Metaplanet Appoints Eric Trump as Strategic Advisor Amid Bitcoin Adoption

Metaplanet has named Eric Trump as the first member of its Strategic Advisory Board. The decision aims to strengthen the Japanese company’s presence in the Bitcoin economy and elevate its public brand.

On this page

Japanese investment firm Metaplanet, which recently adopted Bitcoin as a strategic reserve asset for its treasury, has appointed Eric Trump, son of current U.S. President Donald Trump, as the first member of its new Strategic Advisory Board.

The appointment is part of Metaplanet’s broader strategy to promote Bitcoin adoption and strengthen its global presence in the crypto industry. In line with this, the company continues to grow its Bitcoin reserves, aiming to become one of the largest BTC holders in the world.

The market reacted swiftly: after the announcement of Eric Trump joining Metaplanet’s Strategic Advisory Board, the company’s stock jumped by 17.37%, reaching $29.25 per share.

Eric Trump: Metaplanet’s Media Asset and Crypto Ally Ally

Eric Trump is an entrepreneur, media personality, and son of current U.S. President Donald Trump. In its official statement, the company highlighted Trump’s experience in real estate, finance, and brand development as key reasons for his appointment.

According to Metaplanet CEO Simon Gerovich, Trump’s involvement is expected to strengthen the company’s global Bitcoin strategy. Moreover, Metaplanet believes his personal brand and growing presence in the crypto space will play a major role in boosting the company’s visibility beyond Japan.

Eric Trump is also involved in the development of the DeFi crypto project World Liberty Financial (WLFI). According to the company, WLFI has already generated approximately $390 million for the team, and the project actively uses the Trump name as part of its branding and promotion.

Related: World Liberty Financial Raises $550M in Public Token Sale

Although WLFI officially claims that members of the Trump family are not part of its executive leadership, their public visibility and media influence play a clear role. Therefore, Eric Trump’s appointment to Metaplanet is not just a staffing decision—it's a strategic media move designed to strengthen the company’s position within the global Bitcoin community.

Metaplanet Expands Bitcoin Reserves and Scales Treasury Strategy

Metaplanet Inc., a Japanese investment firm listed on the Tokyo Stock Exchange, began executing its strategy in 2023 to become one of the world’s largest corporate holders of Bitcoin.

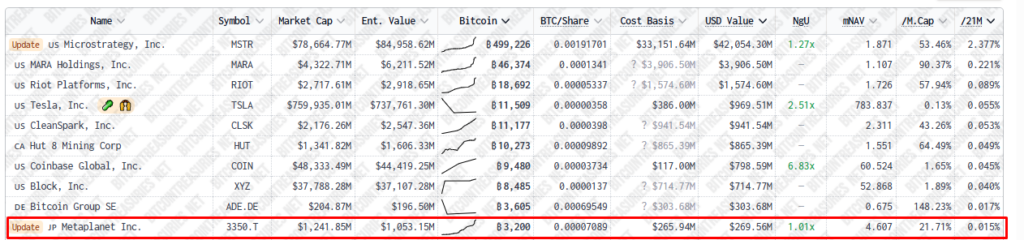

This week, the company purchased an additional 150 BTC, bringing its total reserves to 3,050 BTC (or 3,200 BTC, according to some sources that include recent undisclosed acquisitions). Based on data from BitcoinTreasuries.net, this places Metaplanet among the top 10 corporate Bitcoin holders globally.

However, Metaplanet’s current position is just a stepping stone. The company has officially announced its goal to accumulate 10,000 BTC by the end of 2025 and 21,000 BTC by 2026. To finance these purchases, Metaplanet is preparing what could become the largest equity offering in Asian history, specifically designed to support its Bitcoin acquisition strategy.

This model closely follows the approach of Strategy (formerly MicroStrategy) under Michael Saylor, but with a stronger focus on Asian markets and public capital. Eric Trump’s appointment fits seamlessly into this strategy, as a move to attract investor attention and build global confidence in the company.

Potential Conflicts of Interest

Amid the growing involvement of the Trump family in cryptocurrency projects and their public endorsement of Bitcoin, questions are emerging about potential conflicts of interest. Eric Trump is engaged with World Liberty Financial (WLFI), while Donald Trump is actively promoting initiatives to establish a national Bitcoin reserve.

As a result, for Metaplanet, this alignment could strengthen its position, but also pose regulatory transparency challenges. In the short term, however, it’s undeniably a media boost for the company.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.