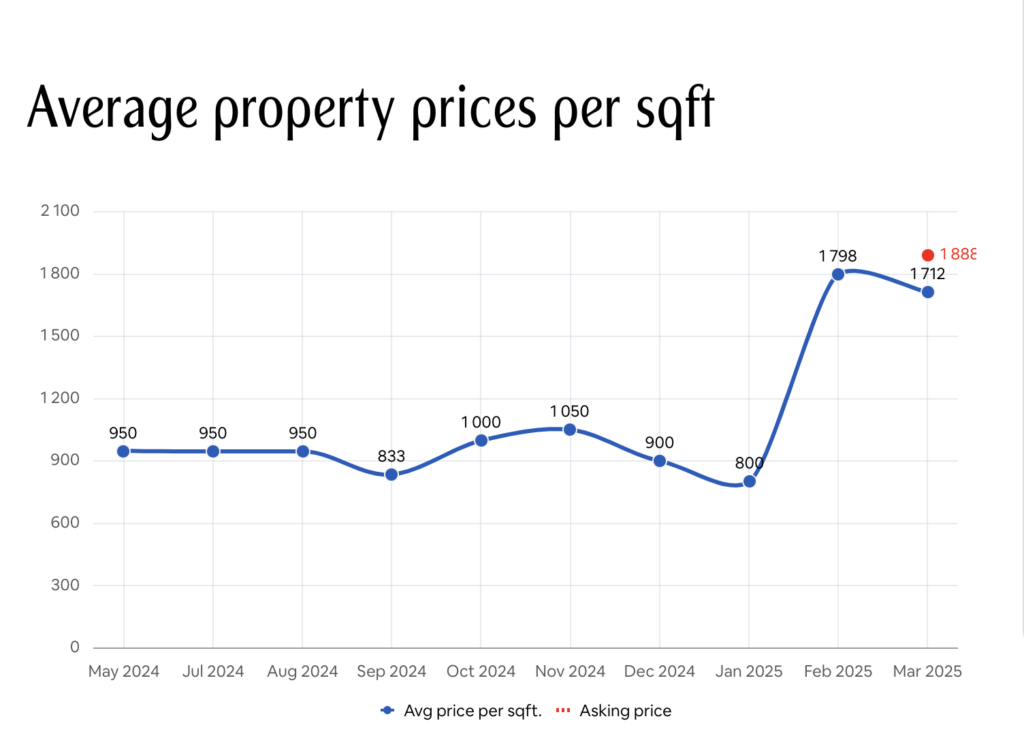

With fears of a global financial crisis, more crypto holders are choosing Dubai’s real estate market as a safe investment target. However, this growing demand has led to a sharp increase in price per square meter across the city.

Buying Property with Bitcoin and Other Cryptocurrencies

Many reputable developers in Dubai (such as Emaar Properties, DAMAC Properties, and FAM Properties) now accept crypto payments, including Bitcoin, Ethereum, and USDT.

The process is simple:

- The buyer selects a property

- The cryptocurrency is transferred through an intermediary platform, where it is converted into dirhams

- The authorized transaction is then registered with the Dubai Land Department (DLD).

Payment takes just a few minutes, much faster than traditional bank transfers. Moreover, final registration and issuance of the ownership certificate are usually completed within hours.

Property prices range from AED 888,000 for a small studio on the outskirts to several million dollars for luxury villas on the islands. One major advantage is saving on banking fees.

Blockchain ensures secure and transparent transactions. In addition, the absence of capital gains tax, as highlighted by DAMAC Properties, allows investors to retain more profit when reselling or renting out the property.

Related: Can You Really Live Off Crypto? Here’s What It Takes

Profitability and Long-Term Potential

Real estate in Dubai provides returns in two ways:

- through the appreciation of property value

- and from monthly rental income

According to Dxboffplan.com, the average rental yield ranges from 6% to 10% per year, which is higher than in cities like New York or London.

For example, an apartment in Dubai Marina purchased with BTC could pay for itself within 12 to 15 years through rental income alone. When factoring in annual price growth (between 5% and 10% in high-demand areas), property investment becomes a strong tool for building capital.

Investors can use cryptocurrency to enter the market, effectively turning volatile digital assets into stable, income-generating physical property.

Staking as a Source of Passive Income

Staking is another option for investors in Dubai to generate income from their crypto assets. It allows them to earn rewards while holding their digital coins, which makes it a strong fit for long-term strategies.

How Staking Works in Dubai

Don’t worry—the technical side of staking in Dubai is exactly the same as it would be if you were on a polar research station at the North Pole.

What makes Dubai attractive to crypto investors is its tax-free environment. Unlike many Western countries, Dubai doesn’t tax staking rewards. Over time, even small investments can grow into substantial capital that can later be reinvested into other assets, including real estate.

In simple terms, staking involves temporarily locking up your cryptocurrency in a wallet to support blockchains that run on the Proof-of-Stake (PoS) consensus mechanism. Node operators receive the required pool of coins to validate transactions, while users earn rewards proportional to the size of their stake.

The most popular staking platforms in Dubai include major exchanges such as Binance and Bybit. Investors can simply choose a crypto asset, lock it for a selected period, and earn rewards in the same cryptocurrency or in USDT. This process does not require any advanced equipment like mining does and is accessible even to beginners.

In Dubai, where cryptocurrencies are legal under VARA oversight, liquid staking is also gaining popularity. It offers the benefit of earning interest while still allowing the use of staked assets within DeFi ecosystems. Investors can reinvest the earned tokens, gradually increasing their overall holdings.

For more on how DeFi can boost your passive income, check out our article: Can DeFi Help You Achieve Financial Freedom?

Regulated Options as Part of Crypto Investment in Dubai

Regulated products allow investors to diversify their portfolios. These investment tools combine:

- Relative safety (the asset may lose value over time, but the risk of fraud at the deal-making stage is much lower),

- Growth potential (it’s worth noting again that we’re talking about ever-appreciating Dubai, not the North Pole)

This combination makes regulated products a key element of any investing crypto Dubai strategy.

Real Estate Tokenization in Dubai

Real estate tokenization is one of the most promising areas for investors looking to gain exposure in the UAE.

In March 2025, the Dubai Land Department (DLD) launched a pilot initiative called the Real Estate Tokenization Project, making it the first real estate regulator in the Middle East to adopt blockchain for property title registration.

The project was developed in partnership with the Virtual Assets Regulatory Authority (VARA) and the Dubai Future Foundation (DFF) as part of the broader Real Estate Innovation Initiative (REES). It allows investors to purchase digital tokens that represent fractional ownership in real estate, with entry starting at just AED 183 (around $50 as of March 2025).

Platforms such as Estate Protocol and SandBox Real Estate are already involved in testing. For example, these platforms enable investors to buy shares in apartments located in Downtown Dubai, one of the city’s most prestigious and tech-savvy districts, and earn rental income.

The process is simple:

- The investor signs up on the platform

- Completes KYC verification

- Sends the payment in cryptocurrency (Bitcoin, Ethereum, or USDT)

- Receives the corresponding property tokens in their wallet

Rental income is then distributed based on the investor’s ownership share and is paid out either monthly or quarterly, depending on the platform’s policy.

Related: Real Estate for Cryptocurrency: Lawyers Express Doubt

Tokenization lowers the barrier to entry into the real estate market, making it accessible even to small-scale investors. Traditional property purchases in Dubai typically require a minimum investment of 750,000 AED (around $204,000), while tokenized ownership allows investors to get started with significantly smaller amounts.

Another often overlooked benefit for traditional investors is the ability to sell tokens on the platform’s secondary market at any time. This offers a level of liquidity that physical real estate lacks, where selling a property can take weeks or months.

To explore the most promising areas of this market, read our article: Best RWA Projects.

How Much Can You Earn from Real Estate Tokens in Dubai

DLD estimates that by 2033, the tokenized real estate market will reach 60 billion AED (approximately $16 billion), making up 7% of all property transactions in the emirate. This growth aligns with Dubai’s long-term real estate development strategy through 2033.

The market is regulated by VARA, which oversees the issuance and circulation of real estate tokens as virtual assets.

Platforms must:

- Follow anti-money laundering (AML) regulations

- Provide transparent financial reporting

- Link each token to a specific property

- Store ownership data on the blockchain, which prevents forgery or double selling

DLD Director General Marwan Ahmed bin Ghalita stated that the initiative streamlines the buying and selling process while attracting new investors. During the pilot phase, properties in popular areas such as Downtown Dubai and Jumeirah Beach Residence are being tested, with plans to expand the program after reviewing results at the end of 2025.

Moreover, private companies are also following the trend. For example, in January 2025, DAMAC Group signed a billion-dirham agreement with the blockchain platform MANTRA to tokenize its financial assets.

For investors, tokenization opens new doors. For example, investing 10,000 AED in tokens representing Downtown Dubai apartments can generate between 700 and 800 AED in annual rental income (7–8%). This level of yield matches that of full property ownership but requires far less capital.

It’s an attractive option for those who want to diversify their portfolios with cryptocurrency while generating stable income in Dubai’s growing real estate market.

Investing Through Licensed Platforms

For those seeking structured and secure crypto investment options, several platforms in Dubai operate under the supervision of the Dubai Financial Services Authority (DFSA).

Every real estate property listed on these platforms undergoes DFSA verification, ensuring compliance with regulatory standards and reducing the risk of fraud.

One such platform is Stake, a service that allows users to invest in real estate with a minimum contribution of just 500 AED (around $136). Investors gain fractional ownership in high-yield properties, including apartments in areas like Dubai Marina and Business Bay. Stake carefully selects properties that offer annual rental returns of over 5%. Earnings are distributed monthly, and investors can choose to receive payouts in either dirhams or stablecoins.

To become a Stake client, users must register, complete KYC verification, and make a deposit using either a bank transfer or a cryptocurrency transaction.

Investors can sell their share in a tokenized apartment or office on the secondary market after holding it for six months. This approach limits speculative risks while still offering relatively quick access to capital.

The platform charges a 2% fee when purchasing and a 1% fee when selling. These fees cover asset management and legal support for each transaction.

Cryptocurrency transactions combined with the reliability of traditional investments attract users who want to enter the real estate market without taking on excessive risk or making large commitments.

Participating in Crypto Funds

In addition, Dubai continues to develop crypto ETFs that focus on blockchain startups.

Among the most recognized names are Arqaam Capital and 21Shares. These funds operate under the oversight of the Dubai Financial Services Authority (DFSA) and the Securities and Commodities Authority (SCA), offering investors a portfolio-based approach to cryptocurrency investing. The funds cover a range of sectors, including decentralized finance (DeFi) and tokenized assets.

Minimum investment requirements vary:

- For retail investors: from 10,000 AED

- For qualified investors: from 500,000 AED

For instance, 21Shares provides access to a fund that includes native cryptocurrencies from large-cap blockchains such as Ethereum and Solana. Depending on market conditions, annual returns can reach 10–12%.

Participation in these funds comes with strict requirements. Investors must complete full identity verification, including proof of the source of funds, in line with anti-money laundering (AML) regulations.

Management fees include:

- 1.5% to 2.5% of the asset value annually

- Up to 20% of profits as a performance fee

Redemptions are typically allowed during predetermined windows, usually once per quarter, which means investors need to plan with a long-term perspective.

Crypto ETFs must submit quarterly reports to the DFSA or SCA and undergo independent audits, which helps reduce risk for participants.

Their main advantage lies in risk diversification without requiring investors to analyze the market in detail. Unlike staking, where income depends on the performance of a blockchain, returns here are linked to real assets or businesses.

This makes them an ideal option for those looking to balance their portfolios while reducing the inherent volatility of cryptocurrencies.

Dubai’s regulatory environment adds to the appeal of these options by eliminating income taxes, allowing investors to retain more of their earnings.

Related: Dubai Lets You Rent Homes and Cars With Bitcoin. Here’s What to Know

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.