Bitcoin Breaks Above $87,000: What’s Driving the Surge?

Bitcoin has once again surged past $87,000, driven by renewed interest from major traders and growing optimism around a potential easing of trade tariffs.

The key catalyst appears to be reports from U.S. media suggesting that President Donald Trump may soften import tariffs initially set to take effect on April 2. Over the past two days, BTC has climbed more than 3.9%, firmly establishing support above $86,000, a strong bullish signal for the market.

Furthermore, another factor fueling optimism is that the bulls managed to break through the $85,000 level, which previously acted as strong resistance.

According to CoinMarketCap, the Crypto Fear & Greed Index has slightly increased, reaching 31 points. If the market maintains its upward momentum, the index could shift into neutral territory around 40–45, a sign that panic is easing.

Meanwhile, the Altcoin Season Index has dropped to 17, indicating Bitcoin’s ongoing dominance. Its market share remains steadily above 60% relative to other cryptocurrencies.

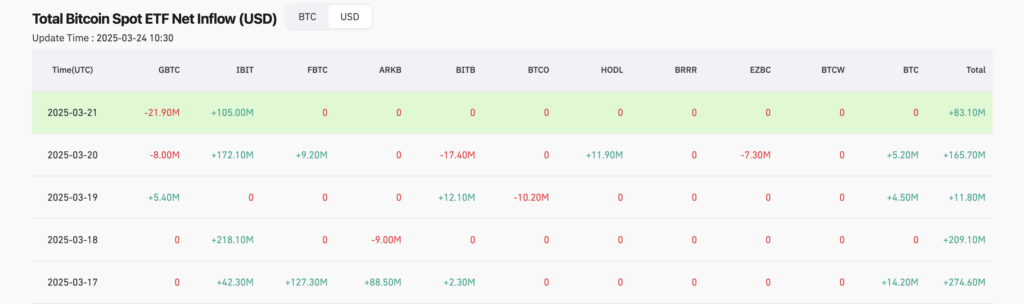

Institutional Investors Are Buying In

Major investors continue to pour money into Bitcoin through U.S. spot Bitcoin ETFs. Over the past week, net inflows into these funds totaled more than $742 million. This figure confirms a bullish signal, especially after previous weeks saw cumulative outflows exceeding $3 billion.

In contrast, interest in Ethereum ETFs is waning. During the same period, they recorded net outflows exceeding $102 million.

Accumulation Continues

Analysts at 10x Research believe that Bitcoin has already completed its local correction and is ready to resume its upward trend. Moreover, they link this momentum to potential steps by Donald Trump to ease trade tariffs on other countries, along with cautiously optimistic forecasts about the Federal Reserve's future monetary policy, including a possible rate cut, despite persistent inflation.

You might also like: Life Inside a Bitcoin Mining Farm: The Daily Grind of Miners

Enmanuel Cardozo, a market analyst at Brickken (a platform focused on tokenizing real-world assets), shares a similar view. According to him, long-term accumulation is ongoing, although short-term corrections remain possible. He also noted that since early February, the amount of BTC held by long-term investors has increased from 13.1 million to 13.35 million coins, representing a value gain of more than $20 billion.

Earlier, Ryan Lee, lead analyst at Bitget Research, pointed out that a weekly close above $85,000 is a key milestone for Bitcoin. So far, buyers have managed to achieve that.

A close above this level could prevent a drop to $76,000 and signal strength, while $87,000 would provide even clearer bullish confirmation. Macro factors like steady rates and cooling inflation support risk assets, but the Sunday close will be decisive,

Ryan Lee added.

Market sentiment among traders is turning increasingly optimistic, thanks to renewed institutional investment, favorable political developments, and a cautiously supportive macroeconomic environment. For now, traders should keep a close watch on key Bitcoin levels around $87,000 and $91,000, as well as any policy announcements from the U.S. President regarding tariffs.

You might also like: Jesse Powell’s Wild Ride: The Untold Story of Kraken’s Rise

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.