Polymarket Integrates Solana Deposits Amid Solana’s Rise in Web3

Polymarket has integrated the Solana network, enabling users to place bets using SOL. The update comes as crypto betting sees a resurgence in the U.S.

On this page

On March 24, 2025, crypto betting platform Polymarket announced the integration of the Solana blockchain. The move reflects the project’s effort to stay in step with Web3 trends, where Solana remains one of the most widely used blockchains.

As a result, users can now deposit funds using SOL, a top-6 cryptocurrency by market capitalization.

Notably, this is Polymarket’s first step beyond the Polygon network and could act as a potential growth driver for SOL, especially amid rising interest in crypto betting and a more relaxed tone from U.S. regulators.

Solana as the Next Step in Polymarket’s Evolution

Until March 25, Polymarket operated exclusively on Polygon and only accepted USDC deposits. The addition of Solana marks the platform’s first integration with a different blockchain ecosystem and a strategic move to attract new users by offering faster transactions and lower fees through Solana.

Related: Polymarket Betting Platform’s TVL Reaches $137 Million

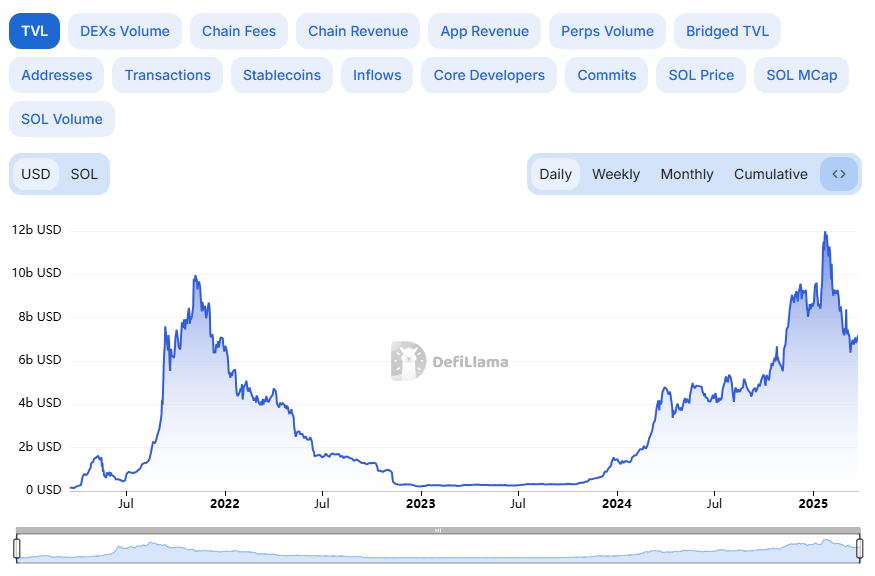

Currently, Solana ranks second in total value locked (TVL), with $7.1 billion.

For comparison, Ethereum has a TVL of $53.4 billion.

Moreover, Polymarket’s new integration gives traders more flexibility by allowing them to place bets directly in SOL, without the need to convert funds into stablecoins. Given Solana’s position as the sixth-largest cryptocurrency by market capitalization and its strong user base, this move appears both strategic and timely.

The full launch of SOL deposits is expected to drive higher engagement on the platform, which peaked at 450,000 active monthly traders in January.

Polymarket: Balancing Growth and Regulatory Pressure

While expanding, Polymarket remains under regulatory scrutiny.

For example, in 2022, the platform reached a settlement with the U.S. Commodity Futures Trading Commission (CFTC) and agreed to cease operations for U.S. users. The decision followed allegations that Polymarket was offering unregistered binary options trading.

However, the situation escalated further in November 2024, when the FBI searched the New York apartment of Polymarket CEO Shayne Coplan and seized his phone. The raid was reportedly part of an ongoing investigation into whether U.S. citizens were still accessing the platform despite the official restrictions.

Nonetheless, Polymarket’s position within the crypto community is growing stronger. On March 8, Coplan took part in the White House Digital Asset Roundtable, a meeting with President Donald Trump and other key figures in the industry.

Coplan remarked that the current administration is showing a genuine willingness to engage with crypto companies, calling it “a second wind for the American Dream.”

Despite past restrictions, regulatory attention has begun to shift toward a more constructive tone, opening the door for Polymarket to expand further.

Crypto Betting on the Rise: How Polymarket Is Tapping Into User Curiosity

Polymarket is betting big on the rapid growth of crypto prediction markets, a sector that sits at the crossroads of decentralized finance and prediction markets.

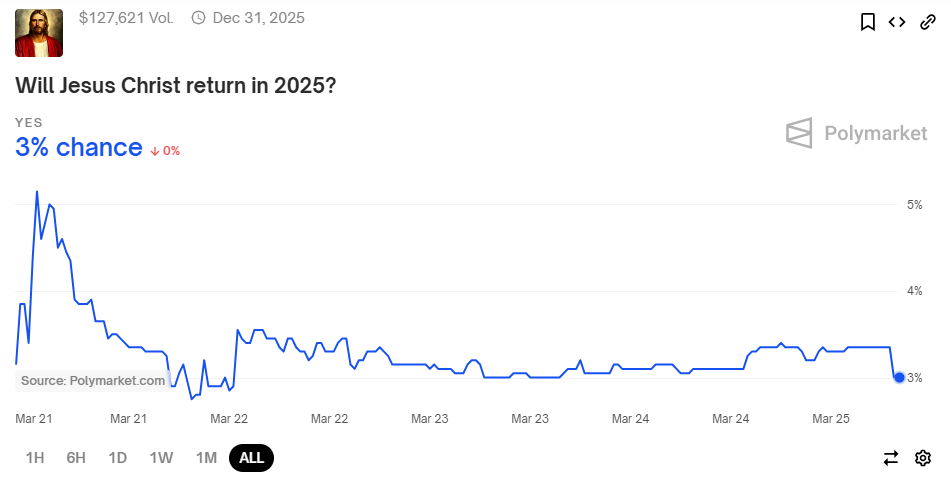

The platform enables users to place bets on political events, cryptocurrency prices, and even offbeat questions (for example, “Will Jesus Christ return in 2025?” which, according to Polymarket, currently carries a 3% probability.).

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.