Today on Crypto Twitter: CryptoQuant CEO on Bitcoin Price, Community Discusses Pump.fun, and More

Pump.fun’s hack, crypto market downtrend and Bitcoin price analysis are among the trending topics on Crypto Twitter today.

On this page

CryptoQuant CEO Ki Young Ju shared his perspective on when Bitcoin price will recover, Darky says Pump.fun is over while Arthur Hayes sees NVIDIA see Jensen Huang as someone who can save the situation.

Follow along to find out more about what’s going on.

1. Ki Young Ju Says Bitcoin Price Recovery Will Take Some Time

Ki Young Ju, the CEO and co-founder of CryptoQuant, has some thoughts on the recent Bitcoin price drop – and he’s not panicking. In fact, he’s telling people to keep their cool.

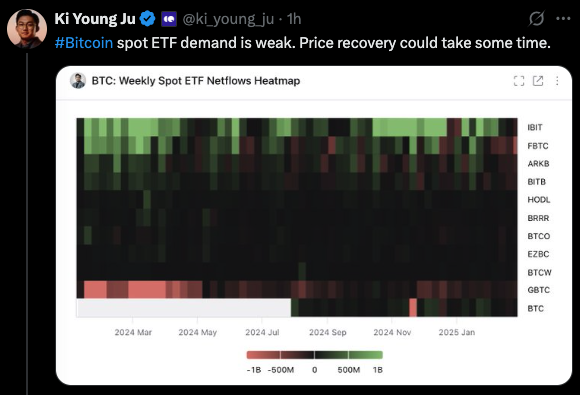

While the price has taken a hit, he believes Bitcoin isn’t likely to bounce back anytime soon. Why? Because the demand for Bitcoin spot ETFs is weak, and that’s a sign that institutional interest is slowing down.

If you're watching Bitcoin ETF funds like the iShares Bitcoin Trust (IBIT) or the Grayscale Bitcoin Trust ETF (GBTC), you’ll notice something important: they’ve been seeing outflows. Not exactly the signs of a bullish market.

Currently, Bitcoin is hovering around $86,000. But don’t let that scare you into selling, says Ki Young Ju.

In another post, he pointed out that a 30% correction is actually pretty common in crypto. Remember 2021? Bitcoin dropped by a massive 53%, only to bounce back and hit new all-time highs. So, don’t sweat the dip—it’s just part of the crypto game. He shared this piece of advice:

Buying when prices rise and selling when they fall is the worst investment strategy. Invest with a clear plan.

Earlier in February, Ki Young Ju predicted a 30% dip from Bitcoin’s all-time high, similar to what we've seen in previous cycles. But this doesn’t mean the end of the bull run, according to him. In fact, Ki Young Ju is still bullish on the future. As he puts it:

I don’t think we’ll enter a bear market this year.

We’re still in a bull cycle. The price would eventually go up but the range seems broad.

2. Darky Believes Pumpfun Era Is Over as Less Tokens Are Being Launched on the Platform

It’s undoubtedly a tough time for memecoins. Massive volatility, along with small- and large-scale scandals – such as the one related to LIBRA and Argentina’s president – has shaken investors' confidence.

Previously, Castle Island Ventures partner Nic Carter stated, “Memecoins are unquestionably over.” This could not have failed to impact Pump.fun, a popular memecoin launchpad on Solana.

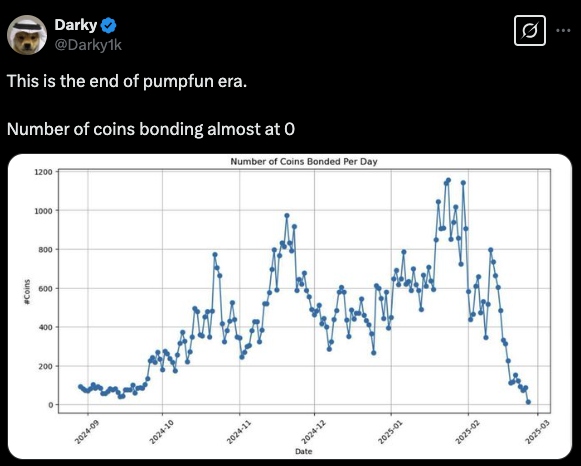

In his recent X post, Solana investor Darky (@Darky1k) shared a chart showing that the number of coins bonded per day is almost zero. This indicates that there’s little buying pressure on the platform, and only a few tokens are reaching predefined prices.

At the same time, crypto trader Ash Crypto shared other stats showing that the number of tokens launched on the platform fell from 24,008 to 11,532 over the span of a month, and the descending trend continues.

Both Darky and Ash Crypto view this as good news for altcoins. “Altseason is coming”, wrote Ash Crypto, in response to a comment from Darky, who predicted: “The money will start flowing into quality projects”.

3. Jensen Huang and NVIDIA Earnings Can Save Bitcoin According to Arthur Hayes

Arthur Hayes, who predicted Bitcoin would drop to $75,000 – $70,000, has now turned his attention to Nvidia. In a recent post, he said the Nvidia earnings report might be the key to driving Bitcoin’s price back up. “Only our AI godfather can save BTC now,” he quipped, referring to Jensen Huang.

However, despite all the hype, the Nvidia earnings report from February 26, 2025, hasn’t really moved the needle. It didn’t do much for the stock market or crypto, even though Nvidia’s 4th-quarter revenue surged by 78% compared to the same period in 2023.

AI is still a major market driver, and many were expecting Nvidia’s strong performance to give Bitcoin a nice little boost. Well, Nvidia’s stock did rise by 4.6% in the last day, but Bitcoin? Not so much. It’s still trading around $86,500, with no sign of a major rally just yet.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.