Metaplanet Invests Another $12.5 Million in BTC

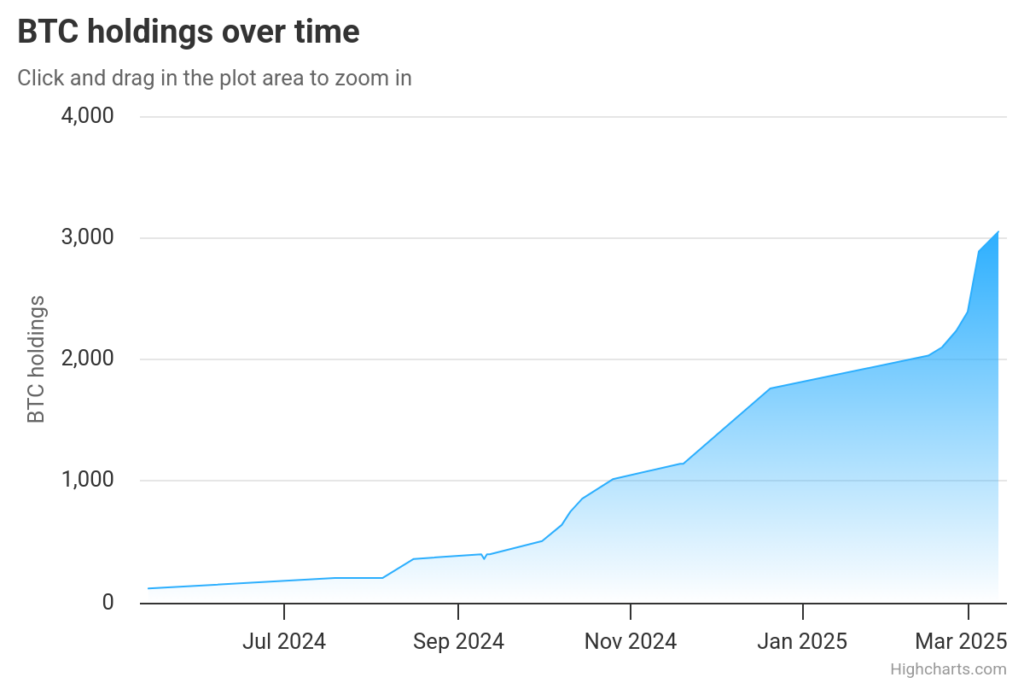

Japanese company Metaplanet has acquired $12.5 million worth of Bitcoin, increasing its total holdings to 3,200 BTC. This purchase aligns with its strategic plan to grow its reserves to 10,000 BTC by the end of 2025.

On this page

Japanese investment firm Metaplanet has increased its Bitcoin holdings by acquiring 150 BTC for $12.5 million, at an average price of approximately $83,508 per coin.

Now, Metaplanet’s total Bitcoin reserves have grown to 3,200 BTC, making it one of the top 10 corporate Bitcoin holders globally and the largest Bitcoin-holding company in Asia.

Moreover, Metaplanet plans to expand its BTC holdings to 10,000 BTC by the end of 2025.

To finance the purchase, Metaplanet issued bonds worth 2 billion Japanese yen (approximately $13.3 million). This move reinforces the company’s strategy to actively expand its digital asset holdings.

Since April 2024, Metaplanet has been following a systematic Bitcoin accumulation strategy, betting on BTC’s long-term appreciation and its potential as a reserve asset. Additionally, this approach enables the company to diversify its investment portfolio and reduce dependence on traditional financial markets.

Related: Metaplanet Sets Sights on 10,000 BTC by 2025

Market Reaction to Metaplanet’s BTC Purchase

Shares of Metaplanet, traded on the Tokyo Stock Exchange, remained largely unchanged following the announcement of its Bitcoin acquisition. According to Yahoo Finance, the stock has stayed stable, though it has shown moderate growth since the beginning of the year.

As of this writing, Bitcoin was trading at approximately $83,000. Despite a slight market correction, Metaplanet investors remain confident in the cryptocurrency’s long-term potential.

Moreover, Metaplanet is expected to continue increasing its Bitcoin reserves as part of its long-term strategy. Analysts suggest that institutional BTC investments will become increasingly common among major players seeking greater financial independence from traditional markets.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.