Arthur Hayes Predicts Bitcoin Short ETF Unwind, Eyes $70K

Arthur Hayes, a notable crypto trader and the co-founder of 100x, analyzes everything from political impacts to trading trends, predicting where the market is headed. This time, he shared his perspective on the market decline and made further predictions.

On this page

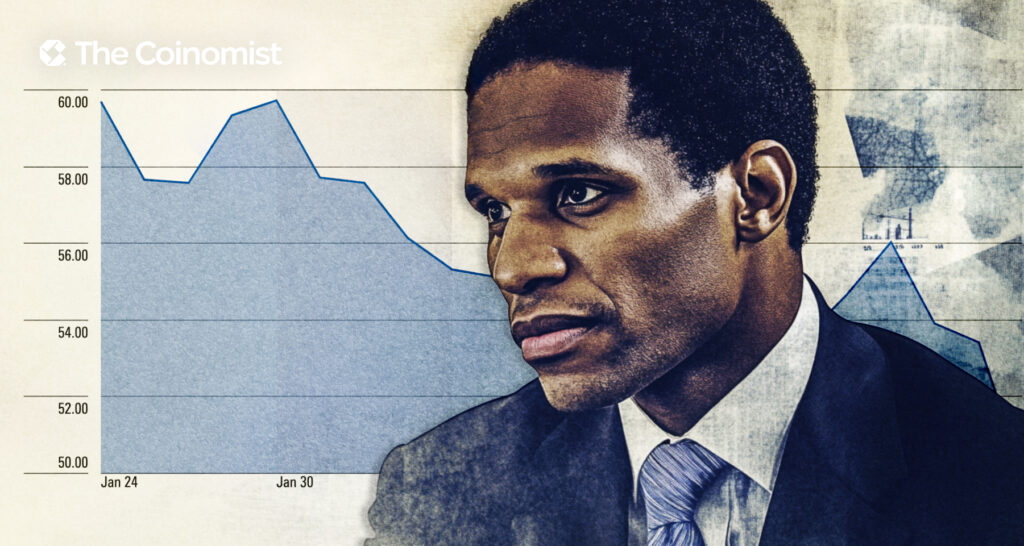

At the time of writing, negative sentiment dominates the crypto market. According to CoinMarketCap, Bitcoin is below $90,000, and the Fear and Greed Index is heavily tilted toward fear, showing that investors are cautious.

Arthur Hayes believes the decline will continue, with Bitcoin possibly falling to $70,000. In a recent post on X, he explained why this could happen.

Hayes Sees Bitcoin Short ETFs as a Reason for Further Bitcoin Decline

Looking into the current market, Hayes highlights the role of hedge funds and their exit from ETFs (exchange-traded funds) as a reason for the price decline.

In a recent post on X, Hayes wrote:

Bitcoin goblin town is incoming”. With this term, he refers to a market downturn, where prices plummet, and investors panic.

Hayes made his prediction based on institutional trading of Bitcoin products, particularly iShares Bitcoin Trust ETF (IBIT) by BlackRock and Bitcoin futures.

He explained that many IBIT holders are hedge funds that are betting on the ETF's rise while shorting Bitcoin futures on the Chicago Mercantile Exchange (CME) to earn a yield higher than short-term U.S. Treasuries.

Meanwhile, when Bitcoin falls, their strategy is to sell IBIT and buy back CME futures.

This sell-off and hedge funds’ bitcoin short ETF liquidations could cause further Bitcoin decline, potentially as low as $70,000, Hayes said.

Arthur Hayes on Trump's Budget Plan

In another post on X, Hayes said what remains to be done now is to chill out, retrace, and wait to see how Trump’s budget plan plays out. The government agenda includes tax cuts and a debt limit hike.

On February 26, House Republicans passed a budget resolution supporting Trump's agenda, but it still needs action from the Senate.

If Trump can't pass his budget which spends more and hikes debt ceiling, resume capitulation to levels pre the election day victory $75k to $70k

– wrote Hayes.

How are the two connected?

Bitcoin is often seen as a “risk-on” asset, meaning its price can be affected by factors like government spending, debt, and political uncertainty.

If Trump's budget passes, it could keep the economy's liquidity flowing and maintain confidence in riskier investments like Bitcoin. But if the budget gets blocked or faces strong opposition, it could cause panic, reduce liquidity, and lead to a Bitcoin sell-off, pushing prices down.

Will Hayes’s Prediction Come True?

Hayes has made a name for himself with his ability to read market trends and understand the broader economic forces that affect Bitcoin’s price. However, not everyone agrees with his predictions.

While he’s been right on some calls in the past, a few of his more bearish forecasts have raised doubts in the crypto world.

The current market, shaped by factors like institutional trading and political uncertainty, plays a big part in why Hayes expects a Bitcoin drop, but opinions on what will actually happen vary widely.

Related: Arthur Hayes — Is Trump’s Crypto Policy Setting a Trap?

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.