BlackRock Doubles Down on Bitcoin—Boosts Stake in Strategy to 5%

The world’s largest asset manager, BlackRock, has added 1.78 million more shares of Strategy, a company widely known for its Bitcoin reserves. This move brings BlackRock’s total stake to 5%, further cementing its involvement in the crypto space.

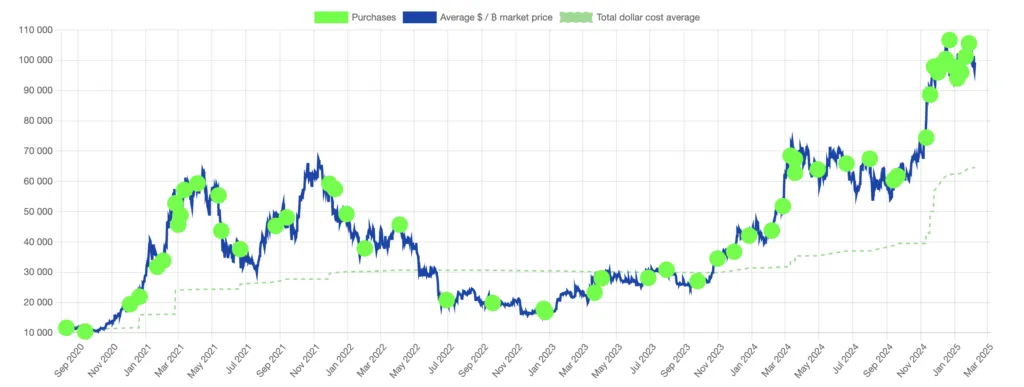

While the exact sum remains undisclosed, market estimates suggest BlackRock’s latest investment in Strategy totaled around $584 million. SEC filings confirm that the company now holds 11.26 million MSTR shares, valued at approximately $3.67 billion—further solidifying its confidence in the Bitcoin-centric firm.

Meanwhile, Strategy continues to make headlines with its unwavering commitment to Bitcoin. In a move to enhance brand visibility and attract new investors, the company has undergone a full rebrand, introducing a new name, updated logo, and a merchandise store.

Even a titan like BlackRock is adapting to the evolving financial landscape. Known for its meticulous yet innovative investment approach, the firm’s increased stake in Strategy signals growing institutional interest in the crypto sector. With traditional markets facing instability and digital assets expanding at an unprecedented pace, allocating capital to blockchain-heavy companies is becoming a compelling strategy.

This investment came into public view due to regulatory requirements—crossing the 5% ownership mark meant BlackRock had to officially disclose its holdings, revealing a calculated bet on the future of Bitcoin.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.