BTC Faces Resistance at $85K as Trade War Pressure Mounts

Bitcoin remains pinned under $85,000, as global markets digest rising tensions between the U.S. and China over fresh tariffs.

On this page

In just 24 hours:

This wave of volatility follows China’s tariff retaliation, which Beijing says was provoked by Washington’s “unjust” trade policy.

Bitcoin is moving in lockstep with the S&P 500, fluctuating within a tight range as traditional markets continue their decline.

- The Fear and Greed Index, tracked by CoinMarketCap, remains stuck in “fear” at 25.

- The altseason index stays low at 14 — signaling little traction for altcoins.

- Bitcoin dominance has jumped above 62%, with altcoins falling below a 30% market share — levels not seen since the 2019 pre-pandemic shakeout.

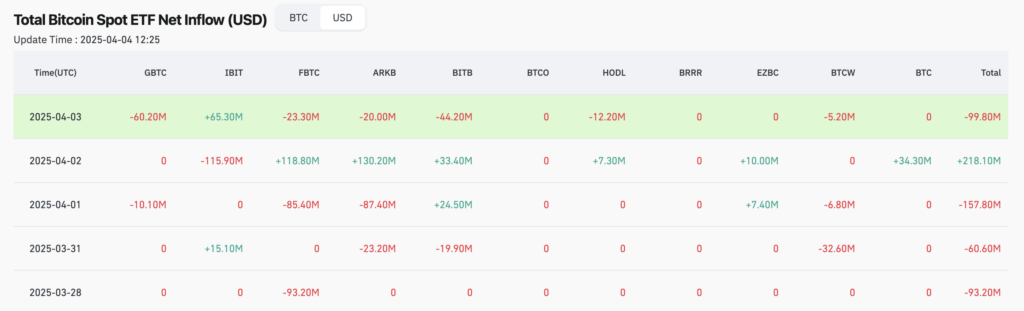

Bitcoin ETFs Bleed Out—Except BlackRock

April 3 saw another red day for U.S. spot Bitcoin ETFs, as institutional investors pulled out nearly $100 million. The sole bright spot? BlackRock’s IBIT fund, which brought in $65.3 million in net inflows.

These sharp swings are fueling the sense that Bitcoin ETFs are being used more for tactical plays than long-haul investing.

Check this out: Ethereum Developers Target May 7 for Pectra Mainnet Launch

Decline in Treasury Yields Signals Shift Toward Riskier Assets

The deepening tariff dispute and a softening dollar have pushed 10-year U.S. Treasury yields down to 4%, a drop from 4.4% the prior week, hitting their lowest point in several months.

This downward movement reflects increased demand for bonds, suggesting that investors might turn to higher-yielding options like Bitcoin to enhance their portfolios.

Axel Merk, Chief Investment Officer at Merk Investments, pointed out that the recent tariffs are creating a supply shock by limiting the availability of goods and services, leading to market imbalances. He cautioned that reducing interest rates in this context could potentially spur inflation.

The yield on 10-year U.S. Treasuries has recently dipped to 4%, a decrease from 4.4% the prior week, signaling robust demand amid escalating tariff conflicts and a dollar weakening.

This scenario raises the possibility that even a slight reallocation—around 3%—of investments from government bonds to alternative assets could unleash approximately $1 trillion into sectors like digital currencies, equities, real estate, and commodities.

Such movements are increasingly likely as inflationary pressures mount, diminishing the allure of fixed-income instruments. Additionally, the dollar's depreciation may prompt nations to seek diversification in their reserve holdings, exploring options beyond the traditional reliance on U.S. currency.

Asian governments are sitting on a combined $2.63 trillion worth of U.S. Treasuries. That capital, while currently tied up in traditional bonds, may eventually trickle into newer, risk-tolerant asset classes like Bitcoin.

These countries are still wary of BTC’s volatility, but their hesitation is showing cracks. Even marginal exposure from such vast reserves could send a bullish shockwave through the crypto market, positioning Bitcoin not just as a speculative asset but as a credible component of future sovereign portfolios.

Read on: Clanker Hits $13 Million Revenue with 200,000 Tokens on Base in Just 5 Months

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.