Top Crypto Tweets of The Day: MOVE’s Market Issues, Circle’s Japan Approval

The MOVE token has sparked active discussions on crypto Twitter (X) after Binance warned users about unusual market maker activity and froze proceeds from it.

On this page

- 1. Movement Labs Co-Founder Rushi Manche Comments on Market Maker Issues and $38M Token Buyback

- 2. Circle Becomes the First and Only Stablecoin Approved in Japan, Says Jeremy Allaire

- 3. Alek Carter Posts About Mt. Gox’s Transfer of Over $1B in BTC

- 4. Crypto Investor Olimpio Discusses Airdrop Challenges for the Small Fish

- 5. Crypto.com Founder Blocks ZachXBT After He Calls CRO a Scam

Rushi Manche, co-founder of Movement Labs, shared insights into the situation in a recent post. Other trending topics include Circle’s USDC approval in Japanese markets, Mt. Gox’s fund transfer, ZachXBT’s criticism of Crypto.com, and an analysis of airdrops.

Follow along for our recap of the top 5 discussions on X through trending posts.

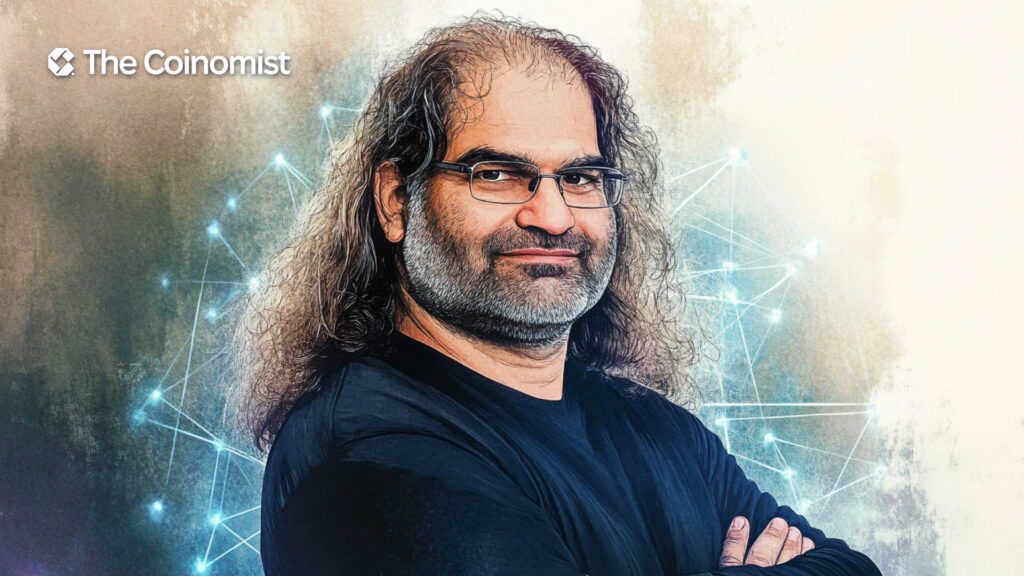

1. Movement Labs Co-Founder Rushi Manche Comments on Market Maker Issues and $38M Token Buyback

Movement Labs co-founder Rushi Manche clarified the situation surrounding the MOVE token’s suspicious activity and the Binance investigation.

On March 25, 2025, Binance reported unusual activity related to a market maker trading MOVE tokens. On the day MOVE was listed on the exchange, the market maker sold 66 million tokens for $38 million, with few buy orders.

Binance informed Movement Labs of the issue and froze the proceeds from the account. They also reminded that authorized market makers must place both buy and sell orders to maintain price stability.

In an X post, Manche explained that in the past few weeks, they worked with Binance to understand the problem and recover the funds.

Movement Labs managed to recover the $38M and established a strategic reserve for long-term use. “We've learned a lot of lessons but now have a suite of great partners supporting the movement ecosystem on and off-chain,” Ruche said.

Some users, however, remained skeptical, requiring more details from the project and the name of the market maker involved.

2. Circle Becomes the First and Only Stablecoin Approved in Japan, Says Jeremy Allaire

Circle's USDC stablecoin will be launched in the Japanese market. On March 4, SBI VC Trade, a Japanese crypto exchange and subsidiary of SBI Holdings, received approval from the Japan Financial Services Agency to offer USDC.

In an X post, Circle CEO and co-founder Jeremy Allaire announced that Circle becomes the first and only stablecoin to be approved in Japan. Initially, USDC will be launched by SBI VC Trade, with plans to expand to other exchanges later.

Allaire mentioned that the company worked with Japan’s regulators, industry players, banks, and others for over two years to prepare for the launch.

Currently, USDC is the second-largest stablecoin after Tether (USDT), with both pegged to the US dollar.

3. Alek Carter Posts About Mt. Gox’s Transfer of Over $1B in BTC

Alek Carter, a partner at CoinMarketCap and DWF Labs, posted about the recent asset movement by the defunct crypto exchange Mt. Gox. According to Carter, this transfer may be related to creditor repayments.

The transaction involved 11,501 BTC, valued at over $1 billion, and aligns with previous movements indicating ongoing repayment efforts.

Mt. Gox, a Tokyo-based crypto exchange, lost 750,000 Bitcoin from its customers, filed for bankruptcy, and shut down in 2014.

4. Crypto Investor Olimpio Discusses Airdrop Challenges for the Small Fish

@OlimpioCrypto highlighted the changing dynamics of crypto airdrops in a recent post. “It’s not like you can’t do one on-chain interaction for $10 and get a decent five-figure airdrop, but those are extremely rare now”, he says.

Olimpio views airdrops as an extra APY (Annual Percentage Yield) on top of what traders earn from farming points. He adds that protocols now prioritize liquidity over simple transactions, making it harder for small wallets to compete with whales who benefit from the point-based system.

To adapt to these changes, Olimpio suggests focusing more on yield farming strategies, sharing his experience with Sonic and Berachain.

5. Crypto.com Founder Blocks ZachXBT After He Calls CRO a Scam

Commenting on Crypto.com co-founder and CEO Kris Marszalek’s post about the Trump Media partnership, blockchain investigator ZachXBT called the platform’s native CRO token no different from a scam.

He pointed to the recent reissuance of 70% of the token’s total supply which was burned in 2021, against the community's wishes.

According to ZachXBT, Trump Media could have partnered with Coinbase, Kraken, or Gemini instead of Crypto.com.

Later, ZachXBT shared a screenshot showing that Marszalek had blocked him, adding, “The truth hurts”.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.