Solana Futures ETFs Are Here—Volatility Shares Leads the Market

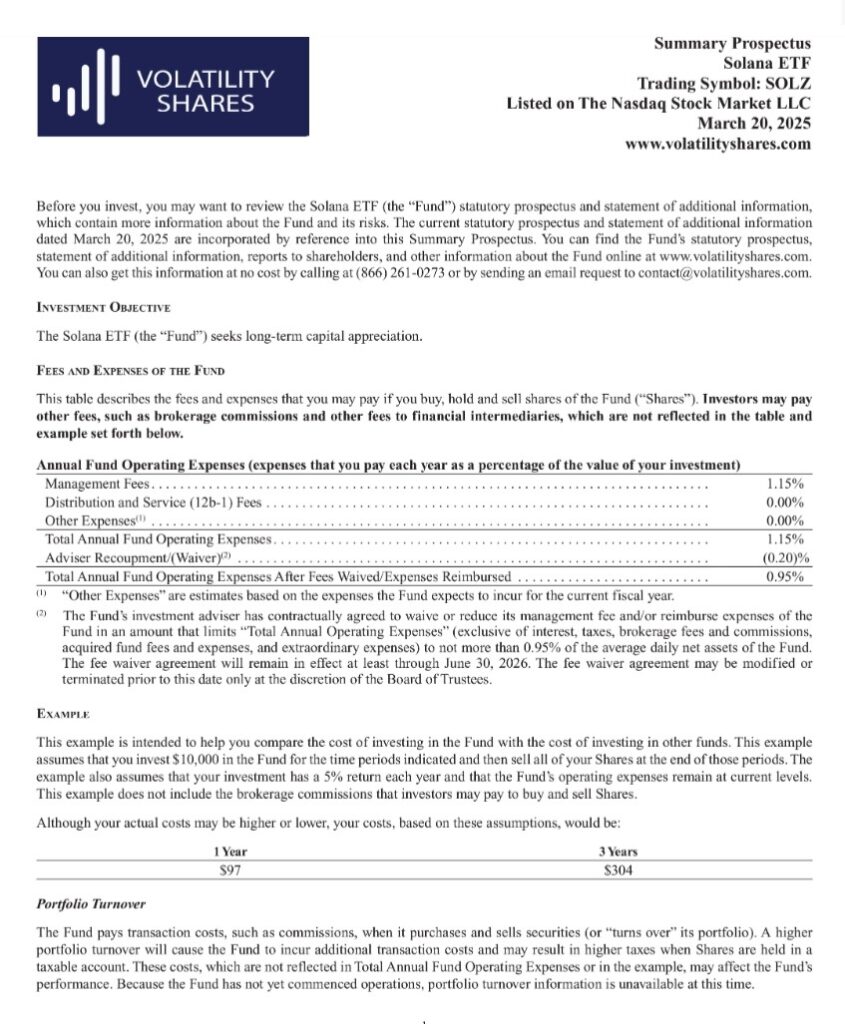

Volatility Shares has officially launched the first Solana futures ETF, offering investors a structured way to trade Solana’s price movements. The new ETFs, SOLZ and SOLT, provide exposure through futures contracts.

Institutional investors see the launch of Solana futures ETFs as a potential catalyst for the approval of spot ETFs that directly hold SOL. As momentum builds, industry heavyweights Franklin Templeton, 21Shares, and VanEck have already submitted applications for their own Solana spot ETFs.

Solana Futures ETFs: Key Details

Currently, Volatility Shares is preparing to roll out two new products. SOLZ will grant investors direct access to Solana futures contracts, while SOLT will provide double leverage for amplified trading strategies.

Check this out: Solana’s Controversial Ad Withdrawn Following Community Criticism?

Both funds have been officially registered with the Depository Trust & Clearing Corporation (DTCC), paving the way for market trading. The launch was set for March 20, with management fees established at 0.95% for SOLZ and 1.85% for SOLT.

How Solana’s ETF Launch Could Shape the Market

Industry analysts believe that the introduction of Solana ETFs could enhance the cryptocurrency’s standing, particularly through institutional liquidity support. Greater access for large-scale investors may lead to increased market stability for SOL.

Meanwhile, the potential green light for spot ETFs has sparked excitement, with projections indicating that such products could attract between $3 billion and $6 billion in assets within the first six months. Still, some experts warn of potential investment slowdowns, drawing parallels to the challenges faced by Ethereum’s spot ETFs.

Solana spot ETF is yet to be approved but given the increased awareness around Solana and the Futures ETFs this would be a logical next step,

remarked Anmol Singh, co-founder of Bullet.

With 92% of all payments powered by USDT, it’s clear that stablecoins have become the go-to financial tool. The average payment size stands at $8.36, while deposits average $85.

Read on: Solana at 5: A Celebration Overshadowed by SOL’s Price Drop

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.