Solana Proposal SIMD-228 Gains Support: What Does It Mean for SOL’s Future?

Solana’s latest governance proposal, SIMD-228 (Solana Improvement Document), is set to bring massive changes to the ecosystem by introducing a new way of controlling token emissions.

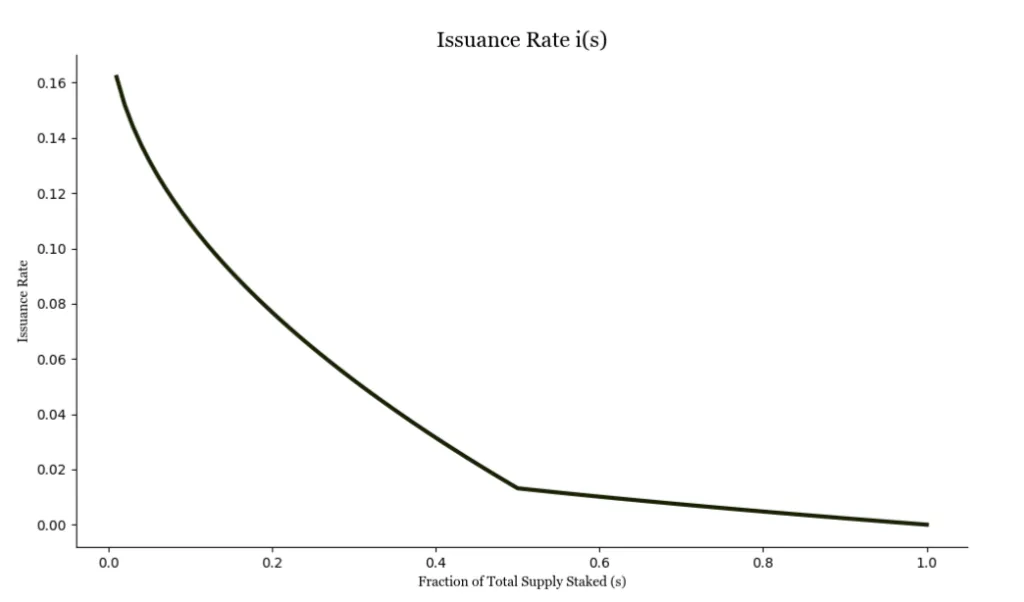

Solana Proposal SIMD-228 aims to reduce SOL’s inflation rate to below 1% while making staking more responsive to market conditions. Lower inflation means fewer new tokens flooding the market, which could reduce selling pressure and help SOL maintain or increase its value.

The proposal, authored by Tushar Jain and Vishal Kankani of Multicoin Capital, along with economist Max Resnick, is set to conclude by March 14, 2025, and has garnered over 70% approval.

At the same time, Solana Proposal SIMD-228 encourages more people to stake their SOL to help secure the network. As the network grows, it’s becoming clear that validators (the people running Solana’s infrastructure) already make good profits from transaction fees and additional rewards. This new system ensures they still get paid but without excess inflation.

Concerns Over the SIMD-228

Authors mention that as Solana's economic activity has grown, validators and stakers have begun earning additional income streams, such as Miner Extractable Value (MEV). In Q4 2024, MEV amounted to approximately $430 million (2.1 million SOL), indicating a significant increase in network activity and validator earnings.

With the network generating significant economic activity and stakers earning additional revenue from MEV, the proposal suggests that now is a great time to rethink the emission model. Shifting from a fixed-schedule system to a dynamic, market-driven approach would better align with the network’s growth and staking incentives.

Currently, the issuance rate is 4.5%, and with 65% of SOL staked, validators earn about 6.25% in rewards (excluding MEV). Under the new proposal, staking would likely stay above 40% since a 6.25% return has already attracted 65% participation. If demand remains steady, the new system should keep staking levels above this threshold.

The biggest concern with this proposal is that it might lead to a lower-than-expected amount of SOL being staked. However, given current market conditions, staking participation is still expected to remain above 40%.

Related: What Is Staking in Crypto?

How Can SIMD-228 Affect SOL Holders?

For SOL holders, this proposal could be a big positive. Lower inflation means less selling pressure, which could help support SOL’s price. It also encourages more staking, strengthening network security and decentralization.

A reduced inflation rate could benefit long-term investors by preserving SOL's value. However, the dynamic nature of staking rewards and its potential impact on validators should be carefully considered.

As the Solana community debates SIMD-228, stakeholders are encouraged to stay informed and engage in discussions to ensure the proposal supports the network’s long-term success.

Related: Solana vs. Ethereum in DeFi: Franklin Templeton Breaks Down the Competition

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.