Strategy Targets $500M Fundraising with STRF for Bitcoin Expansion

Strategy looks to secure $500M by issuing perpetual preferred shares (STRF), aiming to boost its BTC holdings despite the ongoing volatility.

On this page

Strategy is doubling down on Bitcoin, aiming to raise $500M through a fresh issuance of Series A Perpetual Strife (STRF) preferred shares. Part of the capital will also support the company’s operational needs.

A heavyweight in the crypto investment space, Strategy continues to accumulate Bitcoin, brushing off market volatility. This aggressive expansion aligns with its mission to make BTC a cornerstone of its corporate financial strategy.

STRF Financing Explained

Strategy is launching a new financing instrument: Series A Perpetual Strife Preferred Stock (STRF). The company plans to issue 5 million of these perpetual shares, priced initially at $100 per share, with an impressive 10% annual dividend.

Quarterly dividends will be paid on June 30, September 30, December 31, and March 31. If any payments are missed, the unpaid amounts will accumulate, attracting extra interest. Compounded dividends start at an annual rate of 11%, increasing by 1% every quarter until reaching 18%.

The STRF financial instrument differs from Strategy’s previous offering, Strike, in key aspects. The main difference lies in the dividend structure—STRF pays dividends only in cash, whereas Strike offered a more flexible approach. Additionally, STRF comes with a higher dividend rate of 10%, compared to Strike’s 8%.

While this higher rate makes STRF more attractive to institutional investors, it also increases the overall cost of capital for the company.

Related: MicroStrategy Unveils New Brand Identity as Bitcoin Strategy Expands

How STRF Fits into Strategy’s Bold Vision?

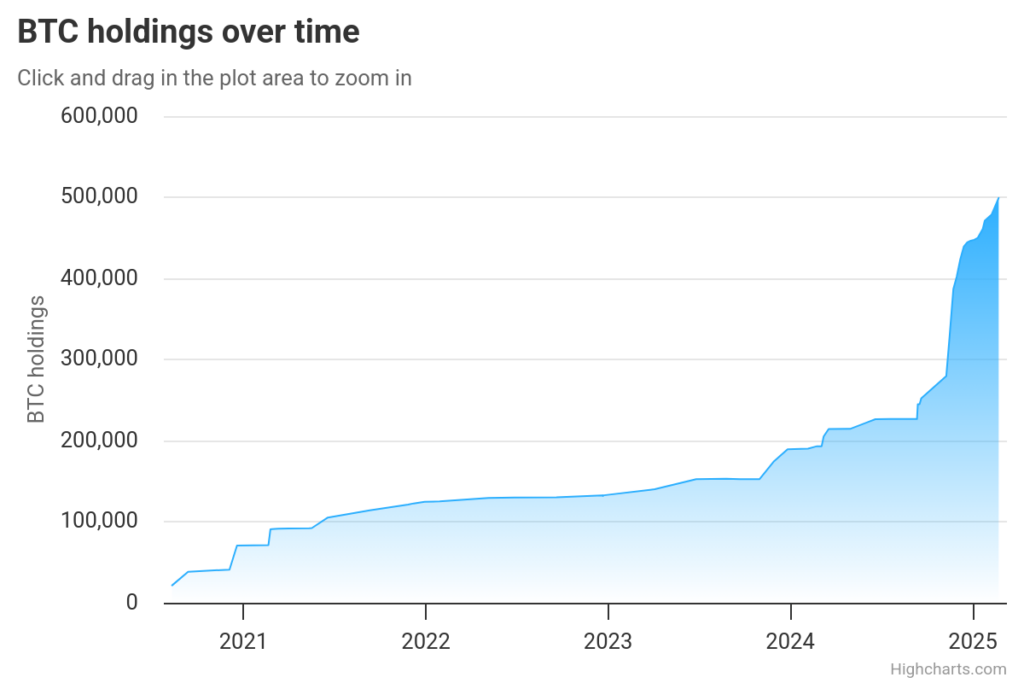

For Strategy, capital raising is a key tool for expanding its Bitcoin reserves. The company has been consistently issuing shares and bonds to fund its BTC investments for several years.

One day prior to the STRF issuance announcement, Strategy purchased 130 BTC worth $10.7 million, pushing its total Bitcoin assets to 499,226 BTC (approximately $41.4 billion in value).

This acquisition is part of the broader 21/21 Plan, launched by Strategy in October 2024. The plan’s goal is to raise $42 billion, with $21 billion coming through the issuance of equity and another $21 billion through debt instruments.

Despite ongoing market volatility and changes in macroeconomic conditions, Strategy continues to pursue its Bitcoin accumulation strategy. The company views Bitcoin as the leading long-term asset, with the current price decline seen as a temporary fluctuation.

Check this out: MicroStrategy’s Next Move: Bitcoin Bank?

STRF Launch: Market Response and MicroStrategy’s Bullish Bitcoin Outlook

The news of STRF’s launch triggered a mixed market response. On the announcement day, Strategy stock (MSTR) dropped by 6.5%, falling to $275. While the stock has decreased by 5.5% this year, it has doubled in value over the last six months.

Despite recent market volatility, analysts point out that Strategy remains committed to expanding its Bitcoin reserves. The recent price drop in BTC is linked to shifting expectations for Fed interest rates, trade tariffs, and broader macroeconomic uncertainty. Nonetheless, many experts believe Bitcoin’s long-term prospects remain strong and bullish.

During his address at Future Proof Citywide in Miami, Michael Saylor, co-founder and executive chairman of Strategy, described the current market phase as a “macro, risk-off zone.” He is confident that when the market shifts, Bitcoin will grow “with double the strength.” For Saylor, raising capital through STRF is another step toward firmly positioning Bitcoin as the core corporate asset in Strategy’s long-term vision.

Read on: Michael Saylor: Bitcoin’s Future Price Tag? $10 Million

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.