Polymarket Predictions Hit 90% Accuracy — 9 Out of 10 Bets Are Correct

User predictions on Polymarket hit over 90% accuracy.

On this page

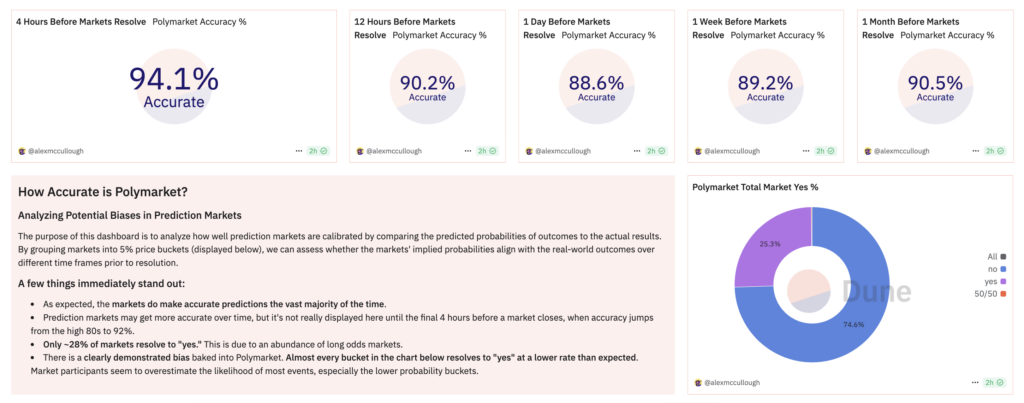

This evaluation comes from analyst Alex McCullough, who built a dedicated dashboard on Dune to track Polymarket statistics. A blockchain data expert since 2016, McCullough recently turned his attention to studying the performance of prediction markets, where users place bets on the outcomes of real-world events.

Overall, the results are impressive: Polymarket predictions show around 90% accuracy one month before an event, rising to nearly 94% within four hours of the outcome. According to McCullough, this can be attributed to the nature of long-term markets, where a few highly unlikely outcomes can distort overall accuracy.

McCullough uses a simple method to measure accuracy: a prediction is considered correct if:

- the probability is above 50% and the event does occur (“Yes”), or

- the probability is below 50% and the event doesn’t occur (“No”).

To ensure cleaner data, he excluded markets with extreme probabilities (above 90% or below 10%), since those are often impacted by delays in result finalization.

Related: UMA, Polymarket, and EigenLayer Launch a Next-Gen Prediction Market Oracle

Additionally, he pointed out that Polymarket often slightly overstates the probabilities of certain events. According to him, this may stem from a mix of herd behavior, limited liquidity, and users’ inclination to take on higher risks in hopes of greater rewards.

Sports and Political Forecasts

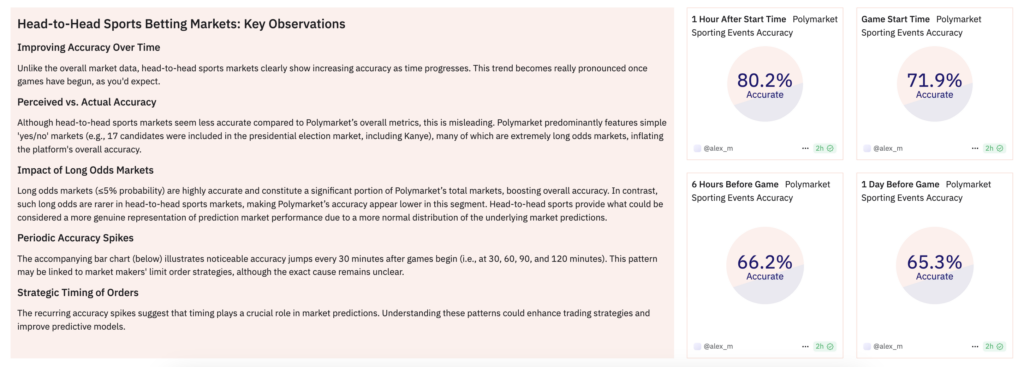

A closer look at sports prediction markets reveals a sharp increase in betting volume (nearly $4.5 billion). Accuracy in this category tends to increase as the event draws closer or begins (around 80%). This pattern highlights the collective intelligence of users and their ability to adapt quickly in real time to evolving conditions.

A more even distribution of probabilities in sports markets helps maintain a high level of objectivity and accuracy. Moreover, the analytics dashboard shows that as historical data accumulates, forecasts may become even more precise. Since Polymarket is primarily focused on sports and political events, a similar pattern of improving accuracy is also observed in political prediction markets—just on a larger scale.

It would make sense that it’s getting more accurate over time, like with the efficient market hypothesis. But my current dashboard doesn’t look at this. I would love to have a lot more data, but the tables I used didn't have price data that granular,

said Alex McCullough in response to a question about whether accuracy increases based on timing or event type.

Collective intelligence powered by financial incentives is pushing prediction markets into new territory. These innovative tools are drawing greater interest in alternative analytics, and the consistently high forecast accuracy is helping to strengthen trust in decentralized prediction platforms.

Related: Polymarket Grows as Users Move Beyond Election Bets

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.