Bitcoin Drops Below $85K: What’s Left to Drive Long-Term Growth?

A swirl of speculation and Trump-era tariff talk has nudged Bitcoin below $85K, raising questions — but not killing optimism.

On this page

In the past day, Bitcoin has fallen close to 2%, briefly slipping under the $85,000 psychological floor. This correction appears linked to renewed market anxiety and deteriorating sentiment around the upcoming tariff decisions by former President Donald Trump, particularly in relation to America’s trading allies.

Trump’s tariff policy update, expected on April 2, 2025, is generating concern across trading desks. A growing number of investors now anticipate that rather than easing restrictions, the administration may opt for a tougher approach.

The Fear and Greed Index has stabilized at 33, remaining in the fear range despite a mild pullback and waning panic in the market. Likewise, the Altseason Index sits at a low 17, reinforcing Bitcoin’s continued outperformance across the broader digital asset landscape.

BTC market dominance has climbed nearly 1% in the last day, now standing at 61.1%, with Ethereum once again contributing to the shift through a loss of market share.

Institutions Stay the Course Amid Bitcoin Volatility

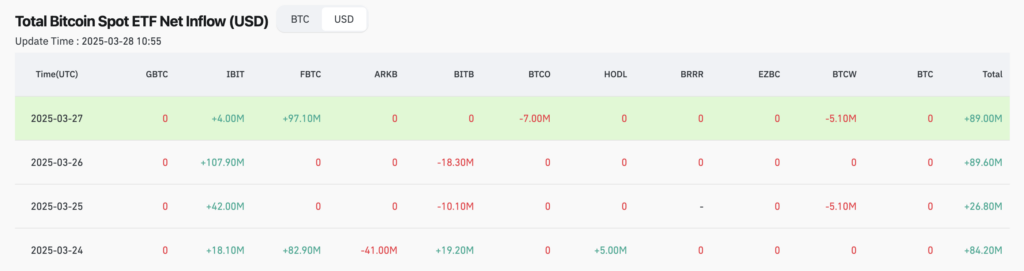

Despite the sideways action from Bitcoin, the big players are holding the line. On March 27, 2025, U.S. spot Bitcoin ETFs brought in $89 million in net inflows, according to CoinGlass.

And the surprise leader? Not IBIT from BlackRock, but the FBTC fund from Fidelity, which posted a strong $97.1 million in new capital. Other issuers mostly hovered near zero, with minimal moves on either side.

Can the Fed Chart Bitcoin’s Course?

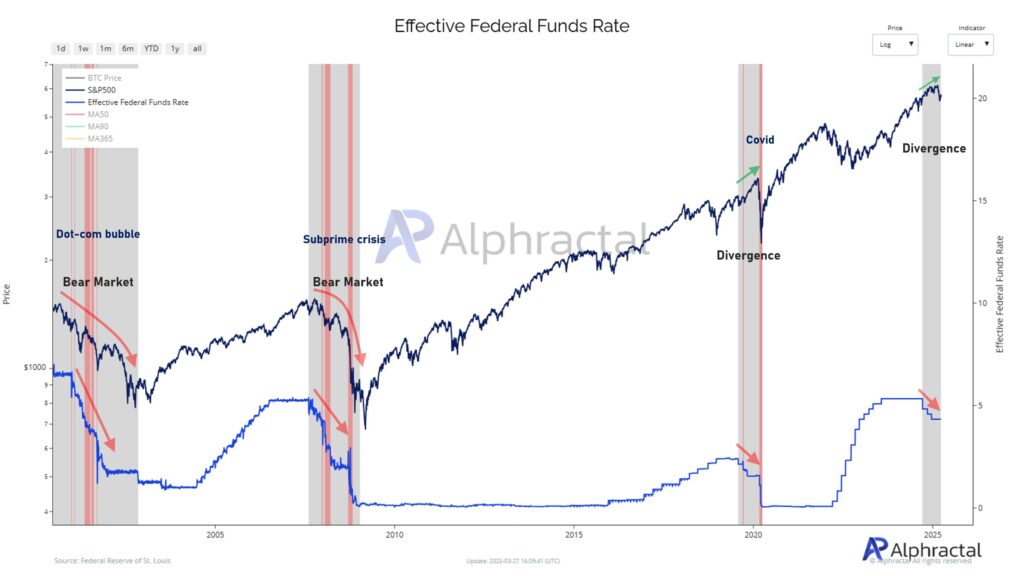

The investment analysis platform Alphractal has published findings linking Federal Reserve rate changes to broad market dynamics, including the impact on Bitcoin. A notable reference: the 2007–2009 recession, when higher rates coincided with a 57% decline in the S&P 500. Conversely, the aggressive rate cuts following the COVID-19 pandemic sparked a sharp recovery across both traditional markets and crypto.

Alphractal’s research shows a clear pattern: since 2010, Bitcoin has gained steadily when rates are low but faltered during tightening cycles—like in 2022, when BTC bottomed at $16,000.

Analysts suggest that a gradual easing of rates may fuel continued growth in both stocks and crypto. But sudden changes—or sticky inflation—could lead to renewed price pressure.

Divergence as a Warning: The current divergence between the S&P 500 and interest rates suggests the market may be “overstretched.” Historically, this precedes periods of high volatility,

the analysts commented.

The outlook for Bitcoin’s long-term growth is further supported by crypto analyst Boj, who underscores the link between liquidity expansion, new business cycles, and the asset’s historic performance. According to his research, these macro shifts often act as catalysts for Bitcoin rallies, a trend that supports current market sentiment.

Despite short-term corrections and geopolitical uncertainty, Bitcoin’s fundamentals remain strong. Institutional investors continue to engage actively, and if monetary policy stays loose, the broader macro backdrop could sustain upward momentum.

Read on: GameStop to Sell $1.3B of Convertible Notes to Fund Bitcoin Purchases

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.