USDC Reaches $60 Billion Market Cap, Setting New Record

Circle’s stablecoin USDC reaches $60 billion market cap, doubling in value over the past year. This growth is fueled by multichain expansion, its entry into the Japanese market, and ongoing improvements to Web3 infrastructure.

On this page

USDC has hit a record market capitalization of $60.2 billion, doubling in value over the past year. This growth highlights the increasing trust in the stablecoin and its expanding role in the DeFi ecosystem.

As a result, the total stablecoin market cap has also reached a new all-time high, climbing past $230 billion. For comparison, the stablecoin market first went beyond the $200 billion mark in December 2024.

The surge in USDC’s market cap to $60.2 billion reflects Circle’s ongoing efforts to scale its infrastructure and broaden the token’s global adoption.

At the time of writing, USDC remains the second-largest stablecoin by market capitalization, behind only Tether (USDT), which currently exceeds $144 billion.

How Circle Is Expanding USDC’s Global Reach

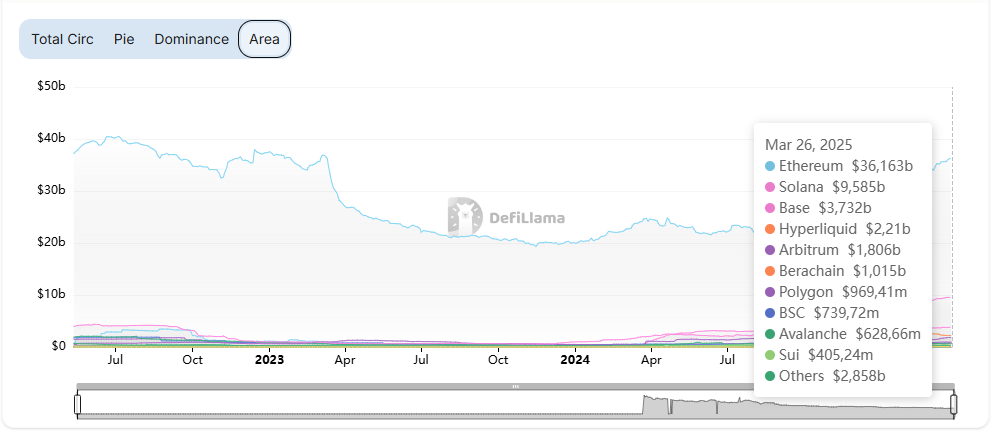

A major driver of USDC’s expansion has been Circle’s multichain strategy. Several key blockchain networks now integrate the stablecoin, including:

- Ethereum (over $36 billion)

- Solana ($10 billion)

- Base ($3.8 billion)

- Hyperliquid ($2.2 billion)

- Arbitrum ($1.8 billion)

- Berachain ($1 billion)

Solana has seen especially strong momentum. In Q1 2025, Circle issued multiple $250 million USDC tranches on the network, bringing the total value above $10 billion.

Furthermore, in 2025, Circle is focusing not only on increasing USDC issuance but also on strengthening its role as a foundational layer of Web3 infrastructure.

A major milestone was USDC’s expansion into Japan, one of Asia’s key markets. Through a partnership with SBI VC Trade, Circle introduced official support for USDC in the country for the first time, giving both institutional and retail users access to the stablecoin.

On the technology front, Circle is accelerating the shift to native USDC deployments. For example, USDC will no longer rely on bridge mechanisms on the L1 blockchain Linea. Instead, it will now be issued directly on-chain. This transition reduces risk and simplifies integration with smart contracts and decentralized applications.

Additionally, Circle has rolled out an upgraded version of its Cross-Chain Transfer Protocol (CCTP v2), now live on Ethereum, Avalanche, and Base, with support for Solana, Arbitrum, and Linea coming soon. The new protocol cuts cross-chain USDC transfer times down to just a few seconds.

Related: How Jeremy Allaire Built Circle and Made USDC a Stablecoin Giant

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.