Berachain Rolls Out Proof-of-Liquidity System, Starting BGT Governance Phase

Berachain has launched its Proof-of-Liquidity consensus mechanism, transitioning to a BGT token-based governance model. Under the new system, voting power is granted to liquidity providers rather than stakers.

On this page

On March 24, 2025, Berachain, an EVM-based L1 blockchain, launched its Proof-of-Liquidity (PoL) system, a key mechanism for distributing its governance token, BGT. This launch marks the beginning of the first on-chain governance phase, where participants in the ecosystem can influence the network by providing liquidity.

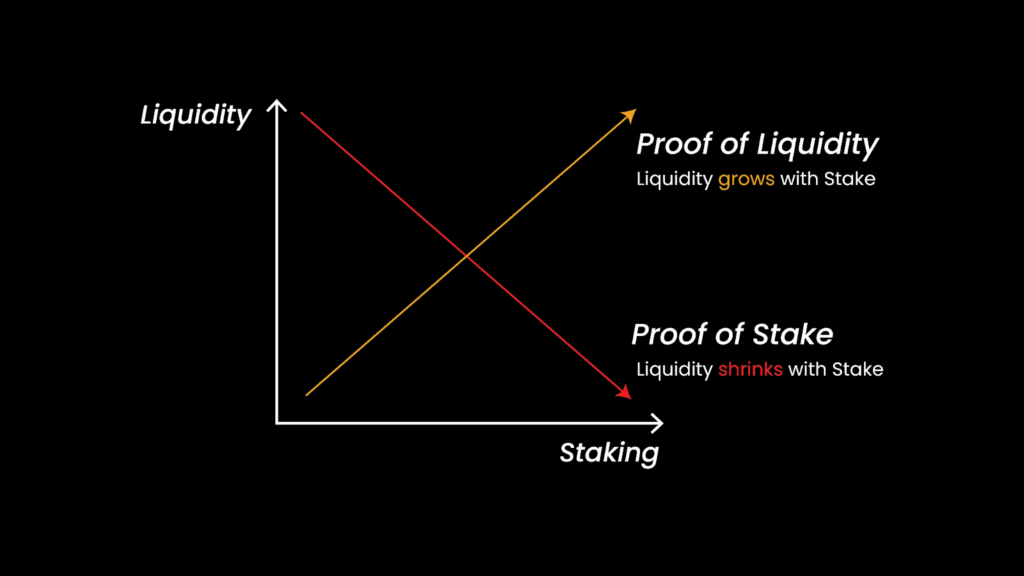

Unlike traditional Proof-of-Stake models, Berachain introduces its native Proof-of-Liquidity mechanism. Instead of locking up assets for staking rewards, users supply liquidity to DeFi pools and earn BGT tokens, which serve as in-network governance assets.

BGT (Berachain Governance Token) is a soulbound token, meaning it cannot be transferred or sold. It is used solely for participating in governance votes and delegating voting power to validators. The more BGT a validator receives from the community, the greater their influence on network consensus and reward distribution.

Related: Soulbound Tokens: The Ultimate Ownership Solution

Consequently, the network’s security relies not only on the amount of BERA (the gas token) staked, but also on user participation in the ecosystem through liquidity provision. This makes Proof-of-Liquidity more than just a token distribution model—it ties together decentralized governance, liquidity provision, and consensus into a single economic framework.

Phase One of PoL: Launching with DEX Pools and the Beginning of BGT Distribution

The launch of Proof-of-Liquidity kicks off the first phase of BGT (the primary governance token of the Berachain network) distribution. At this stage, users can participate through a select number of DeFi pools by providing liquidity and earning BGT in return.

Importantly, the key difference between PoL and traditional staking lies in the absence of asset lockups. Participants maintain full control over their tokens while still contributing to the ecosystem and gaining access to governance rights. Moreover, this approach lowers the barrier to entry and encourages more active community involvement.

According to the developers, new reward vaults will be added over time, going beyond the initial DEX pools. This will allow the ecosystem to include more protocols and use cases, bringing in a wider range of governance participants.

The launch of PoL is not just a technical update. Rather, it marks a move toward more open and dynamic governance, where influence is based not on capital alone but on contributions to the network’s liquidity and resilience.

From Boyco to PoL: How Berachain Prepared for the Governance Launch

Berachain is built on the Cosmos SDK and uses the Tendermint consensus mechanism, which ensures compatibility with Ethereum and supports scalability. The move toward full on-chain governance is the result of a long-term strategy that started well before the mainnet launch.

Before the network went live, the Berachain team introduced Boyco, a pre-launch platform created to attract liquidity. The goal was to bring capital into the ecosystem before the mainnet launch, making it possible for dApps to start functioning from day one.

As a result, by March 2025, Berachain reached $3 billion in TVL, making it one of the top-performing new blockchains on the market.

The project's financial strength was backed through two major investment rounds. In 2023, Berachain raised $42 million in a round led by Polychain Capital and Hack VC. This was followed by another $100 million in April 2024, with participation from Framework Ventures. These funds allowed the team to design an economic model that brings together security, liquidity, and governance.

Therefore, today’s launch of PoL is a natural next step in this process. With the infrastructure in place and liquidity secured, the focus now shifts to distributing governance power to the users.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.