Fidelity Integrates Ethereum Blockchain into Treasury Fund Management

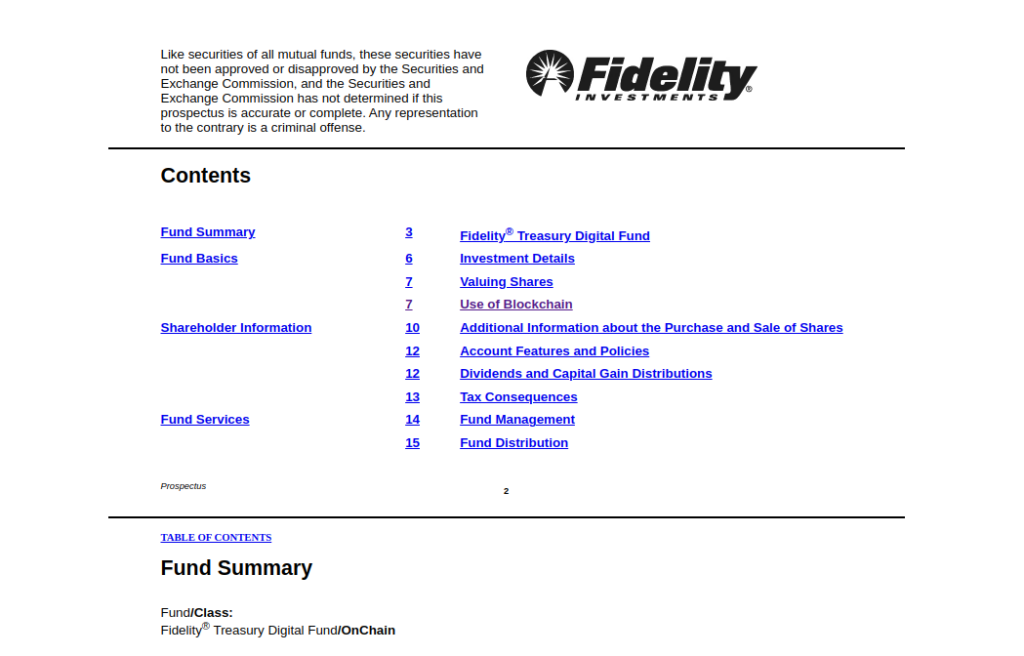

Fidelity Investments has announced the launch of a new share class called OnChain, which will be tracked on the Ethereum blockchain.

On this page

The product integrates traditional financial instruments with blockchain technology and aims to provide investors with greater transparency in transactions.

According to documents filed with the SEC, the new share class applies to the Fidelity Treasury Digital Fund (FYHXX), which primarily invests in cash and U.S. Treasury securities.

The launch is scheduled for May 30, pending regulatory approval.

OnChain Launch Details

Fidelity Investments, which manages approximately $5.8 trillion in assets, has joined the growing trend of tokenizing traditional financial instruments. Specifically, the new OnChain share class enables transactions to be recorded on the public Ethereum blockchain, while official records will still be maintained in the traditional book-entry format. Furthermore, this solution is designed to increase transparency and meet rising client demands for security.

Related: Fidelity: Crypto in 2025 and the Global Adoption of Bitcoin

According to the filing, the fund’s securities (primarily composed of U.S. Treasury bonds) do not appear to be directly tokenized. Instead, blockchain technology will be used to track transactions involving the new share class.

Additionally, Fidelity stated that it may expand OnChain to other blockchains in the future.

RWA Tokenization Market

According to rwa.xyz, the tokenized U.S. Treasury market is valued at approximately $4.77 billion, with $3.3 billion of those assets hosted on the Ethereum blockchain.

Other major players in the space include BlackRock and Franklin Templeton. Notably, BlackRock’s BUIDL fund manages around $1.5 billion in assets, while Franklin Templeton’s tokenized product has attracted about $689 million.

Related: RWA Market Insights: Key Trends for 2025

Fidelity’s latest product highlights the increasing interest of traditional financial institutions in adopting blockchain technology. As a result, enhanced transaction transparency and high levels of security are becoming crucial factors in attracting investors. Moreover, technological innovation enables more efficient accounting and reporting processes.

The recent filing for the Fidelity Solana Fund also signals the company's potential intention to expand into other blockchain platforms, particularly Solana.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.