Crypto Donations Hit Record Highs in 2024: What Drives the Rise?

2024 was the biggest year ever for crypto giving, according to a 2025 report by The Giving Block.

On this page

The platform, which focuses on nonprofit crypto fundraising, reports that a record-breaking $1 billion was raised in 2024.

For context, the total amount raised in crypto over the past five years was $2 billion. Notably, one-third of 2024's crypto donations came in December.

This rise is driven by growing donor interest in crypto and increasing openness among nonprofits to accept digital assets.

According to the report:

- Adoption grows: 70% of Forbes’ Top 100 Charities now accept cryptocurrency donations, marking a 25% increase from the previous year.

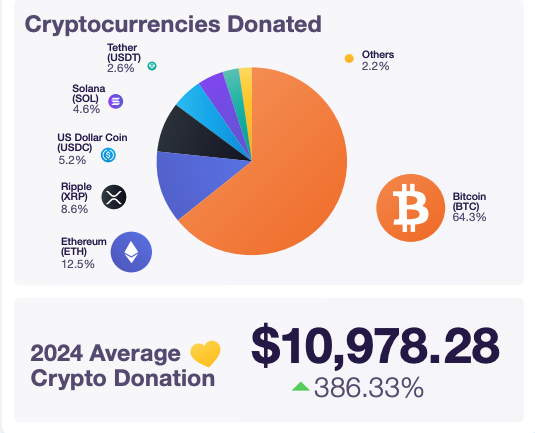

- Donation size increases: The average crypto donation in 2024 was $10,978, a 386.33% increase from 2023.

- AI and crypto are merging in philanthropy: The first AI-led crypto donation in 2024 highlights how AI could help manage or even automate charitable giving, expanding blockchain's role in social impact.

- The US dominates in total crypto donations: Most crypto donations came from the US, with New York being the top donating state in both 2023 and 2024.

- Bitcoin and Ethereum donations lead the way: In 2024, Bitcoin was the most donated cryptocurrency, accounting for 64.3% of the total received. Ether (12.5%), XRP (8.6%), and USDC (5.2%) followed. This is a shift from 2023 when stablecoins were more popular.

Related: How Blockchain is Changing the Face of Charity

Where Crypto Donations Went in 2024

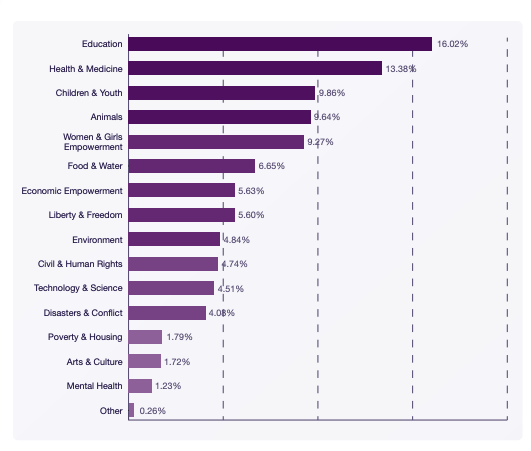

Crypto donors in 2024 spread their contributions across a variety of causes, but a few stood out. Education nonprofits took the lead, grabbing 16% of all crypto donations through The Giving Block – showing that learning and access to knowledge remain top priorities.

Right behind them were Health & Medicine organizations, pulling in 13.4% as donors backed medical research, treatment access, and healthcare initiatives. Children & Youth charities received 9.9%, proving strong support for the next generation, while animal welfare groups weren’t far behind at 9.6% – clearly, crypto donors care about our furry (and not-so-furry) friends.

Women & Girls Empowerment charities also saw 9.3% of donations, reinforcing the community’s commitment to gender equality and opportunities for women and girls around the world.

Other causes included food and water donations, civil & human rights, economic empowerment, and more.

Crypto donors are usually young, often in their 20s or 30s.

Expectations for Crypto Donations in 2025

The Giving Block expects that 2025 will surpass 2024 as the crypto philanthropy movement continues to grow. Analysts predict that the total amount of crypto donations will exceed $2.5 billion this year.

Key drivers include a favorable political climate, increased accessibility, broader institutional acceptance, optimized tax strategies, and crypto market performance.

The Giving Block also highlighted the current challenges faced by traditional nonprofits, such as limited visibility, outdated transaction processes, and poor website functionality.

Meanwhile, stock and crypto donations remain inaccessible for most nonprofit websites today. Addressing this accessibility issue could easily boost donations made in stocks and crypto by 5-10 times, according to The Giving Block.

How Can Blockchain and AI Be Used in Crypto Donations?

Blockchain ensures transparency in fundraising. Since every transaction is recorded on an open ledger, donors can see where their money goes – ensuring accountability. Plus, it helps nonprofits reduce admin costs, allowing more funds to go directly to the cause.

This works thanks to smart contracts – automated agreements that process transactions when specific conditions are met, without a middleman. In the future, AI could help manage these contracts, making donations even more seamless.

Imagine an AI system tracking global events, detecting disasters, and instantly sending funds where they’re needed. That would mean faster relief, fewer delays, and less red tape for nonprofits.

As both technologies evolve, they could completely redefine how we think about giving and make a bigger impact on the causes we care about.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.