Crypto Market in Freefall as Investors Seek Safety

The night of March 4, 2025, saw a major crypto market crash, triggered by the U.S. announcement of new trade tariffs and escalating geopolitical tensions. As uncertainty spreads, investors are questioning whether this is the start of a larger downtrend.

On this page

A string of negative headlines sent the crypto market into a tailspin, wiping out recent gains from the U.S. crypto reserve announcement.

At the center of the storm? A rapidly escalating trade war. The U.S. rolled out new tariffs on Canada, Mexico, China, and the EU, prompting swift pushback from affected nations.

Things took an even sharper turn when the White House doubled down on its China tariffs, raising concerns that the standoff could ripple across financial markets—including crypto crash.

The Growing Political Divide

The impact of U.S. policy shifts extends beyond tariffs—geopolitical fractures are deepening among Western allies.

The new administration’s less assertive stance on European security—including a decline in direct support for Ukraine—has raised fears that NATO’s eastern borders may no longer be as secure as once believed.

With Moscow watching closely, the possibility of a direct military confrontation looms larger than ever. If that moment comes, will Washington still be in Europe’s corner?

Сheck this out: Why Crypto Is Down: How Trump’s Policies Spark Market Panic

As the U.S. pulls back on military aid to Ukraine, global confidence in Washington’s strength is faltering, with critics calling it a dangerous display of weakness.

Markets have taken notice—investors are fleeing riskier assets like crypto and equities, pivoting toward traditional safe havens such as gold and fiat currencies.

Meanwhile, inflation remains a headache, and with new tariffs squeezing supply chains, rising import costs and growing investment risks could soon follow, turning an already uncertain financial landscape into a high-stakes economic chess match.

Investor Panic Spreads as Market Fear Grows

The Crypto Fear & Greed Index has slid to 29, confirming what traders already feel—fear is now the dominant force in the market. While not a flawless indicator, it reflects the growing uncertainty surrounding digital assets.

Analysts are split—some argue this is just a standard market cooldown, while others, including The Kobeissi Letter, believe U.S. trade policies have become a major destabilizing factor.

The real driver here is the GLOBAL move towards the risk-off trade. As trade war tensions rise and economic policy uncertainty broadens, ALL risky assets are falling. This was seen in stocks, crypto and oil prices which all fell sharply today. Safe havens are thriving,

The Kobeissi Letter analysts noted.

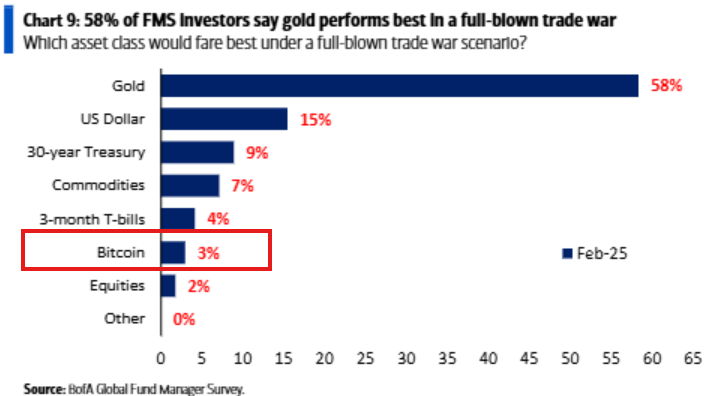

A Bank of America survey reinforces the concerns, with 42% of investors identifying the trade war as the biggest risk to volatile assets.

When it comes to hedging strategies, only 3% believe Bitcoin can hold its ground, while 58% favor gold as the ultimate safe-haven asset, and 15% put their trust in the U.S. dollar.

The takeaway? Institutional players still don’t view cryptocurrencies as a reliable hedge against global uncertainty.

Will Crypto Recover? Experts Weigh In

Despite ongoing market turbulence, experts agree that crypto will recover—the real question is when. A sustainable rebound hinges on two key factors: regulatory clarity and economic stability on a global scale.

Optimists expect a turnaround within months, while more cautious analysts believe instability could drag on until the world’s major financial concerns are addressed. One thing is certain—crypto’s next chapter is still being written.

The takeaway? Adapt or be left behind. In the days ahead, traders and investors must keep a close watch on key developments, adjusting their strategies to match an unpredictable market.

Crypto has once again proven that it’s anything but an isolated ecosystem—its growing interconnection with traditional finance means every policy shift or economic shake-up can trigger a domino effect that reshapes the playing field.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.