Takashi Kotegawa: The Trader Who Broke the Japanese Stock Exchange

Legendary Japanese trader Takashi Kotegawa, known for his dramatic rise and fall, offers timeless lessons in discipline and risk management, helping traders stay composed amid the chaos of market volatility.

On this page

Takashi Kotegawa: The Trader Who Turned a Dream Into a Nightmare

Imagine a young man in his twenties, sitting in a cramped 10-square-meter room in Tokyo, surrounded by nothing but a computer, a cup of green tea, and a few charts glowing on the screen.

In the 2000s, Takashi Kotegawa, a Japanese student, earned over $150 million through day trading. And then, almost lost it all.

However, his story isn’t just about luck and risk. It’s a powerful example of how a trader’s own mindset can become their greatest enemy. While Kotegawa didn’t trade crypto, but stocks, his experience still offers timeless lessons that are deeply relevant to today’s crypto markets.

So who is the man known as “J-Com Man”? What made him a legend and what lessons can traders around the world take from his story?

Related: Japan’s Bitcoin ETF: Regulatory Shift on the Horizon

The Beginning: A Small Start with Big Ambitions

Do you know what hikikomori are? Unless you're a fan of anime or Japanese culture, the term might not ring a bell.

Hikikomori are individuals in Japan who completely withdraw from social life, often isolating themselves in a single room and avoiding interaction with others. Yes, they're the ones whose mothers quietly leave a plate of instant noodles by the door and walk away without saying a word.

And honestly, in a city like Tokyo, where the population density exceeds 6,400 people per square kilometer, becoming a recluse isn’t all that surprising.

Takashi Kotegawa was a seasoned hikikomori. He had barely left his room since the age of 19. But that isolation became an unexpected advantage: within a few years, he turned $13,000 into $153 million.

Born in 1978, Kotegawa wasn’t some financial prodigy from an elite university. Instead, he dropped out of school because he couldn’t stand being around his peers. Out of boredom, he started learning about stock trading on his own.

In 2000, as the dot-com boom was taking off, he invested a modest 1.6 million yen (roughly $13,000 at the time) in stocks. Why stocks? Because online trading was just starting to gain traction in Japan, and Takashi saw his moment.

He used specialized scanners to spot the hottest moves on the Tokyo Stock Exchange (TSE) and traded obsessively for hours. He ate just twice a day—once before the market opened and once after it closed. Good thing he wasn’t trading crypto, or he might’ve starved.

However, Takashi wasn’t making blind trades. He mastered technical analysis, studied market cycles closely, and timed his entries with precision. His approach was simple but disciplined: buy low, sell high, and stick to your strategy—even when the market’s swinging like a drunk after a party.

Related: TOKYO FRIENDS and the Future of Virtual Tourism

The Breakout Moment: J-Com and the Livedoor Shock

Takashi shot to fame in 2005 when he made his first $10 million on a single trade involving J-Com Holdings. It was a nightmare for the stock exchange, but a defining moment for the hikikomori trader.

A trader at Mizuho Securities had accidentally placed an order to sell 610,000 shares of J-Com at 1 yen each instead of one share at 610,000 yen. The stock price plummeted. But Takashi, with cat-like reflexes, jumped on the opportunity. While others panicked and sold off, he snapped up 7,100 shares at the bottom. Within hours, the market corrected, and he walked away with $17 million in profit.

From that day forward, he became known as the “J-Com Man,” and the legend was born.

However, Takashi didn’t stop at his first millions. In 2006, the so-called Livedoor Shock hit the market. That was a major scandal involving the tech company Livedoor, which was accused of fraud, market manipulation, and falsifying financial reports. The company’s stock crashed, and once again, Takashi found himself in the right place at the right time. Or more accurately, in the same position: sitting in front of his computer. He went all in, buying the stock at the bottom without deviating from his strategy, and once again hit the jackpot. After that trade, his capital grew to $108 million, starting from just $13,000.

It was like putting a few hundred dollars into Bitcoin back in 2010 and cashing out with billions.

Related: 10 Key Investment Trends to Watch in 2025: Green Crypto, Regulations, and More

The Fall of Takashi Kotegawa

But like in any good drama, Takashi’s success was short-lived. By 2008, as the global financial crisis hit, the Japanese stock market began to slide. Takashi, who had built his strategy around buying the dip, made several risky bets and ended up losing a large part of his fortune.

In one interview, he admitted that his overconfidence in his own abilities (or overconfidence bias, to use the technical term), his disregard for fundamental analysis, and his tendency to make impulsive decisions ended up working against him. When the market began to crash, he got too caught up and failed to exit in time.

Fortunately, Takashi didn’t give up. He returned to his roots: technical patterns, discipline, and minimal risks. By the early 2010s, he had recovered much of his capital, although he was no longer the “J-Com Man” who once shook Tokyo.

Today, he remains a legend in Japan’s trading scene, but he no longer sits in his bedroom staring at charts. Instead, he mentors young traders and shares his experience at crypto conferences across Asia. Takashi Kotegawa even got married.

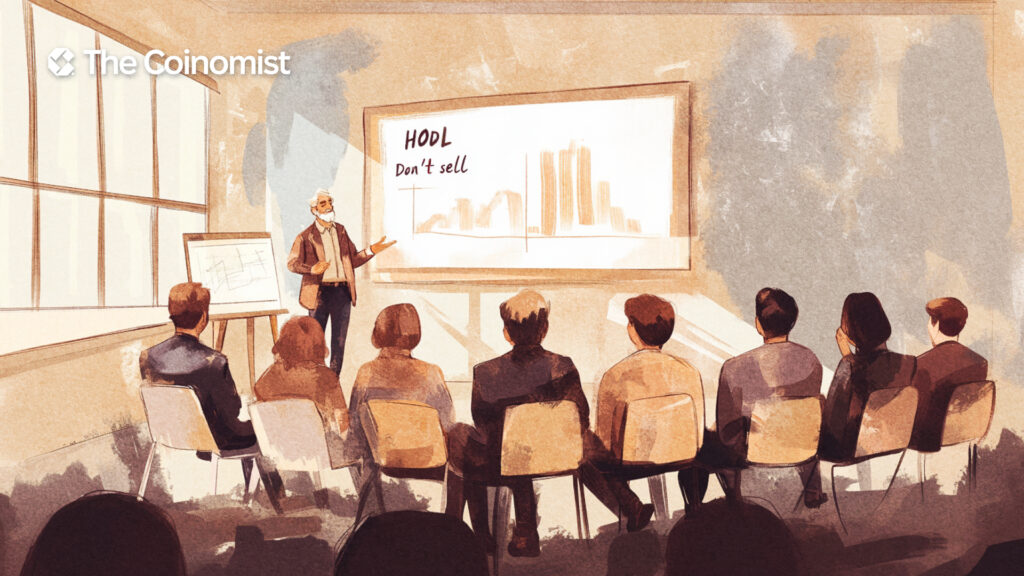

How Takashi Kotegawa’s Experience Can Help You in Crypto Trading

Takashi’s story is more than just a tale of luck. It’s a practical lesson for crypto traders who often face losses from impulsive decisions in a volatile market.

Here are a few key lessons to take away:

- Avoid getting caught up in hype

Takashi made his breakthrough with J-Com because he spotted an opportunity, not because he gave in to panic. The same principle applies to crypto. If a coin is climbing 10% in a day, don’t rush to buy. Check the technical indicators, review the fundamentals, and learn about the project itself. Sometimes, a token has no real utility and is simply being artificially pumped.

- Manage your risk

Takashi’s downfall in 2008 proved that even the smartest traders can slip if they go all in. In crypto, that means not putting everything into one coin, even if it is being promoted as the next Ethereum killer. Use stop-loss orders to manage your risk. There’s no reason to panic during a crash if you’ve already set your risk boundaries.

- Herd mentality is your enemy

Takashi almost lost everything by following the crowd during a crisis. This is especially relevant in crypto. If everyone is shouting “Sell,” pause and think. Are you acting too late or too early?

These lessons are like coffee with milk—simple, but energizing. Takashi often said in interviews that his success was built on discipline, not luck. He wasn’t some kind of supercomputer. He was just an ordinary guy who learned to listen to the market instead of his emotions.

If you want to dig deeper into the mental traps that might be holding you back, check out our article “The Hidden Mental Traps That Undermine Crypto Trader's Success.”

Read more: Metaplanet Acquires Bitcoin Magazine Japan

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.