Bitcoin Stalls at $88,000 — Is the Market Holding Its Breath?

Bitcoin remains range-bound between $86,000 and $89,000, forming a local sideways trend. Meanwhile, investors are weighing the odds of renewed momentum and a potential return to a full bull market.

Bitcoin has gained around 0.80% over the past 24 hours and is trading near $88,000 at the time of writing. Optimism around U.S. trade policy remains a key source of support for BTC.

Notably, the recent drop in the share of long positions among top traders on Binance has stabilized and even ticked upward. Longs now account for 51.34%, up from 48.66% the previous day.

According to data from CoinMarketCap, the Fear and Greed Index is holding steady at 34, still in the “Fear” zone. While sentiment remains cautious, it marks an improvement from recent levels of “Extreme Fear.”

In addition, the Altcoin Season Index also remains unchanged, while Bitcoin dominance continues to hover around 60.5%.

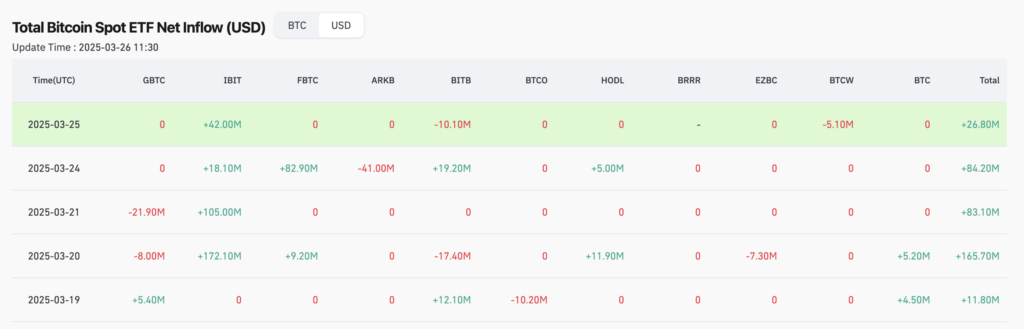

Institutional Momentum Slows

Institutional investors are still allocating capital to U.S. spot Bitcoin ETFs, but the pace has noticeably cooled. On March 25, 2025, net inflows reached just $26.8 million, with most issuers showing little to no movement in either direction.

Meanwhile, Ethereum ETFs continue to struggle. Net outflows totaled $1,590 for the day, highlighting the ongoing decline in investor interest for the product.

Uncertainty Creeps Back Into the Market

Retail traders continue moving assets off centralized exchanges and into cold storage. Notably, traders withdrew 19,000 BTC from major platforms on March 24, 2025, according to data from IntoTheBlock. The largest outflow came from Bitfinex, which saw 21,750 BTC leave the exchange (excluding deposits). Overall, net Bitcoin outflows amounted to $424 million over the past week.

While optimism around U.S. tariff policy and improving sentiment among some traders offer support, analysts warn that uncertainty remains high. Key concerns include macroeconomic risks, geopolitical tensions, weak trading volumes, and the absence of a sustained uptrend.

Read more: Crypto Domain XBT․com Surpasses $3 Million at Lloyds Auctions

Additionally, another indicator of market weakness is the negative funding rate on Bitcoin futures, which reflects traders’ reluctance to maintain long positions. According to data from analytics platform CoinGlass, the rate remains below zero on several major exchanges. This indicates that bearish sentiment still holds sway.

We expect markets to continue their soft rebound into month-end, with the next major catalyst being the ‘Liberation Day’ tariff announcement,

said Augustine Fan, partner at SignalPlus, a cryptocurrency derivatives software provider.

Despite Bitcoin’s relative price stability and steady institutional interest, the market has once again slipped into a phase of uncertainty. The lack of clear bullish signals, continued outflows from exchanges, and negative funding rates suggest that both traders and investors should proceed with caution.

Read more: Trump Media Partners With Crypto․com to Launch Crypto ETFs

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.