Circle Files IPO After $1.68B Year, Targets Stablecoin Market Expansion

USDC issuer Circle has filed for an IPO after a banner year in 2024. The company reported $1.68 billion in revenue and is now targeting a listing on the NYSE.

On this page

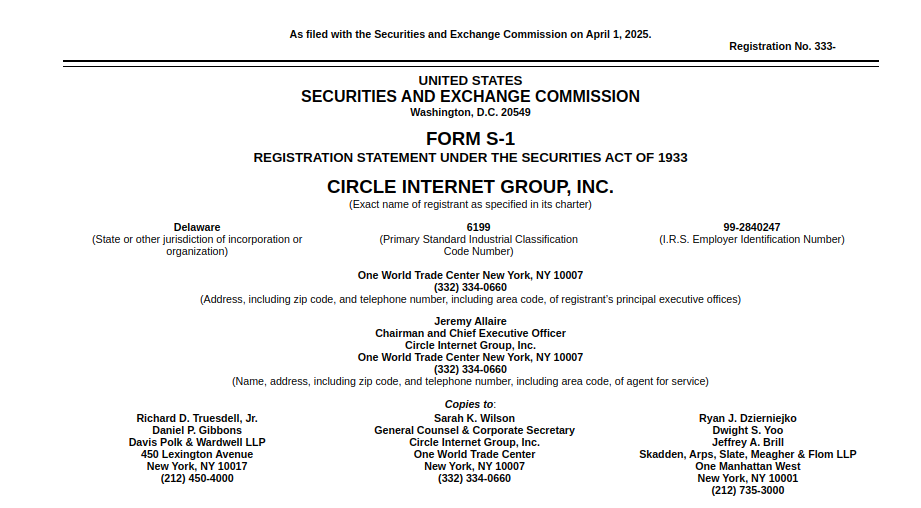

Circle Internet Group Inc. has filed for an IPO with the NYSE, eyeing a new chapter as a publicly traded player in the crypto-finance landscape.

Its latest filings reveal robust growth: $1.68 billion in revenue and $156 million in profit for 2024—numbers that reflect both scale and maturity.

The move comes amid a shifting regulatory environment, with stablecoins drawing increased attention from global watchdogs. Circle, which promotes itself as the regulated counterweight to Tether, sees the IPO as a vehicle to consolidate its leadership in the crypto sector.

Сheck this out: The Stablecoin Showdown: How USDC and Tether Compete for Dominance

Revenue Up, Profit Down: Inside Circle’s Financial Playbook

Circle saw its 2024 revenue rise to $1.68 billion, up from $1.45 billion a year earlier. But net profit took a hit, falling to $156 million, down from $268 million—a shift largely attributed to active portfolio adjustments within its reserve assets, which consist mostly of short-term Treasuries and cash equivalents.

Financials: USDC Reaches $60 Billion Market Cap, Setting New Record

In parallel, the company acquired the remaining 50% of Centre Consortium from Coinbase, in a stock-based deal reportedly worth $210 million.

Going public now is representative of the fact that we are at a significant crossroads for Circle and the development of the internet financial system,

said CEO Jeremy Allaire.

The filing reflects a company in transition: growing topline figures, rising operational demands, and a strategic push to unify control over its infrastructure.

Personalities and Ventures: How Jeremy Allaire Built Circle and Made USDC a Stablecoin Giant

Policy Headwinds and High-Profile Backers Frame Circle’s Public Push

As Circle eyes the public markets, the regulatory backdrop is heating up. The House Financial Services Committee is preparing to vote on bills that could define the future of stablecoin oversight. At stake is the possibility that, without federal clarity, stablecoins like USDC could be regulated as securities—a designation that would dramatically impact business models.

Backing Circle’s IPO journey are prominent players such as Accel, Breyer Capital, General Catalyst, and underwriting partners JPMorgan Chase and Citigroup—all signaling high confidence in the company’s market strategy.

Another pivotal moment came in 2023, when Circle weathered the Silicon Valley Bank crisis, swiftly securing the return of its deposits and stabilizing operations.

These moments of pressure have only clarified Circle’s identity. Now the second-largest stablecoin issuer, the company continues to thrive on a foundation of radical transparency, deep institutional partnerships, and a commitment to evolving alongside the architecture of internet-native finance.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.