Bitcoin Fails to Hold Above $88,000 — What Went Wrong?

Bitcoin failed to break through the $88,000 level, with the price retreating to the upper edge of its previous trading range.

The slight Bitcoin correction seems to be driven by a wave of long position closures, mainly by traders who entered the market in the $80,000–$85,000 range.

Moreover, this explanation is backed by data from top accounts on Binance. For the first time in a long while, the long/short ratio has dropped below 1%, indicating that short sellers now hold the upper hand in the market.

Despite the price movement, the Fear and Greed Index, according to CoinMarketCap, remained unchanged at 34 points (fear).

Meanwhile, the Altcoin Season Index dropped even lower to 18, highlighting Bitcoin’s continued strength over altcoins.

Additionally, BTC dominance remained almost unchanged at 60.5%, despite the recent volatility.

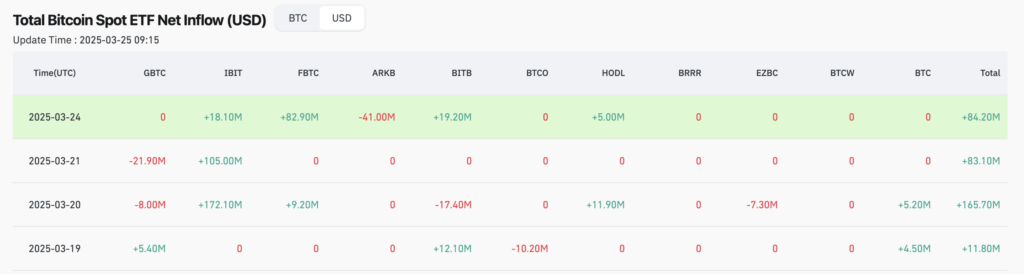

Institutional Investors Stay the Course

Large market players continue to look beyond short-term volatility and are actively investing in U.S. spot Bitcoin ETFs. For instance, on March 24, 2025, total net inflows reached $84.2 million. While not a massive figure by ETF standards, this still signals a lack of panic among institutional investors.

Bitcoin Whales Step In

According to data from analytics platform Arkham Intelligence, a major Bitcoin holder recently purchased $200 million worth of BTC, transferring the funds from an exchange to a personal wallet. Previously, this address had taken partial profits when Bitcoin hit the $100,000 mark. As users have noted, it’s a textbook example of the strategy: “sell high, buy low.” The wallet now holds more than 15,000 BTC (approximately $1.3 billion).

Keith Alan, co-founder of trading resource Material Indicators, has also expressed confidence in Bitcoin’s upward potential. However, he believes two key conditions must be met for the rally to continue:

- BTC must stay above the 21-day simple moving average (SMA), currently around $85,000.

- BTC must break the resistance level at approximately $93,500.

Otherwise, there’s a chance Bitcoin could retest recent local lows.

If/when that happens, I'll be buying those dips when buying resumes,

Keith added.

Overall, market participants are pointing to encouraging signs and remain optimistic. At the same time, they recognize the constant possibility of manipulation and sudden corrections.

Key metrics to monitor include:

- Whale activity

- Institutional behavior

- Technical indicators

- Major support and resistance levels

- Trading volume

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.