Bill Hagerty’s GENIUS Act Seeks to Clarify Stablecoin Rules

A new Crypto Regulations Bill by Senators Bill Hagerty, Kirsten Gillibrand, and Cynthia Lummis aims to set clear rules for payment stablecoins.

Called Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, the framework mentions the benefits of stablecoins, including faster, cheaper, and competitive transactions.

Hagerty released a public discussion draft for the bill in October 2024. The Senator mentioned that since then it has benefited from consultation with industry participants, academic experts, and government stakeholders.

Now, the aim is to advance the legislation to President Trump’s desk.

The 57-page bill defines stablecoins as digital assets used for payment of settlement pegged to a fixed monetary value. It also establishes clear procedures for institutions on how to issue stablecoins, implements reserve requirements, and states supervisory, examination, and enforcement regimes with clear limitations.

Hagerty mentioned that the previous Presidential Administration was hostile toward the crypto industry and has stifled stablecoin innovation.

“The legislation turns a new page”- he added.

The Status of Stablecoins in the US

Currently, stablecoins are regulated under a patchwork of state and federal financial laws, creating uncertainty for issuers, investors, and consumers. However, there is no single, comprehensive federal framework specifically governing stablecoin issuance and operation, leading to confusion and potential regulatory overlap.

On February 4, crypto and AI czar David Sacks said in a press conference that stablecoin legislation is a first priority on his agenda. He noted that stablecoins can potentially ensure U.S. dollar dominance in the world.

Sack announced a joint working group with Congress to promote legislation.

2025 seems to be a year for shifts for the stablecoins industry in the US.

With the GENIUS Act and similar legislative efforts, the U.S. is moving toward a structured framework that could provide long-awaited regulatory clarity. If successfully implemented, these regulations could boost institutional adoption, enhance consumer confidence, and solidify the U.S. dollar’s dominance in the digital economy.

However, the timeline for full regulatory implementation remains uncertain, and the crypto industry will be closely watching how lawmakers navigate this growing landscape in 2025 and beyond.

How Big Are Stablecoins?

Stablecoins have become a major force in the cryptocurrency market, playing a crucial role in digital finance, payments, and trading.

At the time of writing, the stablecoin market is valued at over $227 billion based on CoinMarketCap.

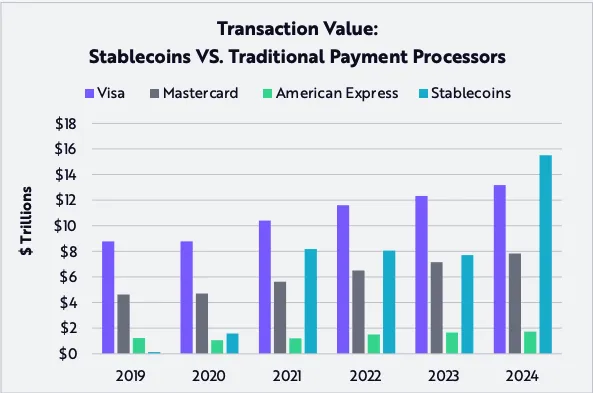

According to ARK Invest Research, in 2024, the transaction value of stablecoins hit $15.6 trillion – roughly 119% and 200% that of Visa and Mastercard, respectively.

Tether (USDT) and USDC lead the way, accounting for 90% of the total supply.

The popularity of stablecoins is due to their ability to provide instant liquidity, making them the preferred choice for traders and investors who want to move funds quickly between crypto and fiat.

In the DeFi (Decentralized Finance) ecosystem, stablecoins are essential. They power lending platforms, staking protocols, and yield-generating strategies. Stablecoins like DAI are widely used in lending protocols such as Aave and Compound, where users can earn interest on their digital assets.

Beyond crypto platforms, stablecoins are increasingly being adopted for cross-border payments, e-commerce, and other use cases.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.