HashKey & Bosera to Launch World’s First Tokenized Money Market ETFs

Bosera Asset Management and HashKey Capital announced the launch of the world’s first tokenized money market ETFs, allowing investors direct exposure to market instruments via tokens.

The Hong Kong Securities and Futures Commission (SFC) approved Money Market ETFs by asset manager Bosera Funds and HashKey Capital, a blockchain tech and digital asset financial services group.

The tokenized shares of Bosera Hong Kong Dollar (HKD) Money Market ETF and the Bosera US Dollar (USD) Money Market ETF will be officially launched in April.

In an announcement, HashKey Group said Bosera’s use of blockchain technology enables innovative investment products that balance traditional stability with digital assets’ flexibility.

The products are developed on HashKey Chain, a public blockchain network, with HashKey Group providing a tokenization solution and full-chain technical support. At the same time, HashKey Exchange will serve as the main distribution channel and custody services provider.

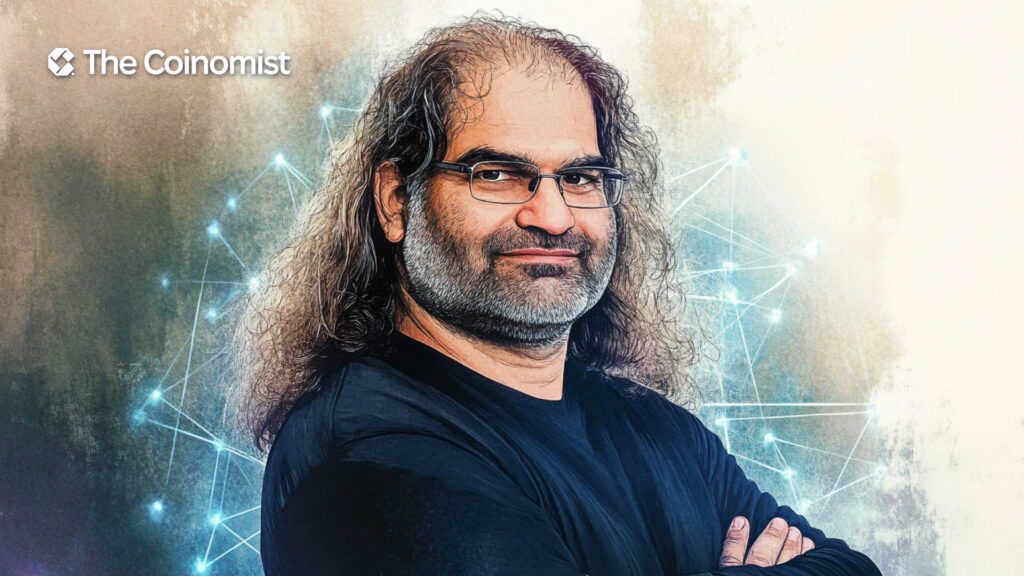

Dr. Xiao Feng, Chairman and CEO of HashKey Group, said:

Bringing money market ETFs on-chain through blockchain technology is a crucial step for traditional finance to embrace Web3.

Related: China May Relax Its Crypto Ban: HashKey Group CEO Says

Xiao Feng believes that more traditional financial institutions will enter crypto finance through tokenization products as regulatory trends favor compliance.

Hong Kong has adopted crypto-friendly policies. In October 2024, the government announced a simplified licensing process for crypto platforms and expanded tax breaks for crypto investors.

The launch of the world’s first tokenized money market ETFs is a major advancement in Hong Kong’s ambition to position itself as a global hub for regulated digital assets.

In April 2024, Bosera Asset Management launched spot Bitcoin and Ethereum ETFs. The company’s chairman and CEO, Ms. Lian Shaodong, said that Bosera pays close attention to the demands of on-chain and Generation Z investors while using strategies to promote financial inclusion and offer investment services through financial technology.

The Growth of Real-World Asset Tokenization in the World

RWA (Real-World Assets) tokenization converts traditional assets like real estate, commodities, and bonds into blockchain-based tokens. This process enhances liquidity, accessibility, and efficiency in asset trading, making it easier for investors to buy, sell, and transfer ownership digitally.

For example, tokenized money market ETFs allow investors to hold blockchain-based tokens instead of traditional shares in a brokerage account. These tokens can be traded, transferred, or used within decentralized finance (DeFi) platforms. Unlike conventional ETFs, which trade only during market hours, tokenized versions can be bought or sold 24/7 thanks to blockchain’s continuous accessibility.

Another key advantage of RWAs is transparent and secure transactions—all records are stored on the blockchain, providing enhanced security and visibility.

The trend is expanding rapidly, with the total value locked (TVL) in RWA tokenization reaching $10 billion, doubling from $5 billion in December 2023, according to DefiLlama.

Related: HashKey Enters the EU Market with Irish VASP License

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.