Markets Are Shaken: Crypto Sinks, Canadian Dollar Falls, and DAX Struggles

Markets are off to a rough start this week. Bitcoin and Ethereum are tumbling, the Canadian dollar has hit a 22-year low, and Germany’s stock market is seeing sharp losses. New U.S. tariffs on Mexico and Canada have triggered a wave of uncertainty, pushing investors to safer assets. Will this downturn continue, or is it just another market shakeup?

On this page

Markets have opened the week on a rough note. Cryptocurrencies are tumbling, the Canadian dollar is at its lowest in more than two decades, and Germany’s DAX is seeing losses. Investors are reacting fast. Some are cashing out, others are holding their breath.

This Monday Market Breakdown is brought to you by Sebastian Scheplitz, CEO of The Coinomist, breaking down what’s happening and what it means for you.

Bitcoin has dropped 6.8% in a day, now sitting at $95,862. Ethereum is down over 20%, marking one of its worst days since early 2020. Smaller cryptocurrencies? Some have lost nearly half their value overnight.

The Canadian dollar has also taken a beating, hitting levels not seen since the early 2000s. Over in Germany, auto stocks are falling as new U.S. tariffs threaten supply chains. The DAX, Germany’s most important stock index, is feeling the pressure.

In light of the recent market upheavals, Frances Donald, Senior Vice President and Chief Economist at Royal Bank of Canada, remarked,

This is the most significant trade shock since the Smoot-Hawley tariffs of the 1930s, which are widely blamed for exacerbating and prolonging the Great Depression.

She further noted that such persistent tariffs could be recessionary for Canada, potentially wiping out growth for up to three years.

Crypto Hits the Floor

Another rough day for crypto. Bitcoin is down. Ethereum is down even more. Other coins? They’ve taken bigger hits. Some traders are calling it a routine dip. Others are worried this is the start of a longer slide.

Why the drop? Market uncertainty is up. Interest rates are still high. Big players aren’t buying as aggressively as before. The same institutions that were supposed to bring stability seem just as jittery as retail traders.

Where do things go from here? Is this another bump before prices climb again? Or are we in for a long period of lower prices?

Canadian Dollar at a 22-Year Low

The Canadian dollar has hit a level it hasn’t seen since the early 2000s. That’s a long time. The reasons are pretty clear:

- Weaker oil prices. Canada’s economy depends heavily on oil exports. When prices fall, the currency tends to follow.

- Interest rates. The Bank of Canada hasn’t kept up with the U.S. Federal Reserve’s rate hikes. Investors see better returns in the U.S., so money is flowing out of Canada.

- Economic worries. Investors don’t like uncertainty. And right now, Canada’s economy isn’t looking as strong as it did a year ago.

What does this mean for you? If you’re earning in Canadian dollars, imports are about to get more expensive. Traveling abroad? Your money won’t go as far. On the flip side, if Canada’s exports become cheaper, that could eventually help balance things out.

DAX and Auto Stocks Are Sliding

Germany’s stock market isn’t having a good start to the week. The DAX has fallen, and major automakers are leading the decline. BMW, Daimler Truck, Mercedes-Benz, Traton, and Volkswagen are all down between 4% and 6%.

What’s behind this? New U.S. tariffs.

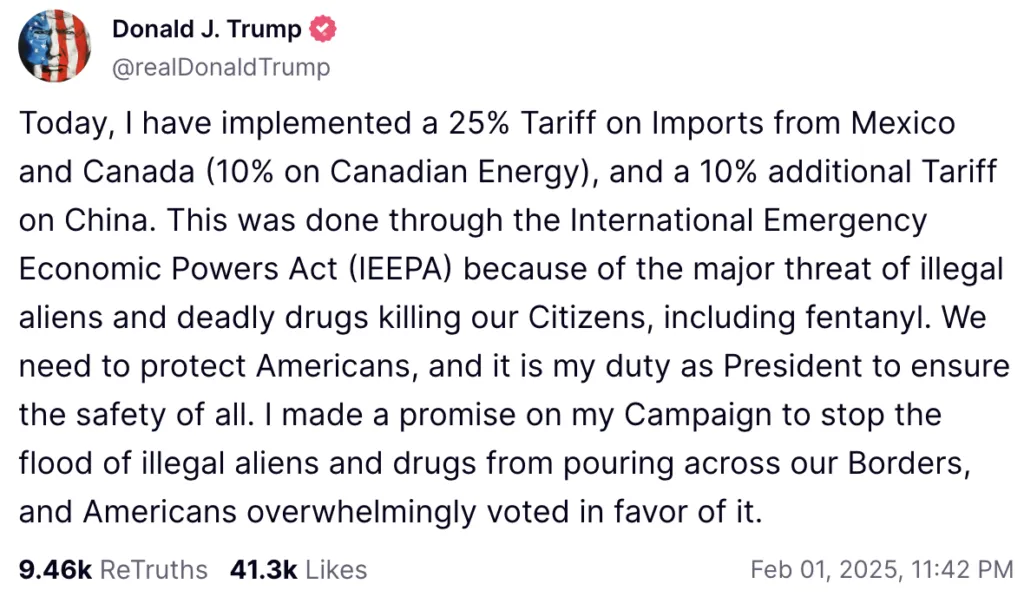

Donald Trump just announced a 25% tariff on all imports from Mexico and Canada. For German carmakers that build vehicles in Mexico and ship them to the U.S., this is bad news. Either they eat the cost or pass it on to buyers. Either way, profits take a hit.

How bad could this get? Will the companies adjust their supply chains, or will customers simply pay more?

Markets React Worldwide

The selloff isn’t just in North America and Europe. Asian markets were the first to show signs of stress. Japan’s Nikkei fell more than 2% overnight. China’s Shanghai Composite and Hong Kong’s Hang Seng also dropped.

The euro is down, too. It’s now trading at $1.0141, the lowest level since late 2022. Meanwhile, investors are moving money into safer options like the U.S. dollar and Swiss franc.

How much worse could this get? If central banks step in, will that help stabilize things, or will it just add to the confusion?

What Happens Next?

Markets don’t like surprises, and right now, there are too many. Jürgen Molnar, a senior strategist at RoboMarkets, put it plainly: “Anyone who thought Trump wouldn’t pull the trigger on tariffs is seeing the reality.”

The real question is how other countries will respond. Will Mexico, Canada, and the EU hit back with tariffs of their own? History suggests they will.

The last time Trump did this, China hit U.S. farmers, Mexico targeted steel, and Europe put tariffs on Harley-Davidsons, bourbon, and jeans. If that pattern repeats, some businesses could see costs skyrocket.

Could this turn into another full-scale trade war? If so, which industries will take the hardest hit?

How This Affects You

If you invest in stocks, crypto, or foreign currencies, expect more price swings. If you work in auto manufacturing, trade, or retail, your costs might change soon. And if you’re just going about your day, inflation could creep back into your shopping bill.

Robert Kiyosaki, author of “Rich Dad Poor Dad,” commented on the cryptocurrency downturn, suggesting that the crash presents a buying opportunity for investors looking to acquire assets at lower prices. I would take this with a grain of salt, more precisely be very sceptical about this statement. We could see a much bigger crash coming. Personally, I have been predicting something “big” since September 2023 and this might just be the time, especially when you factor in the housing prices in the U.S. But I could also be wrong.

Where do you see the markets heading? Are we on the verge of another major shakeup, or is this just another rough week? Let’s see how things unfold.

The content on The Coinomist is for informational purposes only and should not be interpreted as financial advice. While we strive to provide accurate and up-to-date information, we do not guarantee the accuracy, completeness, or reliability of any content. Neither we accept liability for any errors or omissions in the information provided or for any financial losses incurred as a result of relying on this information. Actions based on this content are at your own risk. Always do your own research and consult a professional. See our Terms, Privacy Policy, and Disclaimers for more details.