Stablecoin Market Cap Surpasses $230B Following Trump’s Endorsement

The stablecoin market has reached a record $230.2 billion, driven by increasing institutional adoption and public support from President Donald Trump.

On this page

The $230.2 billion total market capitalization of stablecoins marks a new all-time high, according to DefiLlama. The surge is driven by growing institutional demand for digitally-backed dollar assets and increasing political support in the United States.

One key factor behind this performance is the support from U.S. President Donald Trump, who reaffirmed his commitment to stablecoins earlier this week. At the same time, the GENIUS Act is gaining traction in the Senate and could establish a regulatory framework for the entire sector.

Stablecoin Market Stats and Trends

According to DefiLlama, the stablecoin market has added $2.3 billion in value over the past week, marking a 56% increase year-over-year.

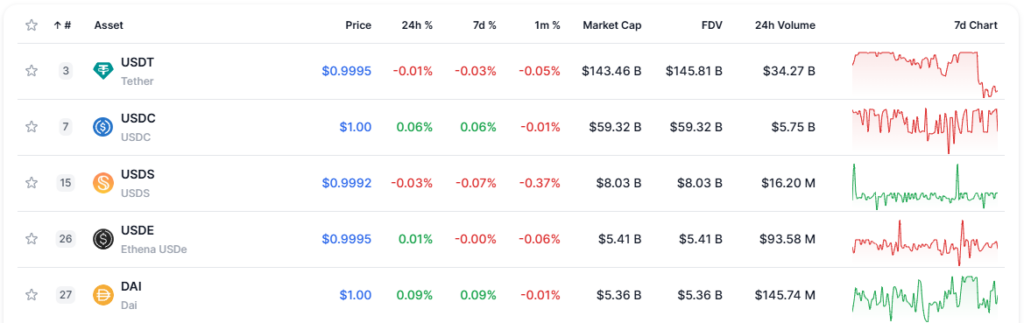

Notably, Tether (USDT) remains the dominant player, representing 62.6% of the total market cap (nearly $144 billion). In second place is USDC, issued by Circle, with around $59 billion, while USDS, launched by Sky (formerly known as Maker), holds third place with $8 billion in market cap.

For context, the stablecoin market peaked at nearly $190 billion in April 2022. However, the subsequent collapse of the Terra/Luna ecosystem and the bankruptcies of major players like FTX, Celsius, and BlockFi led to a significant capital outflow.

After a prolonged downturn, the market only began to recover around mid-2023. The current growth is more than just a rebound—it's a transition into a new phase of stability and institutional adoption for dollar-pegged digital assets.

How Institutional Support Is Fueling Stablecoin Growth

The primary driver behind the recent surge in stablecoins is the increased involvement of major financial institutions and the loosening of regulatory restrictions that previously limited their participation in the crypto market. According to Nick Ruck, Director at LVRG Research, both the U.S. and Hong Kong have significantly improved access to digital assets for traditional financial firms over the past year. This shift has allowed banks and fintech companies to operate more freely with these assets.

Furthermore, several major players have already launched their own stablecoin solutions:

- PYUSD – a stablecoin issued by PayPal, designed for international payments and on-chain transactions

- BUIDL – a tokenized stablecoin developed by BlackRock, the world’s largest Bitcoin ETF issuer

- RLUSD – a stablecoin introduced by Ripple

These initiatives signal a broader shift from experimentation to the practical use of stablecoins in the business world.

In addition, the growing market capitalization may also suggest that investors and institutions are preparing for more favorable market conditions. According to Nick Ruck, this could mark the beginning of a new bull cycle, with stablecoins playing a central role as a foundational liquidity instrument for trading and payments.

Political Factor: Trump’s Support and a Softer Approach to Crypto Regulation

A major catalyst behind the growth of the stablecoin market is increasing political backing in the U.S., particularly from President Donald Trump. During a recent speech at a crypto summit, Trump openly called for the advancement of dollar-backed stablecoins, describing them as a tool to strengthen the global dominance of the U.S. dollar.

Since the start of Donald Trump’s current presidential term on January 20, 2025, the stablecoin market cap has grown by $20 billion, underscoring the strong influence of political signals on market dynamics.

Moreover, on March 13, the U.S. Senate Banking Committee voted to advance the GENIUS Act, a bill designed to establish a clear legal framework for the stablecoin sector. Experts expect final approval in the coming months.

The bill includes several core provisions:

- Mandatory 1:1 asset backing

- Robust anti-money laundering (AML) measures

- Support for corporate and cross-border stablecoin use

According to Paul Howard, Senior Director of Wincent, this marks “a long overdue step for utilizing technology.”

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.