Toxic Positivity in Crypto and the Influence of Influencers

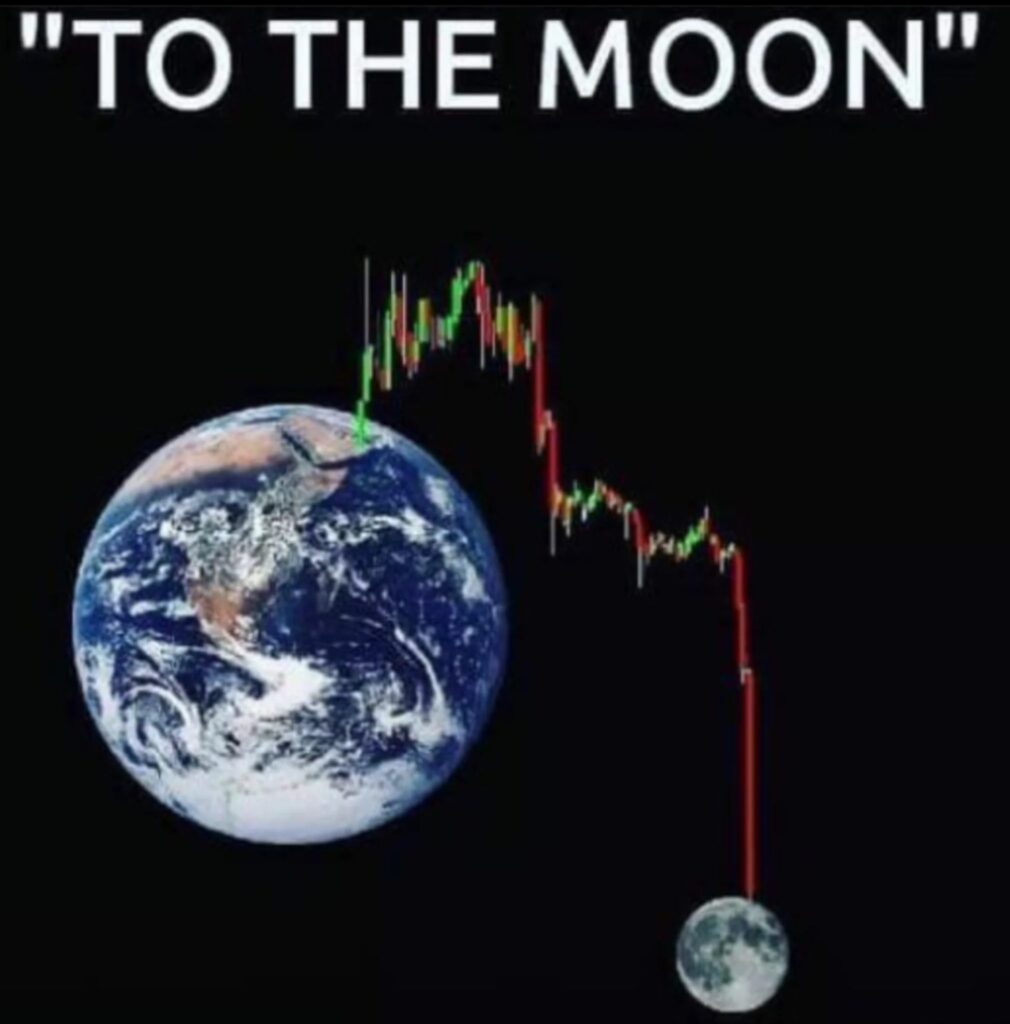

Crypto Twitter and online forums can sometimes blow your mind. Rocket emojis are everywhere, and it feels like every next token is “going to the moon.”

On this page

Every now and then, you’ll spot “gurus” predicting 100x or even 1000x gains in their videos. With new token categories and trends constantly appearing, it becomes harder to catch up with the market, do research, and find the gems.

At the same time, you may want to follow some popular voices in the space, along with statistical platforms and key numbers, because it’s when people are talking about the project you’re interested in that you can build connections with the community, exchange opinions, and share experiences.

When Positivity Becomes Toxic in Crypto

If you’re here, we probably have something in common: the belief, or at least interest in blockchain technology and crypto.

And there are plenty of good reasons for it.

Cryptocurrencies and the technology they rely on offer many benefits, from individual investment opportunities to global technological progress, decentralization, fast payments, ownership, independence, and the list goes on.

But does this mean the industry is perfect, or that every criticism is just spreading FUD (Fear, Uncertainty, and Doubt)?

Not at all.

It also doesn’t mean that prices will keep rising just because the community says so.

No matter how perfect a project seems, you might spot some flaws or conflicts when you dig deeper. Bitcoin, for example, faces scalability concerns, though solutions like the Lightning Network aim to solve this issue.

Ether hasn’t shown the strong performance some investors expected during the bull run that started in November 2024. And there’s something in every project, popular or not.

At the same time, there’s growing competition in the space with new projects entering the market.

Still, when you look at social media posts, especially those related to emerging trends and coins, it may feel like there’s no way for this token to go down.

Looking at things from only one perspective is when positivity becomes toxic in crypto.

There are always “What ifs”. What if the shiny new coin doesn’t grow as much as the key opinion leader with thousands or millions of followers promises?

How much will it cost you if their predictions don’t come true, and even worse, if the coin’s price falls because that same person made a large investment and then decided to dump it, causing their followers to sell off their holdings?

Signs to Recognize Toxic Positivity in Crypto

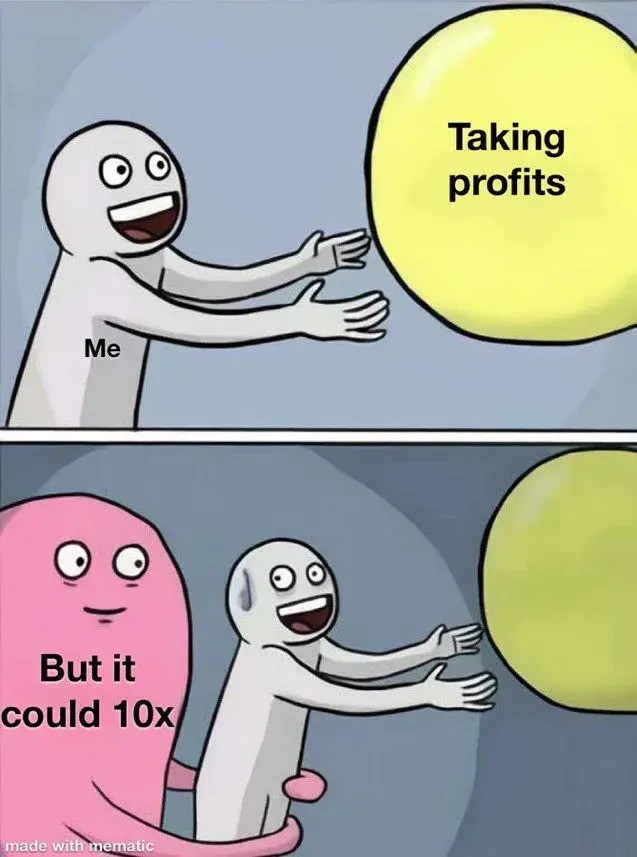

Toxic positivity in personal finance can be harmful. For example, you might convince yourself it's not time to take profits or see a post saying “HODL, don’t sell, the market will turn around”.

During sell-offs, there’s often lighthearted criticism of “bears” (those who are pessimistic about prices). But the truth is, investment strategies vary.

Toxic positivity, often unintentionally, can create unrealistic expectations, leaving investors disappointed. Even worse, it can be a tool for pushing scams. The more people hype up a fraudulent token, the more attention it gets – and the more it thrives.

To spot toxic positivity and red flags in crypto, look out for these signs:

- A ton of hype language and emojis: If every post is filled with words like “to the moon” and a bunch of rocket emojis, it’s probably more about hype than facts. Sure, it’s exciting, but it’s also a way to get people caught up in the buzz and ignore the actual details. You want to see real info, not just hype.

- It’s all about the returns: When people only talk about massive gains and never mention the risks, that’s a red flag. Yes, crypto can be profitable, but losses are just as common as gains. An academic study by Indiana and Harvard Universities, which analyzed 36,000 tweets from 180 crypto influencers about 1,600 crypto assets, showed that most tweets were linked to positive returns. Notably, the posts mostly promoted newer cryptocurrencies with small market caps.

- Ignoring the risks: If someone acts like there are no risks at all, or brushes them off completely, that’s a huge warning sign. Every crypto project comes with challenges – whether it's market volatility, regulatory issues, or something else. Pretending these risks don't exist sets you up for disappointment.

- Pressure to act quickly: If you're hearing phrases like “Don’t wait, get in now before it’s too late,” that’s another sign of toxic positivity. It’s all about rushing you into a decision driven by fear of missing out (FOMO). But good investment choices shouldn’t be made in a panic.

- Shutting down questions: If you ask about the risks or raise concerns, and people just shut you down or get defensive, something’s off. Healthy discussions in the crypto space should encourage questions and diverse viewpoints. Silencing criticism only creates an illusion of perfection.

Facing Reality and Not Falling in the Trap of Toxic Positivity

It’s easy to feel the pressure in crypto when everyone’s shouting that you need to “jump on this coin before it’s too late.” Should you act fast just because others are saying so? The short answer: no. Any time someone pressures you to make a quick decision, it’s a red flag.

Staying grounded in the crypto space means being realistic, doing your research, and not letting emotions drive your choices. While you might miss out on quick profits from a rising coin, investing thoughtfully helps you make decisions with greater confidence, setting yourself up for more sustainable success in the long run.

People often highlight their wins on social media, not their losses. Even experienced investors face setbacks. No investment is a guaranteed success, and crypto, in particular, is known for its highs and lows.

Another important step is focusing on research. Who’s behind the project? Do they have a solid track record? Does technology solve a real-world problem? Read the whitepaper and evaluate the tokenomics. If the project doesn’t make sense to you, don’t invest just because others are hyping it up.

While influencers can offer useful insights, remember that some thrive on hype because it draws attention. Balance their optimism with information from data-driven platforms and voices that provide a more realistic perspective. And never rely on just one source when making decisions.

Related: A complete guide to crypto analysis

How to Balance Optimism With Caution in Crypto

Staying positive about crypto is great, but it’s important to keep your feet on the ground. Optimism works best when paired with a bit of skepticism – it helps you spot potential risks and make smarter choices. Mistakes are bound to happen, and that’s okay. The key is to treat them as learning opportunities rather than ignoring them altogether.

It also helps to follow voices that aren’t just hyping up the next big thing but are offering balanced insights. Hearing both the pros and cons can give you a clearer picture of what you’re getting into.

And remember, crypto isn’t just about quick wins. Taking a step back and looking at the long-term potential of blockchain technology can help you avoid impulsive decisions driven by short-term hype.

Staying grounded doesn’t mean being negative; it just means making decisions with clarity and confidence.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.