Trump Pumps TRUMP Memecoin by 10% with Truth Social Post

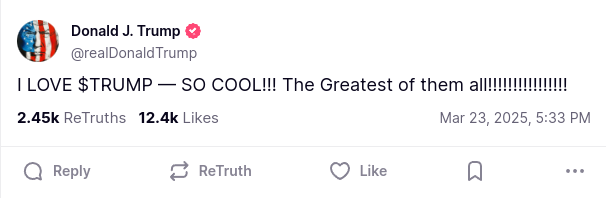

Donald Trump stirred the crypto community with a post on Truth Social, once again expressing his enthusiasm for his TRUMP memecoin. As a result, both TRUMP trading volume and price skyrocketed.

Market Reaction to Trump's Post

On March 23, Donald Trump shared a post on his social media platform, Truth Social, directly mentioning his own memecoin, TRUMP, which was launched just before the inauguration of the new U.S. president (yes, Trump himself).

Truth Social is a social media platform created by Trump Media & Technology Group as a response to censorship and account suspensions on traditional social networks, which were believed to restrict free speech. The platform launched shortly after Donald Trump’s accounts were banned on Facebook and X (formerly Twitter), prior to Twitter's acquisition by Elon Musk.

Read more: Trump Takes the Stage at Digital Asset Summit — Here’s What Moved the Market

Trump’s post had an immediate impact on trading activity. At the time of writing, the price of TRUMP (traded on WhiteBIT) had surged by approximately 10% within a day. After a sharp rise above the $12 mark, the price slightly corrected, highlighting the volatile nature of this asset.

Political Context and Regulation

Recent controversial events in the cryptocurrency market have caught the attention of U.S. lawmakers. Members of the Democratic Party have raised concerns about the involvement of government officials in promoting digital assets.

Notably, Congressman Sam Liccardo proposed a bill that would prohibit public officials and their families from issuing or sponsoring tokens like TRUMP. If passed, this could impact the future of popular memecoins.

Read more: Is the Memecoin Boom Over? Tokens Are Losing Investors and Capital

In addition to the official token, a less successful memecoin, MELANIA, launched in January this year, further prompting discussions within the crypto community. Regulators have recently explained that memecoins like TRUMP currently do not fall under SEC oversight, as they are not classified as securities.

Ultimately, these recent events indicate that the market dynamics of digital assets can be sensitive to public statements from influential figures. Although such effects may be short-lived and dependent on overall investor sentiment, they still attract increased attention from both the community and regulators.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.