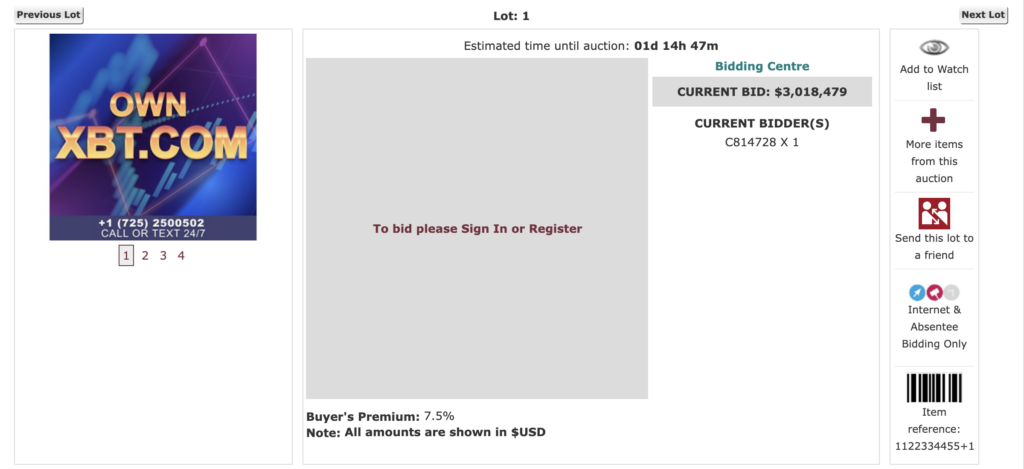

Crypto Domain XBT․com Surpasses $3 Million at Lloyds Auctions

The premium crypto domain XBT․com has surpassed $3 million at auction, attracting strong interest from major investors and institutions.

On this page

The crypto domain XBT.com has surpassed $3 million at Lloyds Auctions, becoming one of the most talked-about digital assets in recent months.

Moreover, this sale could become the largest crypto domain deal since 2021. With more than a day remaining before the auction ends, the final price may go even higher.

The strong interest in the XBT․com domain stems from its direct reference to “XBT,” an alternative ticker for Bitcoin that is commonly used in traditional financial circles, especially on platforms like Bloomberg Terminal. It functions much like XAU, the ticker symbol for gold. As a result, this makes the domain appealing to both institutional investors and crypto enthusiasts.

This is more than just a domain name, it’s the financial future & identity of Bitcoin itself. Whoever wins XBT.com will own the domain name of the decade and a stake in Bitcoin’s future, a digital asset of immense historical and financial significance,

said Mr. Lee Hames, Chief Operations Officer for Lloyds Auctions.

According to Lloyds Auctions, the current auction has drawn attention from a number of prominent investors, trading platforms, and tech companies. Compared to previous deals involving high-value crypto domains (such as ETH․com and BTC․com), XBT․com has already secured the second spot on the list of the most expensive crypto domain sales.

Crypto․com still holds the top position, having been sold for $12 million a few years ago, while ETH․com ranks third at $2 million.

New Realities of the Crypto Market

The excitement surrounding XBT․com highlights a global trend toward the growing recognition of the crypto industry. More investors and government institutions around the world are starting to see digital assets not just as speculative instruments, but as a legitimate part of the modern financial system.

In addition, the introduction of spot Bitcoin ETFs and recent legislative developments are also contributing to increased trust in digital currencies.

Read more: BlackRock Launches Its First Bitcoin ETP in Europe

At the same time, governments in various countries are introducing updated tax and regulatory frameworks that strengthen the position of the crypto industry. For instance, at a recent Digital Assets Summit, statements were made emphasizing the strategic importance of cryptocurrencies for national economies. Some leaders, including the U.S. President, have openly expressed their desire to turn their countries into leading cryptocurrency hubs.

Thus, the sale of the XBT․com domain may not only become a record-breaking deal but also a demonstration of the new realities for the crypto industry. Such events naturally draw the attention of major players, revealing the potential of digital currencies from both an investment perspective and as part of the strategic and technological evolution of the crypto ecosystem.

Read more: Trump Media Partners With Crypto.com to Launch Crypto ETFs

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.