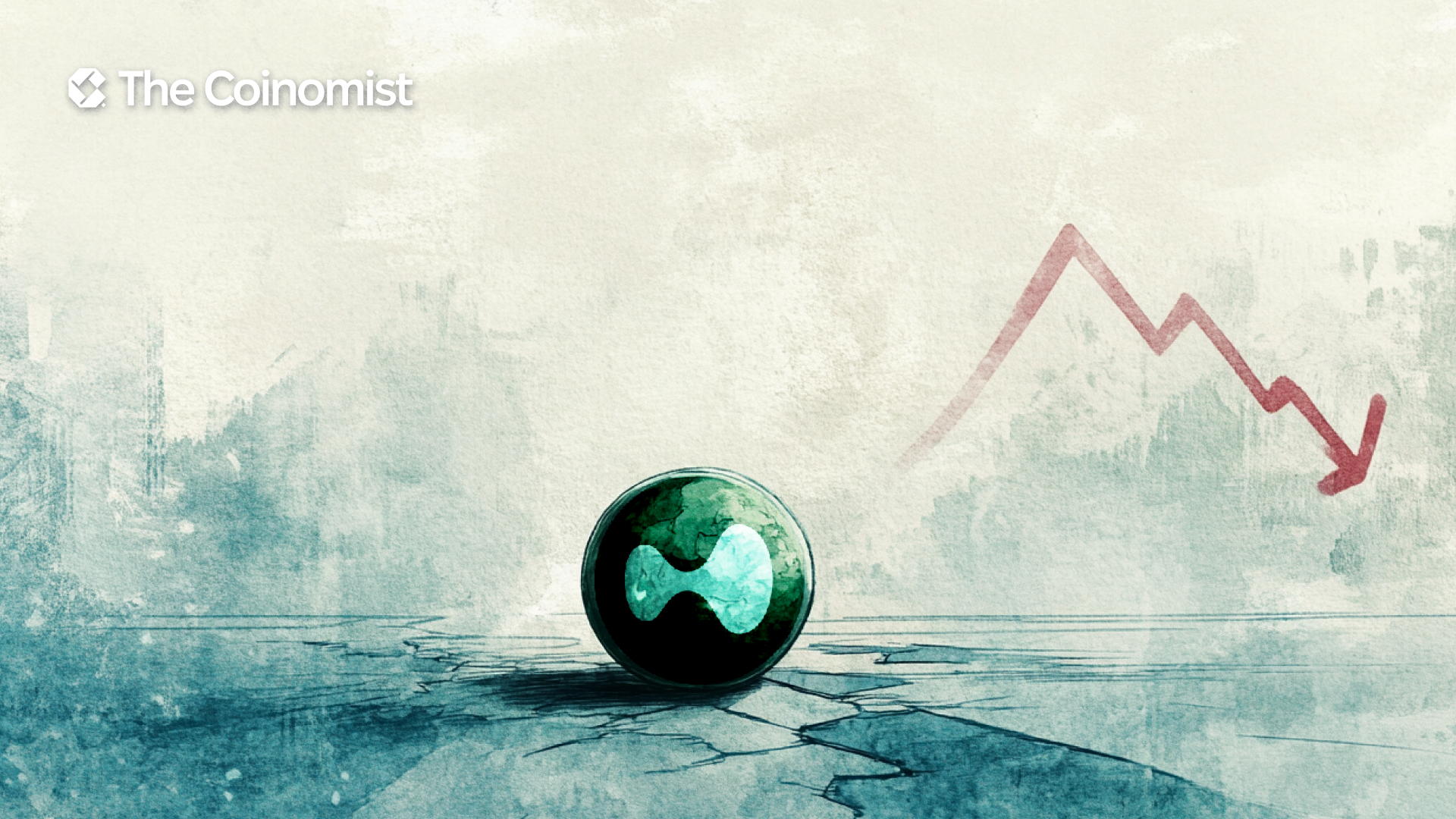

HYPE Token Drops 18% — What Happened to Hyperliquid and JELLY?

Derivatives DEX Hyperliquid is under fire following suspicious market activity involving the JELLY (JELLYJELLY) token.

On this page

The incident led to millions of dollars in lost liquidity on the platform, directly impacting the price of its native token, HYPE (listed on Bitget and Kucoin).

Consequently, HYPE fell from $16 to $13.50 (an 18% drop within an hour), before slightly recovering. At the time of writing, the token is trading just above $14.

Timeline of Events

According to industry experts, the situation unfolded through a series of coordinated market actions. Initially, a trader opened a short position on JELLY via Hyperliquid, then launched a large-scale sell-off of JELLY tokens on decentralized exchanges, triggering a sharp drop in the token’s price.

As a result, Hyperliquid’s liquidity pool suffered significant losses, and the platform’s automated liquidation system (HLP) failed to react quickly enough to offset the losses.

Meanwhile, competing exchanges (Binance and OKX) quickly launched futures contracts for JELLYJELLY, contributing to a sudden spike in the token’s price.

Subsequently, the platform decided to delist JELLY after detecting signs of market manipulation, which prompted a temporary suspension of trading and a freeze on the affected contract.

After evidence of suspicious market activity, the validator set convened and voted to delist JELLY perps. All users apart from flagged addresses will be made whole from the Hyper Foundation,

Hyperliquid stated on X.

Related: HYPE Drops 8.5% as Whale Liquidation Triggers Market Shock

Market Reaction and Expert Opinions

The crypto community was split in its response to the incident.

Some exchange representatives suggested that such manipulative tactics could be strategically used to undermine competitors. For example, Bitget CEO Gracy Chen commented:

The way it handled the $JELLY incident was immature, unethical, and unprofessional, triggering user losses and casting serious doubts over its integrity. Despite presenting itself as an innovative decentralized exchange with a bold vision, Hyperliquid operates more like an offshore CEX with no KYC/AML, enabling illicit flows and bad actors.

Next Steps and Broader Implications

In response, Hyperliquid announced plans to implement technical upgrades to prevent similar situations in the future. Furthermore, the Hyper Foundation pledged to automatically compensate most affected users based on on-chain data in the coming days.

Although the event sparked intense debate within the crypto community, it also highlighted the urgent need for stronger risk management systems on derivatives trading platforms.

Related: Hyperliquid’s HyperEVM Goes Live on Mainnet

JELLY was launched in January as part of the JellyJelly project, founded by Venmo co-founder Iqram Magdon-Ismail and early investor Sam Lessin. JELLY initially reached a market cap of around $250 million but has since suffered a significant decline.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.