Bybit: The Rise, Struggles, and Future of a Leading Crypto Exchange

Bybit launched in 2018 as a daring newcomer—a crypto derivatives exchange challenging the dominance of industry giants. Today, it ranks as the second-largest crypto exchange by trading volume, second only to Binance. But its path to success has been far from easy. Bybit has navigated through intense competition, regulatory pressures, and even one of the biggest hacks in crypto history.

On this page

- The First Steps: A Bold Entry into the Crypto Market

- Expansion: Bybit Breaks Beyond Derivatives

- Regulatory Challenges: Bybit vs Global Authorities

- Dark Day: Hackers Steal $1.4 Billion from Bybit

- Bybit’s Response: A Battle for Survival

- What Is the Future of Bybit Crypto Exchange?

- Regulatory Pressure

- Overhauling Security Measures

- Competing with Binance

- Expanding in Emerging Markets

- Bybit Crypto Exchange: A Giant at a Crossroads

This is the story of the Bybit crypto exchange: from its meteoric rise to the challenges that nearly broke it, and finally, the potential future that awaits the company.

The First Steps: A Bold Entry into the Crypto Market

In March 2018, former forex broker Ben Zhou recognized an opportunity in the cryptocurrency world. At that time, BitMEX dominated the crypto derivatives market but was plagued by server overloads, poor customer support, and a lack of innovation. Zhou was confident he could build a better platform.

Bybit officially launched in December 2018, just as Bitcoin’s price crashed from $20,000 to $3,000. The timing seemed risky, but Zhou saw an advantage: while retail investors were panicking and exiting the market, professional traders kept trading.

He designed Bybit as a high-speed, low-latency crypto exchange tailored for these active traders, introducing:

- 100x leverage on Bitcoin futures, a powerful draw for high-risk traders.

- An ultra-fast trading engine capable of processing 100,000 transactions per second, preventing server crashes and ensuring smooth trading.

- Aggressive marketing and referral programs that rapidly grew the user base.

By 2020, Bybit secured a significant share of the crypto derivatives market, surpassing BitMEX in daily trading volume with over $4 billion in transactions per day. It quickly established itself as one of the top 5 crypto derivatives exchanges.

Traders flocked to the platform for its stability, lightning-fast order execution, and growing liquidity.

Expansion: Bybit Breaks Beyond Derivatives

After establishing itself as a dominant player in crypto derivatives, Bybit set its sights on the spot trading market, aiming to compete with heavyweights like Binance and Coinbase. In 2021, the crypto exchange made its bold move by launching spot trading. This move marked a turning point for Bybit.

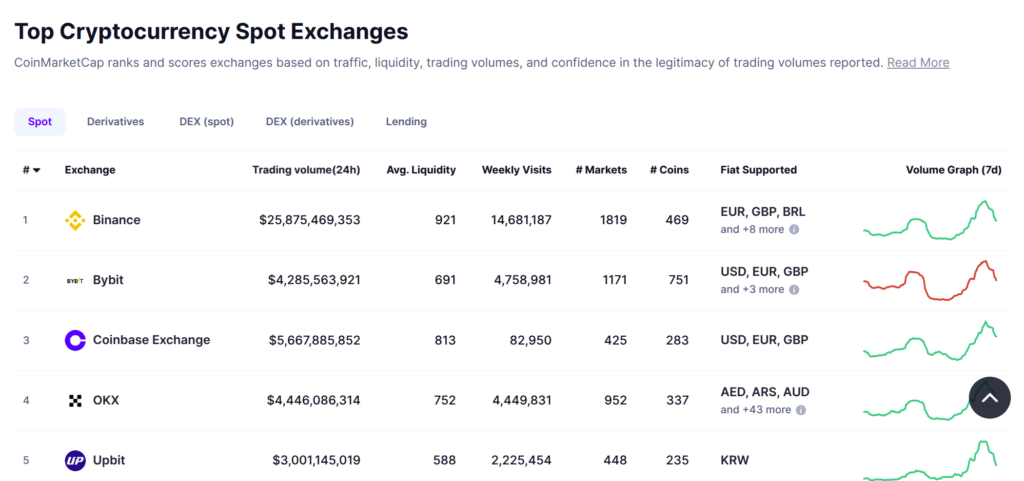

By 2023, Bybit had surpassed Coinbase in trading volume, capturing 16% share of the global market.

Several strategic moves fueled this growth:

- Ultra-Low Fees

Zero-fee trading on USDC pairs attracted high-frequency traders.

- Product Diversification

NFT marketplace, copy trading, staking, and options trading.

- Global Expansion

Bybit entered Latin America, Africa, and Southeast Asia with localized payment solutions.

Bybit strategically bolstered its brand through high-profile sponsorships, partnering with Red Bull Racing, the Argentine Football Association, and esports giants NAVI and Astralis.

The objective was clear: Bybit aspired to transition from a trading platform to a global powerhouse.

However, with rapid growth came significant challenges.

Regulatory Challenges: Bybit vs Global Authorities

Bybit's rapid expansion did not go unnoticed by regulators worldwide. Governments, wary of the unregulated high-leverage crypto market, quickly turned their attention to the exchange.

- 2021 – Canada: The Ontario Securities Commission (OSC) fined Bybit 2.5 million CAD and prohibited it from operating in Ontario.

- 2021 – UK: The Financial Conduct Authority (FCA) banned retail crypto derivatives trading, forcing Bybit to withdraw from the UK market.

- 2023 – France: Under pressure from the Autorité des Marchés Financiers (AMF), Bybit exited the French market due to regulatory non-compliance.

- 2025 – India: After years of operating without proper licensing, Bybit was forced to register with the Financial Intelligence Unit (FIU-IND) and pay substantial fines.

Despite these setbacks, Bybit found a safe haven in Dubai, obtaining licenses and forming strategic partnerships with the Dubai Multi Commodities Centre (DMCC).

The UAE’s crypto-friendly environment allowed Bybit to expand rapidly without the threat of stringent regulations hanging over its operations.

Yet, even this strategic maneuver couldn’t shield Bybit from the crisis that followed.

Dark Day: Hackers Steal $1.4 Billion from Bybit

February 21, 2025, began like any other day. But then, $1.4 billion worth of Ethereum vanished from Bybit’s cold wallets, marking the largest crypto exchange hack in history.

This wasn’t a typical hack. There were no coding exploits or leaked private keys. Instead, the attackers used social engineering to deceive Bybit employees into approving fraudulent transactions through multisig authorization.

Almost immediately, all signs pointed to Lazarus Group, the North Korean hacking syndicate behind some of the most significant cyberattacks in recent years. Blockchain analytics firms Arkham Intelligence and Elliptic traced the stolen funds to 53 wallets linked to Lazarus.

Bybit found itself at the center of a crisis.

Bybit’s Response: A Battle for Survival

A $1.4 billion gap could have easily triggered catastrophic panic and a massive withdrawal frenzy. Yet, Bybit CEO Ben Zhou acted swiftly.

Rather than freezing withdrawals, Bybit secured $1.5 billion in emergency liquidity from Galaxy Digital, FalconX, and Wintermute. This rapid action covered almost all stolen assets within 72 hours, preventing widespread panic and averting a potential collapse of the crypto exchange.

In response, Bybit launched LazarusBounty.com, the first real-time tracking platform to trace stolen funds and identify hacker activities. This bold initiative demonstrated Bybit’s commitment not only to defend itself but to take the offensive against cybercriminals.

Although Bybit successfully recovered its financial footing, its reputation took a hit. The incident reignited concerns about the security risks associated with centralized exchanges, threatening Bybit’s market position for the first time in years.

What Is the Future of Bybit Crypto Exchange?

Despite the crisis, Bybit remains a dominant player in the crypto exchange industry, maintaining over $16.2 billion in reserves. However, its stability is far from guaranteed.

Regulatory Pressure

As governments tighten their grip on the crypto industry, Bybit faces mounting pressure to prove its compliance in key markets such as the EU, India, and Latin America.

Overhauling Security Measures

The 2025 hack exposed critical vulnerabilities in Bybit’s internal security controls. Now, the crypto exchange must revamp its security protocols, enhance employee training, and deploy real-time fraud detection systems.

Competing with Binance

Binance dominates the market with over 50% market share, while Bybit holds 16%. To stay competitive, Bybit must offer lower fees, enhanced products, and superior customer support.

Expanding in Emerging Markets

Bybit is rapidly gaining popularity in Nigeria, emerging as one of the top exchanges thanks to its P2P trading features. Its strategic expansion into Southeast Asia and Latin America aligns with the increasing demand for cryptocurrencies in regions with limited access to traditional banking services.

Bybit Crypto Exchange: A Giant at a Crossroads

Bybit has survived regulatory battles, market crashes, and the largest crypto hack in history. But survival alone isn’t enough.

With the industry evolving at breakneck speed, Bybit must adapt or risk being left behind. Its ability to restore trust, strengthen security, and navigate regulatory challenges will determine whether it remains a leading exchange or follows the fate of platforms it once outperformed.

Can Bybit reclaim its place at the top? Once an industry leader, the crypto exchange now faces unprecedented pressure.

What’s next? The future hinges on the decisions CEO Ben Zhou and the Bybit team make in the coming months.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.