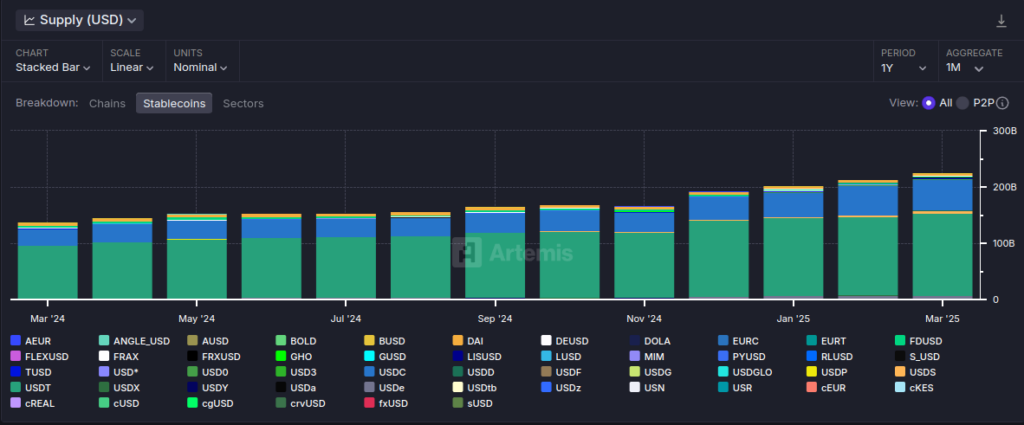

Stablecoin Market Cap Surges 1.5x in a Year: Dune & Artemis Report

Analytics firms Dune and Artemis have released a comprehensive annual report on stablecoins as of February 2025.

The report reveals a significant increase in active addresses and transaction volumes, highlighting the growing role of stablecoins as a bridge between traditional finance and the crypto ecosystem.

Key Stablecoin Market Metrics

Over the past year, the number of active addresses regularly transacting with stablecoins rose from 19.6 million to 30 million (a 53% increase). Notably, this growth mirrors the expansion in overall supply, with stablecoin market capitalization climbing from $138 billion in March 2024 to $225 billion.

Monthly stablecoin transfer volume surged from $1.9 trillion to $4.1 trillion (a 115% increase). However, the average transaction size remained largely unchanged (up from $676,000 to $683,000). Meanwhile, peak transaction volumes in May and July indicate increased activity from major market players.

Overall, these trends underscore stablecoins' expanding role as a vital financial tool for both retail users and institutional investors.

Related: The Stablecoin Showdown: How USDC and Tether Compete for Dominance

Stablecoin Adoption Expands: Expert Insights

Stablecoins are gaining traction across various financial market segments, serving as a key tool for:

- Payments and transactions

- Asset trading and exchange

- Liquidity management in decentralized finance (DeFi)

The growing involvement of institutional players, combined with the introduction of new regulatory standards, is driving deeper integration of stablecoins into everyday financial operations.

Stablecoins offer clear benefits over traditional financial instruments, especially when moving money across borders. Crypto is 24/7, 365 days a year, and transactions on Base typically cost less than 1 cent. In traditional finance, international payments can take days and cost $50+, and foreign exchange can cost 3%. We want more local currency stablecoins on Base, because local stablecoins allow people to transact onchain using the currency they are most familiar with, making this technology more accessible for everyday people,

says Tom Vieira, Head of Product for Base.

Ultimately, the report shows that stablecoins are not just retaining their role as a store of value but are also gaining traction in payment systems and dApps. This growing adoption reflects increasing interest in digital assets, which could be a key driver in the ongoing evolution of the crypto market and its integration with traditional finance.

Related: Senate Banking Committee Passes Stablecoin Bill: What the Genius Act Means

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.