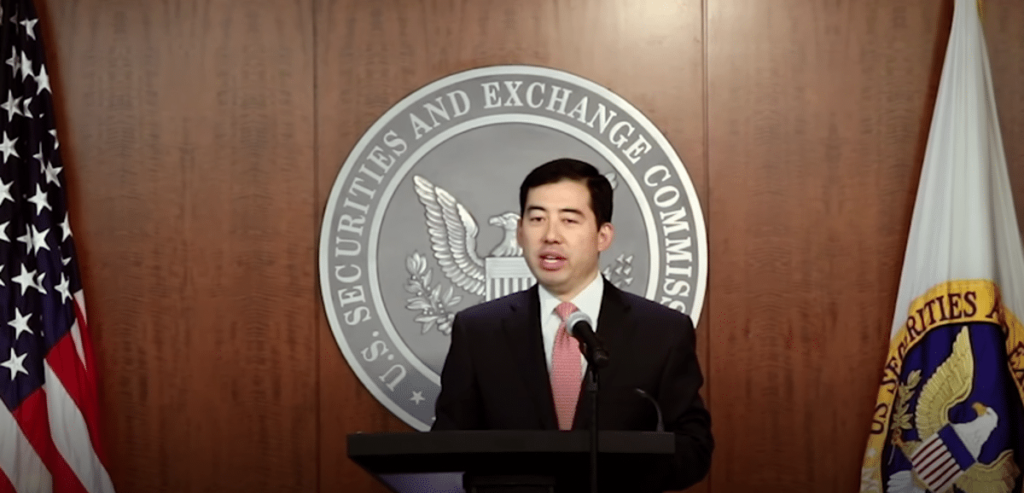

Mark Uyeda: The Path to Power in the SEC and His Vision for Financial Regulation

For years, the SEC has been a dominant regulatory force in financial markets. Under the leadership of figures like Gary Gensler and Jay Clayton, the agency became known for its strict stance on cryptocurrencies.

On this page

- A New Leader at the Helm

- Breaking from the Past

- The SEC Before Mark Uyeda: An Era of Strict Enforcement

- Gensler’s Strategy Missteps

- Uyeda Reshapes the Rules

- Crypto 2.0 Task Force: The SEC’s New Approach

- Breaking Down Barriers to Growth

- Repealing SAB 121: A Bold Move Toward Reform

- SAB 121: A Roadblock for Traditional Finance

- A Clear Signal for Crypto Integration into Traditional Finance

- Regulation Should Protect, Not Punish

- The Future of Financial Regulation Under Mark Uyeda

- A More Transparent SEC: Dialogue Over Confrontation

- Driving Legislative Reform

- Striking a Balance Between Regulation and Innovation

- A More Competitive U.S. Crypto Market

- The Financial World Watches the Shift

- The big question: Can regulation and innovation coexist?

- Mark Uyeda Is Changing the Game

However, in 2025, with Mark Uyeda stepping in as Acting SEC Chair, a new phase in financial regulation began. The era of aggressive crackdowns on crypto companies gave way to regulatory clarity, industry dialogue, and a more balanced oversight approach.

A New Leader at the Helm

Mark Uyeda is no newcomer to financial regulation. With years of experience in Washington, deep expertise in securities laws, and a key role in shaping financial policy, he has long been an influential figure in regulatory circles. However, his appointment as Acting SEC Chair marked a significant shift in the agency’s direction.

His mission was clear: eliminate uncertainty in the digital asset market, establish clear rules for participants, restore investor confidence, and support innovation rather than suppress it.

Under Uyeda’s leadership, the SEC is already taking a new approach to crypto regulation.

By reversing restrictive measures that hindered industry growth, engaging market leaders in dialogue, and prioritizing regulatory transparency over strict enforcement, he is paving the way for a more balanced and forward-looking financial oversight framework in the U.S.

Breaking from the Past

The SEC Before Mark Uyeda: An Era of Strict Enforcement

Before Uyeda took the helm, the SEC was defined by its aggressive enforcement-driven approach to crypto regulation.

Under Gary Gensler, who led the Commission from 2021 to 2024, the agency took a hardline stance, classifying most digital assets as securities and repeatedly urging crypto exchanges to “come in and register” under existing laws.

Instead of developing new rules that acknowledge the unique characteristics of digital assets, the SEC under Gensler focused on litigation, targeting major crypto firms. He argued that regulations were already well-defined, and companies simply needed to comply.

Gensler’s Strategy Missteps

Instead of fostering clarity, this approach instilled fear and uncertainty. Without clear regulations, crypto entrepreneurs were reluctant to develop their businesses in the U.S., unsure how to meet the SEC’s requirements (often discovering them only when summoned to court or receiving a Wells notice). As a result, many moved their companies abroad to escape the regulator’s unpredictable actions.

Meanwhile, the absence of formalized rules created a breeding ground for fraudsters who exploited legal loopholes, further undermining investor confidence.

Uyeda Reshapes the Rules

Mark Uyeda recognized the flaws in this approach and wasted no time in taking action.

As Acting Chair, he openly criticized the SEC’s “regulation-by-enforcement” strategy and advocated for a clear, proactive regulatory framework. His position was straightforward: before imposing fines, regulators must provide companies with a clear roadmap for compliance.

The SEC can do better,

Uyeda declared in early 2025, admitting that the previous approach had created confusion rather than fostering adherence to regulations.

Crypto 2.0 Task Force: The SEC’s New Approach

The SEC took a bold step in January 2025 by launching the Crypto 2.0 Task Force, appointing Commissioner Hester Peirce, a well-known advocate for digital assets, as its leader.

The task force’s mission was clear:

- Develop transparent regulatory guidelines for digital assets.

- Establish practical pathways for registration and compliance.

- Implement fair disclosure requirements tailored to the unique nature of crypto technologies.

This wasn’t just a change in rhetoric—for the first time, the SEC actively engaged with the market under a new framework.

Breaking Down Barriers to Growth

Repealing SAB 121: A Bold Move Toward Reform

Just weeks after taking office, Uyeda made one of his most decisive moves—revoking Staff Accounting Bulletin No. 121 (SAB 121).

Implemented under the previous SEC leadership, SAB 121 had effectively restricted banks and brokerage firms from offering crypto custody services by imposing overly rigid accounting requirements.

SAB 121: A Roadblock for Traditional Finance

SAB 121 faced widespread criticism for imposing excessive regulations that kept traditional financial institutions from entering the crypto space.

Banks and brokerage firms seeking to offer crypto custody services ran into overwhelming regulatory hurdles. In effect, the rule sidelined traditional institutions from the crypto market, leaving digital asset custody largely in the hands of unregulated entities.

A Clear Signal for Crypto Integration into Traditional Finance

By removing this restriction, Uyeda sent a strong message:

- Cryptocurrencies and traditional finance should not exist in separate silos.

- Regulated institutions must be able to work with digital assets within a clear and secure framework.

The initiative received widespread support from lawmakers and financial institutions, who hailed it as a long-overdue step toward integrating cryptocurrencies into TradFi.

Regulation Should Protect, Not Punish

Removing SAB 121’s restrictions was about eliminating an unnecessary hurdle. Investor protection and innovation are not mutually exclusive,

Uyeda explained.

This principle—that regulation should protect rather than punish—has become a defining feature of his leadership at the SEC.

The Future of Financial Regulation Under Mark Uyeda

A More Transparent SEC: Dialogue Over Confrontation

Mark Uyeda’s leadership is already transforming the U.S. regulatory landscape.

By prioritizing dialogue and cooperation with industry leaders, he has reduced tensions between regulators and crypto entrepreneurs. Under his approach, the SEC is no longer seen as an obstacle to innovation but as an engaged participant in shaping the future of digital assets.

Driving Legislative Reform

Uyeda’s backing of congressional initiatives has encouraged lawmakers to develop comprehensive cryptocurrency regulations.

If enacted, these laws will bring long-term stability to the crypto market, reducing legal uncertainty and safeguarding against abrupt policy shifts with each change in administration.

Striking a Balance Between Regulation and Innovation

Uyeda has reshaped the SEC’s approach: clear rules now come first, and enforcement follows.

Now, enforcement targets actual fraudsters rather than companies simply trying to navigate complex regulations.

This marks a new philosophy for the SEC. Regulations should be transparent and fair, ensuring that legitimate businesses can operate within the law.

A More Competitive U.S. Crypto Market

With well-defined regulations, fintech and blockchain startups can now grow their businesses in the U.S. instead of relocating abroad.

If the SEC stays on Uyeda’s course, the U.S. could position itself as a global leader in digital finance innovation—rather than pushing cutting-edge technologies away due to regulatory uncertainty.

The Financial World Watches the Shift

Banks, investment firms, and legal experts are closely following Uyeda’s reforms.

Legal analysts highlight that his approach—combining clear regulations, open dialogue with the industry, and targeted enforcement—could become a blueprint for regulating other emerging technologies, including:

- AI-driven financial systems

- Tokenized securities

- Decentralized finance (DeFi) platforms

The big question: Can regulation and innovation coexist?

Uyeda believes they can.

His actions prove that well-defined regulations and fair oversight can create the foundation for a thriving, innovation-driven financial market.

Mark Uyeda Is Changing the Game

With each step, the SEC moves deeper into the Uyeda era, and the world is watching: Can his strategy of open dialogue, transparency, and balanced regulation truly reshape financial oversight in the U.S.?

Mark Uyeda hasn’t just taken charge of the SEC, he’s rewriting the rules.

If he continues on this path, his influence on the financial world could last for decades.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.