Today on Crypto Twitter: David Sacks on Memecoins, Armstrong’s SEC Update, and More

Today, the crypto market remains down, with Bitcoin falling below $80,000. Crypto Twitter (X) continues to analyze and post memes about the market, while also reacting to other major events in the industry.

On this page

A big part of today’s discussions revolves around regulatory updates, including the legal status of memecoins and the conclusion of the SEC (Securities and Exchange Commission) vs Coinbase case.

Follow along for our spotlight on 3 popular tweets of the day.

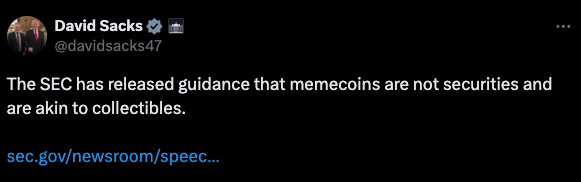

1. Good News for Memecoins: Crypto Czar Shared a Statement from the SEC

David Sacks, founder, investor, and Crypto & AI Czar since December 2024, posted something exciting for memecoin fans.

“Memecoins are not securities and are akin to collectibles” he cited a line from the SEC statement released on February 27, 2025.

In the release, the regulator defines a memecoin as a type of crypto asset inspired by internet memes, characters, current events, or trends. Since the SEC doesn’t consider memecoins to be securities, market participants do not need to register their transactions with the Commission.

However, the SEC warned that fraudulent memecoin activities may still be subject to enforcement action or prosecution by other federal or state agencies.

David Sacks' posts raised mixed reactions. While the memecoin community celebrated this news, critics pointed to the TRUMP memecoin and its decline after launch. “I guess the president is not a criminal then,” said Bitcoin investor Jonny Lee. Others, including Caitlyn Jenner, who previously launched the JENNER memecoin, thanked Sacks for the update.

Crypto founder Nick O’Neill (@chooserich) shared a video saying that this announcement could breathe new life into the market, predicting increased activity. The biggest risk, though, is that people will rush to launch their own memecoins.

2. Brian Armstrong Announces: SEC Dropped the Case Against Coinbase

Coinbase CEO Brian Armstrong receives congratulations from the community for the end of the legal battle against the SEC.

In a press release, Mark Uyeda, the acting Chair of the SEC, stated that it is time for the Commission to change its policy of enforcement actions and develop crypto regulations in a more transparent manner.

The legal battle between the SEC and Coinbase began in March 2023 when the SEC sent a Wells Notice to the exchange over listing crypto assets that may have been securities. Since then, under Brian Armstrong’s leadership, Coinbase has been fighting for regulatory clarity.

Armstrong, as the leader of Coinbase, showed his determination to keep the company in the U.S. market. In June 2024, the company filed lawsuits against the SEC and the FDIC (Federal Deposit Insurance Corporation) for not providing clear rules for the digital assets industry.

After years of legal trouble and a change in administration following Donald Trump’s presidential win, Armstrong finally announced the news the community had been waiting for.

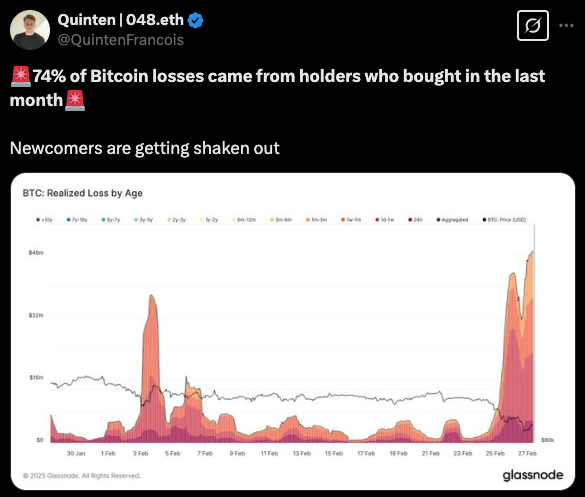

3. 74% of Bitcoin Losses Come from Newcomers: Says Quinten Francois

Author and CoinCompassHQ host Quinten Francois shared some interesting stats about the current Bitcoin selling pattern. According to data from Glassnode, a large majority of those selling their coins are newcomers who bought in January, when the bull run was gaining momentum.

Meanwhile, earlier investors are accumulating more.

The tendency to buy when prices are high is nothing new in crypto. For new investors, assets seem more attractive during periods of price surges – a paradox that is likely to repeat in every cycle.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.