US SEC Rules Out Securities Status for Proof-of-Work Mining

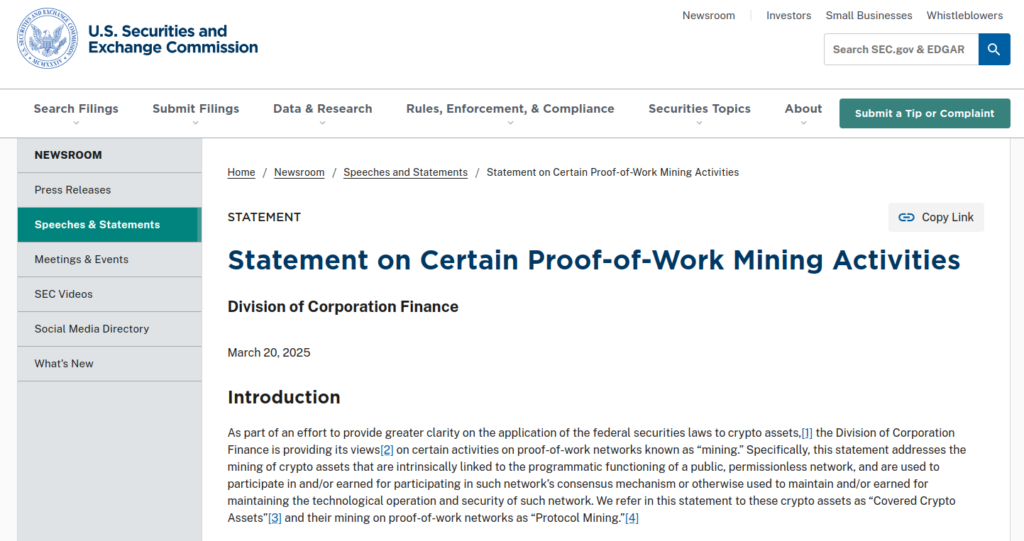

According to an official clarification, the SEC has ruled that Proof-of-Work mining processes are exempt from securities oversight.

In a statement issued on March 20, 2025, the U.S. SEC drew a clear line between investment and labor: Proof-of-Work miners, whether soloЯ or part of a pool, are not investors but contributors.

Their rewards, the SEC emphasized, are earned for providing the raw computational energy that keeps networks secure — not for relying on others’ efforts to generate profit.

SEC Statement on PoW Mining Activities

Mining activities within public and permissioned blockchain ecosystems are no longer treated as securities operations, the SEC confirmed.

The agency noted that PoW-based transaction validation is rooted in the application of independent computing power, distinguishing it from investment contracts.

Сheck this out: Bitcoin Cloud Mining: What It Is and How It Works, and Its Risks

To determine whether crypto mining falls under securities law, the SEC turned to the Howey Test — a legal standard that evaluates if there's an investment in a joint enterprise with profits tied to others’ efforts.

Solo miners, who rely on their own equipment and resources, don’t meet this threshold. The same logic applies to mining pools: each member adds computing power to help validate transactions, earning rewards not from speculation, but for active contribution to network stability.

More Insights: Solo Bitcoin Miner Defies the Odds, Banks $263K with Cheap Rig

Regulatory Clarity Sparks Industry Optimism

The SEC’s statement has resonated strongly with key players in the digital asset space. Cody Carbone, president of the Digital Chamber, hailed the move as a breakthrough: “This gives much-needed legal certainty and clears the path for the mining industry to grow in the U.S.”

With PoW mining no longer under the securities umbrella, the community can focus on building, not battling bureaucracy. The lack of new reporting rules from the SEC signals a green light for deeper market adoption and expansion.

With Mark Uyeda now at the helm, the SEC has taken a notable turn toward crypto-positive policy. Leading the charge is Hester Peirce — affectionately known as “Crypto Mom” — whose influence is steering regulatory strategy toward fostering innovation rather than stifling it.

For miners, this shift provides a clearer legal path forward, freeing them to concentrate on maintaining blockchain networks without the looming threat of securities-related enforcement.

Read on: SEC Retreat Marks Pivotal Legal Win for Crypto Firms

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.