Bitcoin Price in a Sideways Trend – Is a New Upward Move Coming?

Bitcoin price remains stuck in a tight range, with traders cautiously adjusting their positions ahead of potential market turbulence.

On this page

With the U. S. Federal Reserve’s rate decision set for this Friday, financial markets—including crypto—are on edge. Investors are fully focused on the announcement, knowing it could spark intense trading activity. Whichever way the decision goes, it’s expected to set the tone for the coming months, influencing risk appetite and shaping trading strategies.

Market sentiment, according to CoinMarketCap, remains fragile, with the Fear & Greed Index barely moving from 25 points—a small rise from February’s lows but still signaling hesitation.

With the Altseason Index stagnant at 20 points, Bitcoin continues to lead the market, leaving little room for an altcoin resurgence in the near term.

Сheck this out: Strategy Acquires 130 More BTC, Bringing Total Holdings to 499K

For the first time in weeks, spot Bitcoin ETFs in the U.S. saw a positive shift, pulling in $156.5 million in net inflows on March 17, 2025. This could signal the start of a broader market rebound.

Ethereum ETFs, however, remained under pressure, with $7 million in net outflows. Despite the momentum, Bitcoin ETFs still have a long road ahead, needing at least $3 billion in inflows to erase previous losses.

Has Bitcoin’s Bull Run Reached Its End?

Investors are split—some see a healthy correction, others fear a deeper downturn. Ki Young Ju, CEO of CryptoQuant, falls into the latter camp, claiming the bull run is over and that Bitcoin will move sideways or downward over the next 6–12 months.

He points to clear warning signals from key market indicators, despite having previously expressed a much more optimistic view.

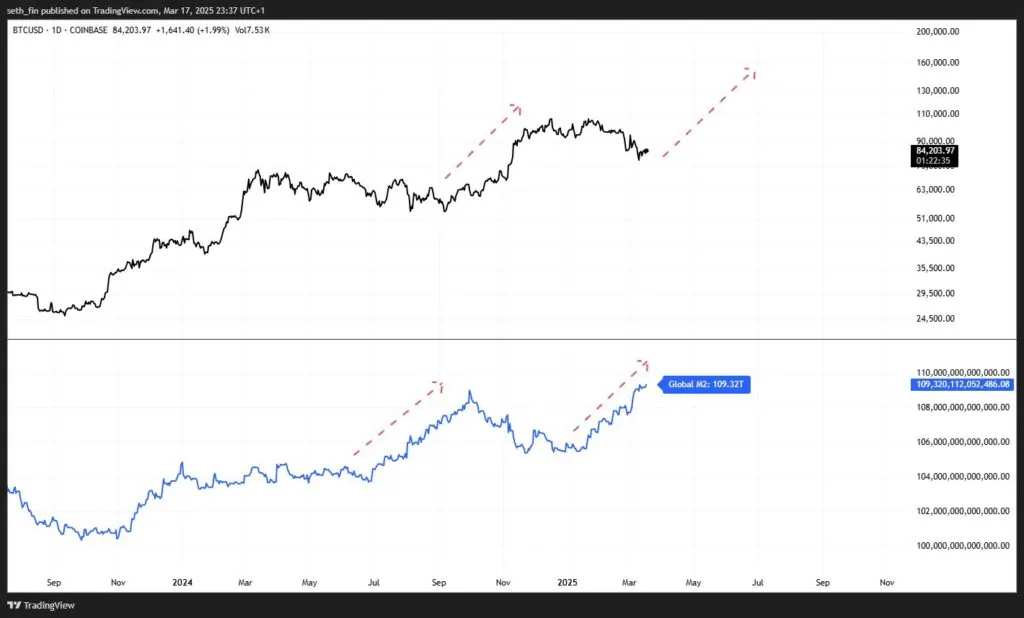

Bitcoin advocates highlight its long-standing correlation with M2 money supply, which has just set a fresh record high. Historically, Bitcoin price movements have lagged behind M2 expansion, leading some to believe another rally may be on the horizon.

One proponent of this theory is trader Seth, whose 2024 prediction of Bitcoin hitting $100,000 was based on this exact metric—and now, he sees a similar setup unfolding.

The past few weeks have seen a sharp $10 billion drop in Bitcoin open interest, largely due to panic selling, risk reduction, and liquidation of leveraged positions. While this might seem alarming, history suggests that market purges like this often lay the foundation for future rallies.

With excessive leverage now out of the picture, is Bitcoin preparing for its next major move?

Read on: Jerome Powell and Crypto: A Fed Chair’s Love-Hate Relationship

Crypto’s short-term outlook remains a topic of debate, but one fact stands firm—volatility is a natural phase of every market cycle. Once the interest rate decision is in, traders will turn their attention to geopolitical events and economic policies, setting the stage for what could be a defining period for digital assets.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.