Fidelity: Crypto in 2025 and the Global Adoption of Bitcoin

The year 2025 could mark a pivotal moment for Bitcoin, with growing integration into traditional finance, state-level adoption, the introduction of structured financial products, and the rapid expansion of the DeFi sector.

On this page

Matt Hogan, Research Analyst at Fidelity Digital Assets, shares his outlook in the 2025 Look Ahead report, highlighting key trends that could elevate Bitcoin adoption to unprecedented heights.

Bitcoin as a Strategic Asset for Nations

The approval of spot Bitcoin Exchange-Traded Products (ETPs) in early 2024 marked a significant milestone for institutional and retail investors, offering easier access to cryptocurrencies. These products have already attracted substantial investments from pension funds and university endowments, reflecting a growing perception of Bitcoin as a dependable long-term asset.

An even more transformative development could emerge in 2025 if governments and central banks begin to view Bitcoin as a strategic reserve asset. Matt Hogan predicts that governments may shift from seeing Bitcoin merely as an asset confiscated from criminal activities to recognizing its value as a hedge against economic uncertainty.

Not making any bitcoin allocation could become more of a risk to nations than making one,

Hogan emphasizes, citing global challenges like inflation, currency devaluation, and ballooning budget deficits.

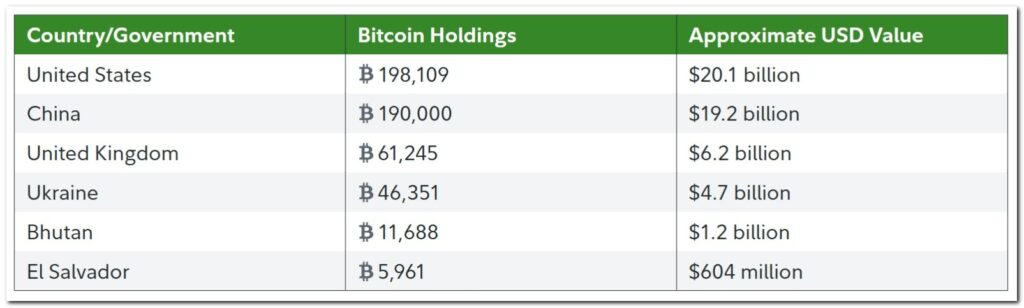

Currently, the largest state holders of Bitcoin include the United States, China, the United Kingdom, Ukraine, Bhutan, and El Salvador (Figure 1).

Source: Fidelity Digital Assets

Countries like Bhutan and El Salvador, which have already realized substantial profits from their Bitcoin holdings, may inspire other nations to adopt similar strategies.

However, Matt Hogan speculates that such actions are likely to be conducted discreetly to avoid significant price volatility in Bitcoin. As a result, the actual number of governments holding Bitcoin could be higher than publicly acknowledged.

No nation has an incentive to announce these plans, as doing so could influence more buyers and drive up the price,

Hogan notes.

The Role of U.S. Policy in Accelerating Bitcoin Adoption

U.S. political initiatives could play a key role in driving Bitcoin adoption on a global scale. President Donald Trump, along with prominent figures like Senator Cynthia Lummis, has openly endorsed the concept of establishing a strategic Bitcoin reserve.

If the Bitcoin Act, proposed by Lummis in 2024, is passed, it could set off a “domino effect” among other nations.

The political and financial game theory at play will force other nations to follow suit,

says Matt Hogan, emphasizing the competitive pressure such a move would create on the global stage.

However, Hogan warns that political promises don’t always translate into actionable policies.

While the digital assets market may have strong beliefs that these promises will turn into policy, elected officials may also prioritize other legislation,

he cautions.

Spot Bitcoin ETPs Revolutionizing Institutional Investments

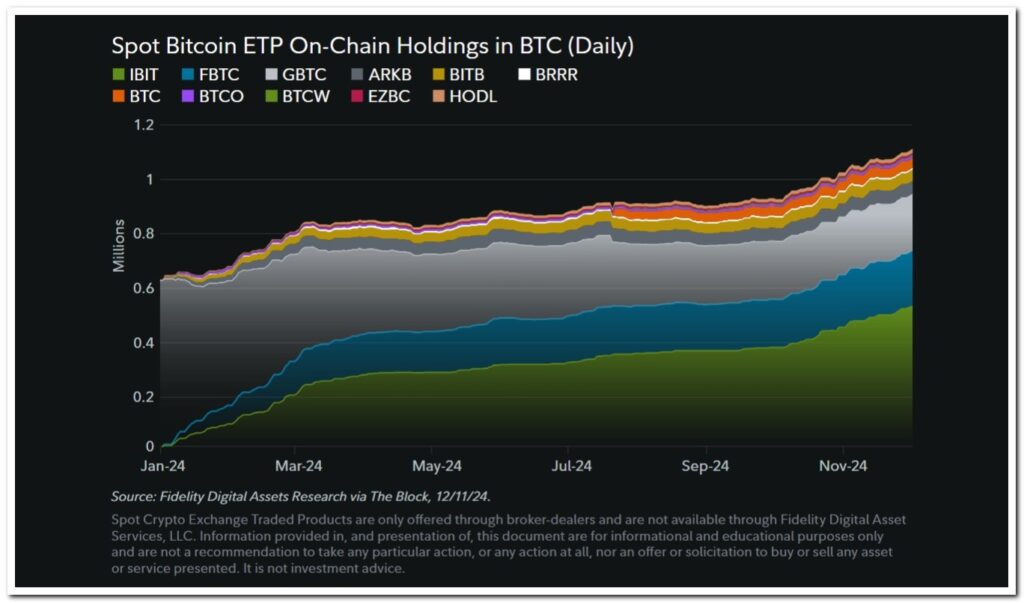

The success of spot Bitcoin Exchange-Traded Products (ETPs) in 2024 has emerged as a significant driver of Bitcoin adoption. By the end of the year, these funds amassed a combined assets under management (AUM) of $114 billion, marking a groundbreaking milestone for the industry.

It is difficult to overstate the success of these products,

said Matt Hogan.

In just ten months, spot Bitcoin ETPs achieved 80% of the asset growth that gold ETFs took two decades to reach (Figure 2).

Source: Fidelity Digital Assets

Hogan credits this rapid growth to the substantial pent-up demand for institutional access to Bitcoin. Over 1,000 organizations, including hedge funds and pension funds, are already participating in these funds.

There is also increasing interest in Bitcoin ETP options, which allow investors to manage risk and execute more sophisticated market strategies.

These products represent a shift from speculative tools to structured, institutional-grade solutions,

Hogan explained, underscoring their pivotal role in integrating traditional finance with digital assets.

DeFi Lending and Bitcoin as Collateral

The DeFi lending market has seen remarkable growth, with total value locked (TVL) rising from $22 billion in 2023 to $55 billion by the end of 2024.

Matt Hogan predicts Bitcoin will play an increasingly pivotal role in this sector, owing to its reputation as a secure and finite asset.

Bitcoin itself finds its way into similar lending markets as pristine collateral and a highly coveted and scarce monetary good,

Hogan explained.

He expects the share of TVL in DeFi lending to continue its upward trajectory, potentially reaching new all-time highs in 2025.

Traditional financial institutions are also making strides into Bitcoin-backed lending. In 2024, Cantor Fitzgerald launched a Bitcoin-based financing business with an initial capital of $2 billion. This initiative could serve as a “bridge” between traditional finance and digital assets, enabling corporations to earn returns on their Bitcoin holdings.

This offering very well may accelerate the adoption of bitcoin ownership by large companies through addressing an unmet need in the market,

Hogan said, pointing to the current lack of options for companies seeking to leverage their Bitcoin reserves.

The Convergence of TradFi and Digital Assets

As Bitcoin adoption accelerates among institutional investors, retail users, and governments, 2025 could become a pivotal year for the digital asset industry.

Spot Bitcoin ETPs, DeFi lending platforms, and rising interest from governments are transforming Bitcoin from a speculative investment into a cornerstone of the modern financial system.

The perception of digital assets has developed from that of a fringe community to one warranting attention from politicians for its transformative potential to disrupt the traditional financial system,

says Matt.

The integration of traditional finance and digital assets is gaining momentum, with Bitcoin at the center of this transformation. It is poised to play a defining role in reshaping the global economy and the future of finance.

Profile: Fidelity Digital Assets

Name: Fidelity Digital Assets

Parent Company: Fidelity Investments

Founded: 2018

Headquarters: Boston, Massachusetts, USA

About

Fidelity Digital Assets, a subsidiary of Fidelity Investments, was established to provide institutional-grade solutions for digital asset management. Fidelity Investments manages $12.6 trillion in assets, making it one of the world’s leading financial institutions (the 2023 report).

Services

- Asset custody

- Trade execution

- Collateral agent services

Global Presence

Fidelity Digital Assets has expanded its footprint into Europe with two offices:

- Fidelity Digital Assets, Ltd., regulated by the UK’s Financial Conduct Authority (FCA)

- Fidelity Digital Assets Ireland, regulated by the Central Bank of Ireland

Competitive Landscape

The digital asset custody market is becoming increasingly competitive, with major financial institutions entering the space. Key players include BNY Mellon, Deutsche Bank, and Standard Chartered. Additionally, European asset managers like Abrdn and Schroders have invested heavily in digital asset companies, further heightening competition in the sector.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.