USDT Powers 92% of Crypto Payments in Europe

According to a report by Oobit, cryptocurrency adoption is accelerating across Europe. Stablecoins, with USDT at the forefront, dominate the region’s digital payments.

On this page

The adoption of crypto payments in Europe is accelerating, with transactions growing rapidly over the past few months. Oobit, a crypto-friendly payment app that enables digital asset spending at traditional merchant terminals, reports that around 70% of transactions have been made in the retail sector, mostly for food and drinks.

The tourism and entertainment industries are also seeing strong demand, with about 26% of crypto transactions going toward travel bookings, accommodations, and airline tickets.

The numbers speak for themselves: digital payments are shifting toward crypto.

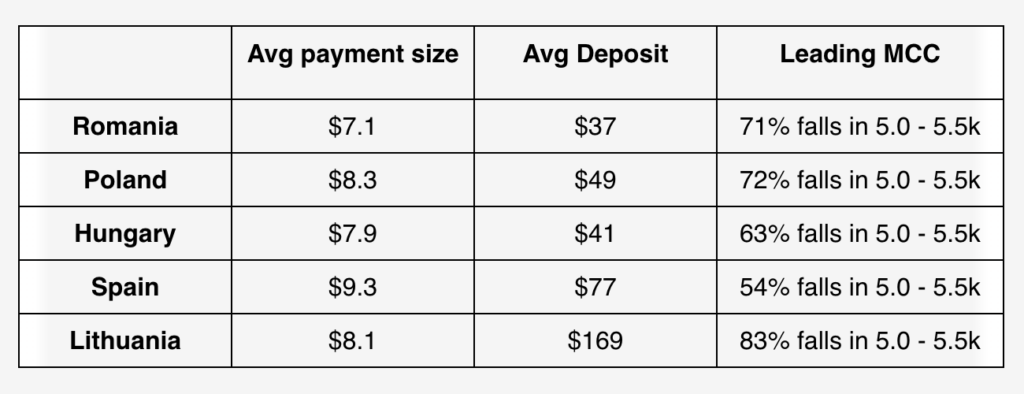

USDT leads the pack, making up 92% of all transactions. Consumers typically spend $8.36 per purchase, while the average deposit sits at $85—reinforcing stablecoins as a key player in the global payments ecosystem.

Crypto Adoption: Key Factors and Future Trends

Regulatory advancements in select European nations have been instrumental in accelerating the adoption of crypto payments.

Romania has introduced a temporary tax exemption, allowing individuals to earn crypto investment income tax-free until July 31, 2025. This policy has not only driven higher transaction volumes but also enhanced transparency—an essential factor in the broader integration of crypto into national economies.

In Poland, with presidential elections on the horizon in May 2025, candidate Sławomir Mentzen has put forward the idea of a strategic Bitcoin reserve. Though his electoral odds remain low, the country’s regulatory landscape already offers crypto businesses a clear legal framework, sustaining high demand for digital payments.

Last year, Hungary’s Ministry for National Economy proposed a draft law on crypto regulation that spans two main areas: allowing local banks to offer digital assets like Bitcoin or Ethereum directly to clients and supervision of the crypto market by the Hungarian National Bank,

Oobit analysts remark.

Check this out: Europeans Are Reluctant to Adopt the Digital Euro

The integration of digital assets into daily financial transactions is accelerating, thanks to cutting-edge mobile payment applications. As the market grows, these innovations are set to become a standard feature of global finance, pushing cryptocurrencies further into the mainstream.

On a broader scale, this movement is gaining momentum worldwide, fueled by technological advancements such as the Lightning Network payment solution, crypto debit cards, and increasing compatibility with traditional banking systems. The widespread adoption of crypto payments in Europe is the result of advancing technology, the expansion of mobile finance, and regulatory policies that support innovation.

Read on: Stablecoin Market Cap Surges 1.5x in a Year: Dune & Artemis Report

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.