Weekly Analysis of BTC, ETH, and the Stock Market (Jan 27, 2025)

An overview of BTC, ETH, XAUT, and S&P500 charts, and the current cryptocurrency market dynamics.

Bitcoin (BTC)

After hitting a new all-time high of $109,406, Bitcoin was unable to maintain its peak. This morning, the price fell below $100,000, reaching a new local low of $97,750.

Bitcoin’s trajectory will depend on buyers' ability to hold the support zone between $97,400 and $99,400. If they manage to defend this level, BTC could recover and test the resistance at $101,800. From there, the cryptocurrency could continue to climb, testing the $105,000–$109,400 range before possibly breaking its all-time high.

If the price falls and consolidates below $97,400, Bitcoin could reach the next support zone for buyers, which is located between $92,400 and $94,400.

Ethereum (ETH)

Ethereum maintains a close correlation with Bitcoin, which means ETH’s price movement tends to follow BTC’s direction closely. This morning, Ethereum fell into the buyer’s zone between $2915 and $3100, where it has remained since.

Buyers need to act promptly to drive the price higher, targeting at least $3220 to reach the next resistance level. This could open the path to testing the resistance zone between $3570 and $3715, giving hope for a continuation of the upward trend.

If, however, ETH falls and settles below $3000, it could lead to a new local low and increase the risk of further downward movement.

S&P 500 (SPX)

Following a dip to a local low of $5773, the most prominent stock index has once again resumed its upward momentum. Last week, it reached a new record high at $6128, with the most probable scenario now being the continuation of the uptrend.

A global downtrend for the S&P 500 is only likely in the event of considerable negative fundamental news. In the meantime, any slight pullback should be viewed as a buying opportunity at a favorable price.

Tether Gold (XAUT)

Gold is showing consistent growth, in contrast to the volatility of cryptocurrencies. Since last week, the asset has gained 3%, breaking through the previous selling zone and successfully closing above it, setting the stage for further price gains.

The first major resistance for XAUT is at $2807, which could be tested this week. If buyers succeed in breaking this level, they will likely continue pushing the price upward, potentially hitting a new all-time high by February.

Any local corrections should be seen as a chance to accumulate the asset and enter long positions. If the price temporarily drops, support is expected around $2636 and within the $2510–$2560 support zone.

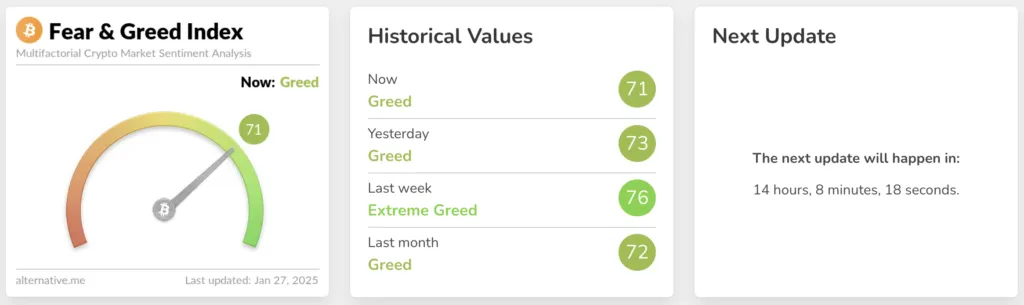

BTC Dominance, Altcoin Season Index, Fear and Greed Index

Bitcoin’s dominance index has been increasing steadily over the past month, now at 59.40%. The leading cryptocurrency continues to be the asset of choice for investors, who are shifting liquidity from altcoins and other cryptocurrencies into BTC.

At the time of writing, the altseason index sits at 47, indicating a neutral market without a clear altseason. For the last two months, altcoins have not been a priority for investors, and this trend is visible on their price charts.

At 71, the Fear and Greed Index indicates a trend of “greed.” Despite the constant fluctuations and global uncertainty regarding the future of cryptocurrencies, investors remain confident and are not backing down from their positions.

Economic Updates

This week, economic news will cover:

- New home sales in the US (Monday, January 27);

- Consumer confidence index (Tuesday, January 28);

- Crude oil inventories and the Fed’s interest rate decision (Wednesday, January 29);

- Q4 GDP and unemployment claims (Thursday, January 30);

- Core PCE inflation index (Friday, January 31).

The major event to watch this week is the Federal Reserve’s decision on interest rates, set for Wednesday. This decision will be crucial in shaping inflation levels in the US, which will, in turn, affect consumer purchasing power. With potential volatility in mind, it’s wise to limit active trading on Wednesday and close significant crypto positions if possible.

Check out The Coinomist for the latest cryptocurrency rates and chart analysis.

Disclaimer

Please note that the analysis provided above should not be considered a trading recommendation. Before opening any deals, we strongly advise conducting your own research and analysis.

Abbreviations

TF (Timeframe) — a chronological period equal to the time it takes to form one Japanese candle on the chart.

Horizontal channel (flat, sideways, range) — the price movement between support and resistance levels, without going beyond the given range.

К — simplified designation of one thousand dollars of the asset price (for example, 23.4K – $23,400).

Gray range on the chart — a support zone.

Red range on the chart — a resistance zone.

Correlation — the tendency of prices of different cryptocurrencies to move in sync, often influenced by the dominance of one of the assets.

Initial materials

This analysis was informed by the following educational materials and articles from The Coinomist:

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.