Fidelity to Launch US Dollar-Pegged Stablecoin for Institutional Clients

Fidelity’s stablecoin will be embedded in the company’s financial ecosystem, offering institutional investors access to tokenized liquidity, without stepping outside traditional infrastructure.

On this page

Fidelity Investments is preparing to launch its own US dollar–pegged stablecoin. The new token is part of the firm’s broader strategy to digitize assets and will be used within the blockchain-based version of its money market fund. With this move, Fidelity aims to strengthen its foothold in the digital finance market and challenge established stablecoin leaders like USDT (Tether) and USDC (Circle).

Fidelity Stablecoin: Purpose and Use Cases

According to the Financial Times, Fidelity is in the final stages of developing its US dollar–backed stablecoin. The token will serve as a form of digital cash—a means of payment and a store of value within Fidelity’s tokenized asset ecosystem.

Moreover, its primary application will be in Fidelity’s blockchain-based money market fund, the Treasury Digital Fund (FYHXX). This fund invests in cash and U.S. Treasury securities and is available exclusively to institutional clients, such as hedge funds.

Related: Fidelity Integrates Ethereum Blockchain into Treasury Fund Management

Notably, Fidelity recently filed for a new “OnChain” share class, signaling its plans to integrate blockchain technology into traditional financial infrastructure.

The new stablecoin is designed to act as a bridge between the conventional fund and the digital asset ecosystem. Furthermore, it will enable institutional investors to engage with digital assets without stepping outside Fidelity’s ecosystem.

Ultimately, the stablecoin goes beyond simply replicating the functions of existing tokens—it’s embedded into Fidelity’s broader product strategy, offering a new layer of flexibility and efficiency in liquidity management.

Fidelity vs USDT and USDC

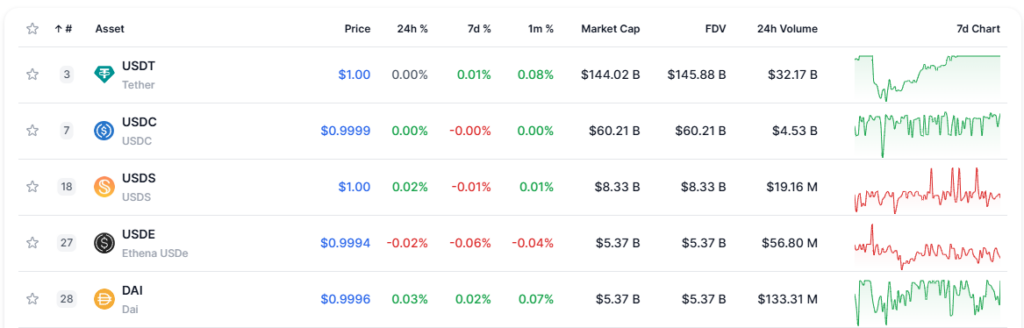

The launch of Fidelity’s stablecoin could shift the balance of power in a market long dominated by USDT (Tether) and USDC (Circle). These two tokens currently make up over 90% of the total stablecoin market cap and are the primary instruments for transactions across the modern crypto economy.

What sets Fidelity apart is its institutional focus and seamless integration with traditional financial products. Moreover, the firm manages over $5 trillion in assets and has a long-established track record with hedge funds, pension funds, and large corporations. For an institution of this scale, a branded digital dollar built into its existing infrastructure could be a game-changing advantage.

In contrast to USDT and USDC, which are largely used for retail transactions and within DeFi ecosystems, Fidelity’s stablecoin is designed for tokenized U.S. Treasuries and money market instruments. This reinforces its role as an institutional-grade stablecoin, aimed not at everyday users but at major financial players operating at the crossroads of TradFi and the crypto industry.

Related: Fidelity: Crypto in 2025 and the Global Adoption of Bitcoin

How Will Fidelity’s Stablecoin Be Used?

Fidelity’s new stablecoin is expected to be a cornerstone of the company’s broader strategy to build a tokenized financial infrastructure. Specifically, one of its first use cases will be its integration into the “OnChain” share class of the Treasury Digital Fund (FYHXX), a money market fund available to institutional clients such as hedge funds and corporate investors.

The fund invests in cash and U.S. Treasury securities, with the stablecoin functioning as a form of digital cash within the system. Importantly, this setup enables automated settlements, faster asset conversion, and reduced risk associated with traditional banking intermediaries.

Notably, this isn’t a public launch aimed at the mass market, but a product designed specifically for institutional players. This marks a key difference from USDT and USDC, which are broadly used in retail trading and across crypto exchanges.

With this move, Fidelity is building an infrastructure bridge between traditional finance and the blockchain ecosystem, integrating stablecoins into familiar money market instruments used by professional investors.

Related: How Jeremy Allaire Built Circle and Made USDC a Stablecoin Giant

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.